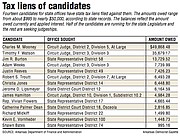

Fourteen candidates for state offices have state tax liens filed against them, with totals owed ranging from less than $1,000 to nearly $50,000, according to state records.

These candidates include five for circuit judge positions, two for district judgeships and seven for state representative, based on records provided by the state Department of Finance and Administration to the Arkansas Democrat-Gazette on Feb. 14. The information was provided under the Arkansas Freedom of Information Act based on a request submitted Jan. 21 by this newspaper.

These records show that circuit judge candidate Skip Mooney Jr. of Jonesboro has the largest lien balance at about $49,868, while circuit judge candidate Timothy Watson of Newport has the second-largest at about $35,679 and state House candidate Jim Burton of Jonesboro has the third-largest at about $13,729.

A lien is a legal claim or hold on a piece of property as security for the payment of a debt. It has the same force as a judgment issued by the circuit court, where the liens are filed.

"[T]the amount listed in the liens may not add up to the overall amount owed as interest and fees are applied," said Scott Hardin, a spokesman for the finance department.

MOONEY'S LIENS

Mooney's outstanding balance stems from seven liens, according to the finance department.

Mooney, in an email, acknowledged that he gradually fell behind on taxes after several "unforeseeable" health problems affected him and his family. However, he did say that he didn't agree with the finance department's figures, but that he planned to pay all that is owed.

"Over my 36 years of practicing law, we have paid an enormous amount of taxes and the fact that one is behind has no bearing on one's legal qualifications to run for Circuit Judge despite your intent to make this an issue," Mooney said in a written response to emailed questions. "Also, the information that you have provided to me should be no surprise to anybody since this has clearly been of public record for many years now and my family is no different than many families that I know of that have struggled with being self-employed with multiple employees coupled with having the highest tax burden of any economic class."

The first lien against Mooney was filed in August 2010 for $3,684 in delinquent income taxes.

A second lien was entered in September 2011 for $2,300 from 2009.

The state filed a third lien in February 2013 for $4,408 owed from 2011.

A fourth lien was entered in February 2016 for $3,605 from 2014.

A fifth lien, for $2,829, was filed in February 2017 for the 2015 tax year.

The department filed a sixth lien in February 2019 for $3,537 from 2017.

The finance department wasn't able to provide the seventh lien because it was filed under the agency's previous software system, but Hardin said state officials confirmed that the lien remained on file with the court.

Mooney said he incurred "hundreds of thousands" in medical expenses after he needed several surgeries to save his vision from an eye disease. He had other medical expenses, all of which weren't covered by health insurance.

At same time, he said a family member became sick from opioid addiction, because of improper medical treatment. That experience, Mooney said, led him to step away from his legal practice to start Out of the Dark Inc., a volunteer organization based in Jonesboro to address drug addiction.

Mooney said that led to a crossroads for his family about whether to file for bankruptcy or juggle the debts.

"In any event, there has never been any dispute that we have an outstanding tax debt and we have been transparent about the same," he said. "However, I now have the ability to resolve this matter since the passing of both of my parents, which was an important factor in our decision for me to run for public office. As soon as certain assets are received and an agreement is reached as to the correct amount that is owed then the plan is to pay the same in order to bring this matter to complete resolve. At this time, it is anticipated that this will be resolved before the end of 2020 and prior to taking public office should I be elected."

WATSON'S LIENS

The finance department filed the first lien against Watson in February 2014 for $14,688, stemming from the 2012 tax year.

It filed a second lien in February 2015 for $16,678 for the 2013 tax year. A third lien was filed in February 2016 for $13,195 for the 2014 tax year.

Watson said the tax liens are "settled," and resulted from large medical bills for a family member.

"I had tax issues several years ago and I am paying them off," he said in an interview. "The state is being paid on a regular basis on their terms and there is no issue anymore."

Watson said he has been making monthly payments to the state for 2½ years.

"I have about four or five years to go" to complete the payments to the state, he said.

BURTON'S LIENS

The state filed its first lien against Burton in December 2015 for $2,309, stemming from outstanding individual income tax for 2010.

A second lien was entered in April 2016 for $7,678 owed from 2011.

Burton, a Democrat, said his solo legal practice "took a considerable hit" during the recession and his number of cases, income and cash flow dropped.

"We are still in the processing of paying all that back," he said.

Burton said he wasn't sure when the money owed to the state would be paid off.

"We are trying to do the best we can," he said.

OTHER LIENS

• Circuit judge candidate Adam Weeks of Powhatan has a $7,739 outstanding balance from two income-tax liens, according to the finance department.

The first lien was filed in January 2015 for $4,512 in delinquent taxes from 2013. The second lien, for $1,017, was entered in March 2018 for the 2015 tax year.

In a Thursday statement through a campaign spokesman, Weeks said he was resolving the debt.

"This was an oversight on our part and today I dropped a check in the mail to pay the full amount," he said.

• State House candidate Justin Reeves, a Democrat from Forrest City, has three unresolved individual income-tax liens, totaling $7,426.

The first lien -- $1,273 from the 2013 tax year -- was filed in January 2017. The second lien was entered in February 2018 for $3,874 from 2016. The lien was filed in February 2019, totaling $2,465 from the 2017 tax year.

Reeves said his mobile food catering trailer was stolen last June and that represented half of his revenue for his Delta Q restaurant in Forrest City.

"It just made things tough for a while," he said. "I am on a payment plan with the state."

Reeves said he started on his payment plan in December and he expects to pay off what he owes at the end of June or in July.

• Circuit judge candidate Robert Scott Troutt of Jonesboro said, "I'm seriously shocked" about the lien.

He said he thought he had paid it off for about $3,800 when he closed on the purchase of a house early last month.

Troutt said Friday afternoon that "we are trying to figure this out.

"Legitimately, I don't know what this is," he said. "There is complete honesty in that."

The Finance Department filed a lien against Troutt in December for $3,319 for individual income tax from 2015. A second lien was filed last month for $6,416 for the 2018 tax year.

Troutt's outstanding balance, according to the agency, is $6,493.

• Christia Jones, an independent state House candidate from Lonoke, has an outstanding lien for $6,448, according to state tax officials.

The lien was filed in April 2019, totaling $5,951 in delinquencies from 2013.

She could not be reached for comment by telephone on Thursday and Friday.

• District judge candidate Jerome Lipsmeyer of Morrilton has an outstanding balance of $6,164, resulting from one lien.

Lipsmeyer said he made "a good amount of money" as part of a class-action lawsuit last year, and he paid the estimated taxes on that income based on the advice of his "tax lady."

"When it came down to the real taxes, it was a lot more than she estimated," he said.

The lien was filed last month for the 2018 tax year, totaling $6,118.

Lipsmeyer said he expects to pay off what he owes this year.

"The penalties are so horrible, I got to [pay it off]," said Lipsmeyer.

• Circuit judge candidate James Hamilton of Crossett has a pair of outstanding state tax liens, totaling $4,984, according to the finance department.

Hamilton said, "We paid that in January of this year," and the tax lien should be released soon.

"It was a state tax delinquency years back," he said.

The first lien was filed in February 2018 in the amount of $2,888 for 2016. The second was entered in January 2019 for $2,796 for 2017.

• Rep. Vivian Flowers, D-Pine Bluff, has a previously reported outstanding lien with a $4,665 balance. The lien was first filed against Flowers, who is running unopposed for reelection, in July 2018 for delinquencies from 2015 and 2016.

Flowers said Friday that she is working to resolve the lien this year.

The lien, she said, resulted from a year when she was doing work on her house, which is in a historic district and eligible for numerous tax credits and deductions, and had to switch accountants because her previous tax preparer died.

She said that after the appropriate deductions are claimed, she doesn't expect the outstanding debt to be significant and believes it will be possibly wiped out altogether.

"I'm still clear that I owe nothing or very little," Flowers said, noting that she received a tax refund last year. "We're getting everything together to file for the current year and make amendments for the past years. It's just one of those situations when you have a lot of deductions and you are working it and there is a lot of back and forth."

• District judge candidate Catherine Dean of Osceola has an outstanding lien balance of $2,816, resulting from one lien.

Dean said she didn't know about the tax lien from 2009 until the Arkansas Democrat-Gazette called her about it last week.

"It's a result of a divorce," she said. "I got hit with a tax debt."

The lien was filed in September 2018 for $1,960 outstanding in income taxes from 2009.

Dean said she called the finance department on Friday morning and confirmed the lien. She said she paid it off.

• Republican state House candidate Richard Midkiff of Hot Springs Village has an outstanding state income tax lien for $1,499, according to the finance department.

The lien stems from Midkiff's 2016 income, and it was filed in November 2018 for $1,927.

In a Friday interview, Midkiff said that issue arose because the Garland County sheriff's office had to issue him a corrected W2 form in 2017.

He said that when the amended W2 was issued he had already filed his taxes for 2016 and left for active duty in the Army. Midkiff is in the Army Reserve. Active military members are exempt from state income tax in Arkansas.

Midkiff said he thought his 2016 taxes had been resolved, but when he returned from duty last year he found that the lien was still in place. He said he is working with an accountant to resolve the matter.

"I drove to Little Rock and showed [tax officials] all the paperwork," Midkiff said. "They said, 'I wouldn't worry about it,' and to work with my accountant to get it taken care of."

• State House candidate Kevin Vornheder, a Libertarian from Mountain Home, has one income-tax lien in the amount of $1,448.

The lien was filed last month in the amount of $1,585 from 2015 taxes.

Vornheder said the lien is related to a tax debt from him and his ex-wife, and he thought she had paid off the debt.

"Apparently some paperwork we lost track of during the divorce," he said.

Vornheder said Friday that he paid off the debt.

• State House candidate Shawn Bates, a Republican from Subiaco, has a $995 tax lien balance.

The lien was filed in August 2014 for $1,642 in delinquent taxes from 2013.

Bates said he is a contractor and he pays estimated taxes based on his income and the state indicated that he owes more than what he paid.

"I'll call and get something done," he said.

SundayMonday on 02/23/2020