The race to purchase Brooks Brothers Group Inc. out of bankruptcy is on as brand manager WHP Global and a group of Italian companies prepare bids after Authentic Brands Group LLC and Simon Property Group Inc.'s $305 million offer.

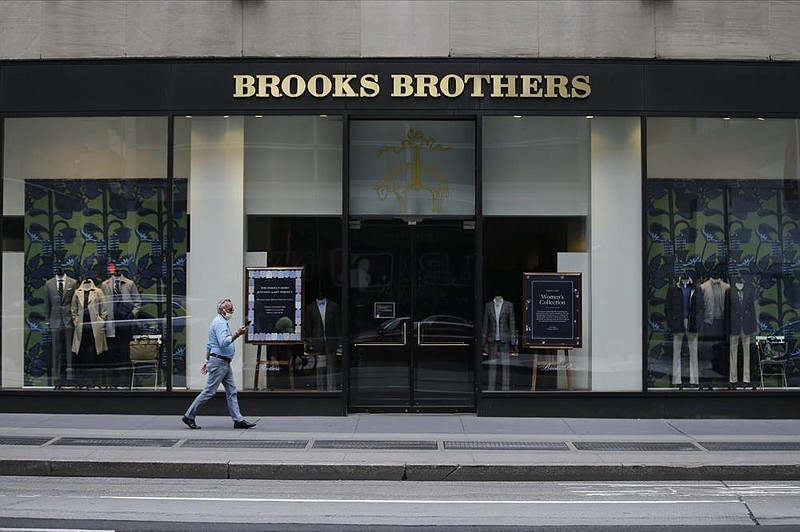

The 200-year-old New York-based clothier, which has dressed nearly every U.S. president, filed for Chapter 11 bankruptcy earlier this month. At the time, it had more than 200 U.S. stores.

Sparc Group has committed to take on at least 125 of the clothing stores in its so-called stalking-horse bid, which sets a minimum price for the auction. A higher bid could still emerge before an Aug. 5 deadline as other firms prepare competing offers.

WHP Global, which owns the Joseph Abboud and Anne Klein brands, is preparing a bid for the retailer's assets, the firm confirmed in a statement to Bloomberg. "It's early innings in the Brooks Brothers bankruptcy sale process," and "we are big believers in the power of the Brooks Brothers brand, the global footprint and the management team," said Yehuda Shmidman, chief executive officer of WHP.

Backed by funds managed by Oaktree Capital and BlackRock Inc., WHP was originally named the lender on Brooks Brothers' bankruptcy loan before Authentic and Simon submitted a competing offer that ultimately won out.

A group of Italian companies, including Giglio Group SpA, is also working on an offer, according to spokesman for Giglio in Milan.

Brooks Brothers' agreement with Sparc comes with a $9.1 million break-up fee and up to $1 million in expenses if the stalking horse doesn't win the auction, according to court papers. A hearing on the sale will be held Aug. 11.

Brooks Brothers said on July 8 when it filed for bankruptcy that it plans to permanently shut 51 stores in the U.S. It has 500 worldwide in 45 countries.

Authentic specializes in reviving beaten-down brands, including Aeropostale and Nautica. Sparc runs more than 2,600 retail stores, shop-in-shops and an e-commerce platform, the company said.

Bloomberg reported earlier that Authentic and Simon were positioning themselves to own the chain. The duo has teamed up before, with a pending offer for Lucky Brand Dungarees, and they've held talks along with Brookfield Property Partners LP about buying bankrupt J.C. Penney Co. and Ann Taylor's parent, Ascena Retail Group Inc. Authentic and the two mall operators already bought Forever 21 Inc., which went bankrupt in September.

Brooks Brothers asked U.S. Bankruptcy Judge Christopher Sontchi in Wilmington, Del., to approve rules for the bidding process and auction. Brooks Brothers is trying to attract as many suitors as possible to compete with the current stalking horse, or lead, bidder, the company said in a court filing Thursday.

"The goal of the Debtors' continued post-petition sale process is now to leverage the Stalking Horse Agreement to have new or existing bidders submit offers for the Company's assets," Derek Pitts, managing director at PJ Solomon, said in the filing on behalf of Brooks.

In May four suitors sent Brooks official indications of interest, Pitts said.

Information for this article was contributed by staff members of The Associated Press and by Rick Green and Katherine Doherty of Bloomberg News.