The state's general revenue collections in June -- the last month of fiscal 2020 -- fell by $47.1 million from what was collected in the same month a year ago to $696 million, yet exceeded the March 23 revised forecast by $77.3 million.

Tax receipts for the last four months of fiscal 2020 were affected by the economic downturn resulting from the coronavirus pandemic, which began in March. The forecast was revised twice -- down on March 23 but raised again Tuesday when revenue came in better than expected.

Individual income tax collections slipped last month compared with June a year ago, while sales and use tax collections surged, but both tax sources beat the March 23 forecast, the state Department of Finance and Administration said Thursday in its monthly revenue report.

Individual income, and sales and use taxes are the state's two largest sources of general revenue.

[CORONAVIRUS: Click here for our complete coverage » arkansasonline.com/coronavirus]

Gov. Asa Hutchinson said Thursday that the June revenue report "closes the fiscal year much stronger than anticipated when the forecast was cut by more than $350 million in March.

"Revenues in June were above forecast and year ago levels in our key categories, indicating the resilience of the state's economy in a tough time period," the Republican governor said in a written statement.

"Motor vehicle sales were up 25 percent, which may be attributed to the effectiveness of the federal stimulus payments," Hutchinson said.

"I expect July to be lower in terms of individual income tax collections because many Arkansans paid their taxes early. We will continue to be cautious with the budget in view of the uncertainty of the national economy," he said. The state changed its deadline for filing individual income taxes from April 15 to July 15.

The record general revenue total for the month of June continues to be the $743 million collected in 2019, said Whitney McLaughlin, a tax analyst for the finance department.

Tax refunds and some special government expenditures come off the top of total general revenue, leaving a net amount that state agencies are allowed to spend.

The net in June dropped by $62.4 million, or 9.6%, from the same month a year ago to $589.7 million, but exceeded the March 23 forecast by $81.8 million or 16.1%.

Tuesday was the last day of fiscal 2020. That was when the finance department again revised its net revenue forecast for fiscal 2020, this time increasing it by $240 million to $5.62 billion, based on better-than-expected collections. In the March 23 revision, the finance department had cut the net general revenue forecast by $353.1 million, to $5.38 billion.

In its fiscal session in April, the Legislature enacted a $5.89 billion general revenue budget for fiscal 2021, which started Wednesday. The finance department's April 2 forecast will provide $5.68 billion for that budget and leave $212.2 million unfunded.

JUNE DETAILS

According to the finance department, June's general revenue included:

• A $26 million, or 7.9%, dip in individual income tax collections from a year ago to $302.2 million, which exceeded the March 23 forecast by $32.8 million or 12.2%.

Withholding taxes from payrolls are the largest category of individual income tax collections.

They declined by $27.7 million from a year ago to $214.8 million and exceeded the forecast by $8.9 million. They decreased because of a combination of payroll timing effects from one fewer Thursday than a year ago, withholding formula changes and increased unemployment.

Collections from returns and extensions increased by $16 million over a year ago to $27.7 million and exceeded the forecast by $27.7 million, while collections from estimated payments dropped by $14.3 million from a year ago to $59.7 million and fell short of forecast by $3.8 million.

• An increase of $18.4 million, or 8.8%, in sales and use tax collections over a year ago to $227.4, million that exceeded the forecast by $23.5 million, or 11.5%. The sales and use tax collections largely reflected taxes remitted to the state based on sales by retailers in May.

Last month's retail and motor vehicle sales collections both increased by 25% over the same month a year ago, said John Shelnutt, the state's chief economic forecaster.

• A $9.9 million, or 13.5%, decline in corporate income tax collections from a year ago to $63.3 million that exceeded the forecast by $9.4 million, or 17.4%.

CASINO TAXES

Casino tax collections in June dropped by $5 million, or 80.2%, from a year ago to $1.2 million. That was $2.1 million, or 62.6%, below forecast.

Those casino taxes in June are based on gambling in May.

Oaklawn Casino Racing Resort in Hot Springs, Southland Casino Racing in West Memphis and the Saracen Casino Annex in Pine Bluff -- across the street from the Saracen Casino Resort under construction -- were closed in mid-March because of the covid-19 pandemic and reopened on May 18.

During fiscal 2020, gambling revenue totaled $32.4 million, a drop of $37.3 million, or 53.5%, from fiscal 2019 and $4.7 million, or 12.7%, below the forecast.

The drop had been expected largely because Oaklawn and Southland are paying a lower tax rate under constitutional Amendment 100 approved by voters in November 2018.

Amendment 100 allows Oaklawn and Southland to operate full-fledged casinos, and authorizes new casinos in Jefferson and Pope counties. No casino has been authorized yet in Pope County by the Arkansas Racing Commission.

Projected casino and gambling revenue in fiscal 2020 totaled $37.1 million but that includes $5.7 million in electronic games of skill taxes collected in July 2019, which does not count toward the $31.2 million cap that general revenue has for casino taxes, according to McLaughlin.

Under Act 416 of 2019, casino gambling revenue above $31.2 million will be diverted to the state Department of Transportation, which will be guaranteed a minimum of $35 million a year from casino revenue, a restricted reserve fund or other sources.

The full $35 million has been provided through the restricted reserve fund that now has a balance of $4.7 million, said Scott Hardin, spokesman for the finance department.

The money is part of a plan to raise more money for highways and roads, which includes a wholesale sales tax on gas and diesel, and increases in registration fees for hybrid and electric vehicles that became effective Oct. 1.

FISCAL 2020

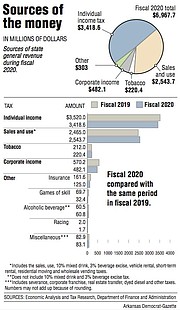

In fiscal 2020, total general revenue collections declined by $176.2 million, or 2.5%, from fiscal 2019 to $6.97 billion and exceeded the March 23 forecast by $272.5 million, or 4.1%.

Individual income tax collections in fiscal 2020 dropped by $101.4 million, or 2.9%, below fiscal 2019 to $3.4 billion and exceeded the March 23 forecast by $175.9 million, or 5.4%.

The state collected $93 million in individual income taxes in fiscal 2020 that was expected to come in fiscal 2021, Shelnutt said.

Individual income tax refunds in fiscal 2020 slipped by $3.9 million, or 0.8%, below fiscal 2019 to $503.6 million and fell $82.7 million, or 14.1%, below forecast, which added to net general revenue results.

Shelnutt said the state expects to pay out about $82 million in individual income tax refunds in fiscal 2021 instead of fiscal 2020.

"There is still some unknowns out there," Shelnutt said. "We don't know the true tax liability for the tax year '19 of these payers who are waiting to file in July. That's about 18% of returns that haven't yet happened, probably from the high income-tax individuals."

About 250,000 total returns have yet to be filed, Hardin said.

Sales and use tax collections in fiscal 2020 increased by $78.7 million, or 3.2%, over fiscal 2019 to $2.5 billion, and exceeded the March 23 forecast by $29.1 million, or 1.2%.

Corporate income tax collections in fiscal 2020 dropped by $88.1 million, or 15.4%, from fiscal 2019 to $482.1 million, and exceeded the March 23 forecast by $48.1 million, or 11.1%.

Net general revenue available to state agencies in fiscal 2020 dropped $168.1 million, or 2.8%, below fiscal 2019 to $5.75 billion, yet exceeded the March 23 forecast by $369.4 million or 6.9%.

Hutchinson said Tuesday that the year-end general revenue forecast revision restored $121 million in the public school fund and $42.4 million for higher education, and boosted the Medicaid Trust Fund by $72.2 million.

State officials said they expect to have about $97 million reclaimed from state agencies and about $128 million left over from the covid-19 rainy-day fund to place $225 million in unallocated reserves.

Rep. Lane Jean, R-Magnolia, who is a co-chairman of the Joint Budget Committee, said Thursday that he wants the Legislature to put some of the unallocated reserves in the state's long-term reserve fund.

The balance in the long-term reserve fund is $184.9 million, Hardin said.