Canadian investor Jeff Olin has increased the stake his private-equity firm owns in Little Rock's BSR Real Estate Investment Trust to become one of the largest stockholders in the company.

There's a simple reason for the continued investment: Olin sees a well-managed company that has successfully transformed with a focus on expanding in high-growth markets in the Sun Belt.

"We think the management team and platform that BSR has is broad and deep," said Olin, chief executive of Capital Vision of Toronto. "They have very solid fundamentals and we believe the growth opportunities with BSR are significant."

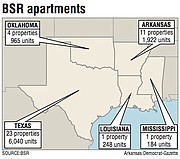

BSR, founded in Little Rock in 1956 as Bailey Corp., went public in May 2018 and trades on the Toronto Stock Exchange. BSR's strategy is to strengthen its multifamily real estate portfolio with properties concentrated in Austin, Dallas and Houston, Texas; Northwest Arkansas; and Oklahoma City.

Since its initial public offering, BSR has purchased eight properties for $348 million for a total 2,213 apartment units. Six of those eight purchases were in the target Texas markets. The other two were in Springdale and Oklahoma City.

"Our mandate is to continue buying in the Sun Belt of the United States," said John Bailey, CEO of the Little Rock company started by his parents, Virginia and Dr. Ted Bailey Jr. "We're very strategic in where we need to grow our company."

Bailey and his team are on a mission to transform BSR by investing exclusively in the five core markets. The key is buying multifamily units in the outlying suburbs, not in the core city.

"All of our Texas markets have demonstrated, and have forecasts of, double-digit economic and population growth over the next five years," Bailey said of the investment focus. "We want to be a part of that."

Northwest Arkansas and Oklahoma City will see continued expansion by BSR, but Bailey cautions that the growth there will not be on pace with Texas. The Arkansas and Oklahoma markets will be clusters with about 1,200 apartments units in each. BSR now has about 600 units in Northwest Arkansas.

BSR today owns and operates 40 garden-style multifamily properties with 9,359 apartment units. Its net operating income on same properties increased to $36 million at the end of the third quarter 2019, up 6% from $33.9 million as of Sept. 30, 2018. Fourth-quarter 2019 earnings are scheduled for release on March 10.

Net operating income, which is revenue minus operating expenses, measures the profitability of income-generating real estate investments. As of November 2018, about half of the company's net operating income came from properties in its five targeted markets. By November 2019, that improved to 71% on an annualized basis.

The Austin, Dallas and Houston metro areas are target-rich environments. Those cities all are in the top 10 in two primary economic categories: projected employment and population growth.

Moody's Analytics ranks Austin first in the nation for employment growth through 2022; Dallas-Fort Worth is ranked third and Houston finished fourth. Population-growth projections through 2022 from Moody's ranks Austin third, Dallas-Fort Worth seventh and Houston eighth.

More people and more jobs mean more renters for BSR. "They're focusing on high-population growth and high-employment growth markets," Olin said. "Those are key factors on the demand side."

The Sun Belt offers opportunity for growth, according to Olin, who said the region has "the most highly sought-after real estate class on the planet."

Texas will be a primary focus going forward, Bailey said. "Those areas are so much bigger and they're growing so much faster than most other areas," Bailey said. "We could grow exponentially there and we still wouldn't make a dent in BSR's exposure to the whole market. There are a lot of opportunities."

Transformation efforts at BSR include selling properties in its non-core markets and investing to renovate the apartment complexes it buys in the five key regions.

In 2019, BSR sold 15 non-core properties for proceeds of $173 million. The company still has 10 properties on the market: one in Blytheville; five in Longview and two in Beaumont, Texas; one in Shreveport; and one in Pascagoula, Miss.

Proceeds from the sales are used to buy newer properties in the five core markets. BSR calls it a "capital recycling" program. The property exchanges allow BSR to maximize its footprint in growing markets.

"We're buying into larger growth markets," Bailey said.

BSR's sweet spot is the Class B market, which means properties refurbished or constructed after 1990 but not built in the past 10 years. BSR favors multifamily complexes that are two or three stories and have numerous amenities.

And the Little Rock company is not wary of investing to spruce up the apartments or make improvements to the pool or other public spaces such as walking trails or dog parks.

Since 2015, BSR has spent $64 million in cash to upgrade apartment units. Investment in renovations lift rents, which improve margins and profitability.

As a result, the company improved net operating income by 30% from year end 2015 to mid-2019. "That's a tremendous validation of what we do," Bailey added. "We've capitalized on investing in our units.

"We hang our hat on being opportunistic and on knowing how to create value for our assets."

As a leading investor, Capital Vision admires the approach BSR is taking, according to Olin, noting that the strategy adds value to properties while providing the financial support needed to acquire newer assets.

"They don't buy coupon-clipping buildings and hope rents go up," Olin said. "They invest to improve the buildings and in doing so they improve the profitability and they improve the rents."

Growth opportunities abound, Olin said. "They have a unique combination of organic growth from their value-add activities and they have external growth opportunities," he said.

BSR is building a well-armed war chest to bolster its growth campaign. The 10 properties on the market will bring in additional funds to reinvest. In November, the company filed a shelf short-form prospectus, signaling its intent to raise $500 million over two years. The filing means BSR can act quickly if it wants to raise money for future acquisitions and upgrade its multifamily holdings.

"As we modernize the portfolio, we're not looking at a certain size unit so much as we're looking at the return on investment we can deliver by putting our platform in place," Bailey said.

The company's internal management platform is an underappreciated asset that provides a strong foundation for growth, according to Bailey, who said that managing the properties within BSR is a highly accretive approach.

"We believe in the value that is created by our platform once we can put it in place after adding a new asset," Bailey said.

The value of the management platform increases over time as new properties are added. The cost to operate the units becomes lower as more apartments are added. BSR's internal management tool provides the scale to operate with greater efficiency as the company grows.

"We're always looking for opportunities to add value. Our platform is extremely scalable," Bailey said. "Part of the reason we wanted to go public was to exploit the value of the management platform."

Internal management of the properties also gives BSR greater influence over its customer-service culture. "It's extremely important to our investors for us to have control over our culture and how it benefits residents," Bailey said.

BSR delivers top tier renter-satisfaction scores in the multifamily sector, according to statistics from J Turner Research of Houston.

The research firm produces an Online Reputation Assessment every year by evaluating feedback from renters at 120,000 multifamily properties in the United States. BSR's latest score was 77.23 on a scale of 1-100. The national average score is 63.05.

BSR's stock was trading near $10 per share when it went public in mid-2018. The price bottomed at near $7 per share to end 2018 but has rebounded since. BSR has been trading in the $12-$13 range over the past month.

Olin believes the company's value is not being reflected in the stock price. "We think the stock is cheap," he said, adding that "it might be a little aggressive, but they could be valued around $18."

Capital Vision will stand behind its partner, Olin said. "This is a core investment for us and we feel very good about the company," he said.

SundayMonday Business on 02/21/2020