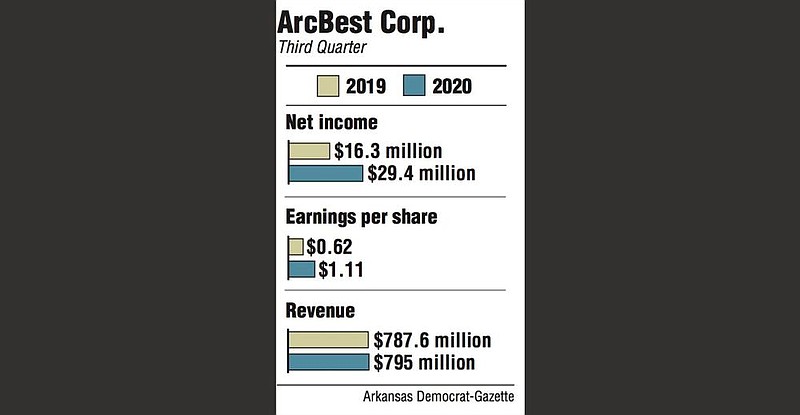

ArcBest Corp. on Tuesday reported a third-quarter profit of $29.4 million, an 80% increase from what the company made in the same quarter a year ago.

In the three months that ended Sept. 30, earnings were $1.11 per share, compared with 62 cents per share a year ago.

Revenue grew less than 1% to $795 million.

Results beat analysts' expectations.

The Fort Smith freight and logistics provider adapted to an improved economy in the quarter. It added more freight and labor to the mix, resulting in better business levels that are expected to carry through the end of the year.

"I am incredibly proud of our employees and how they have performed on behalf of customers" as the coronavirus pandemic continues to affect the industry, Judy McReynolds, the company's chairman, president and chief executive, said in a report released before the stock market opened.

The company surpassed expectations for the fifth consecutive quarter with adjusted earnings of $1.22 per share, well above Wall Street's estimate of 79 cents per share, according to a FactSet consensus. It also beat Stephens Inc.'s estimate of 97 cents per share.

Stephens analyst Jack Atkins noted the upside came from strong margins in ArcBest's core asset-based business and better revenue in its asset-light business.

"We are encouraged by the strong [results] where ArcBest, like other peers, saw tonnage growth improve as the quarter progressed," Atkins said in a research brief.

Looking forward, Chief Financial Officer David Cobb said in a morning conference call that daily tonnage was up 10% in October over last year. Specifically, less-than-truckload tonnage is up double digits and truckload tonnage is up in the mid-single digits, he said.

ArcBest's asset-based -- or less than truckload -- segment, operated as ABF Freight, saw an increase in shipments and tonnage compared with the previous quarter, but had lower revenue compared with a year ago.

Asset-based revenue was $561.9 million, a per-day decrease of 1.4% from $565.6 million in the same quarter last year.

Total tonnage per day increased 1.2% compared with last year. Total shipments per day decreased 3%, while total weight per shipment increased 4.4%. Specifically, less than truckload-rated weight per shipment had an increase of 7.4%.

Total billed revenue per hundredweight declined 1.8% because of freight mix changes and lower fuel surcharges compared with the same quarter last year.

Operating income grew 15% to $36.6 million, and the operating ratio was 93.5%.

ArcBest's asset-light business -- a mix of expedite, truckload, freight and logistics services -- saw revenue growth as the economy improved. A lot of it came from ArcBest's managed transportation services, as well as increases in international and ground expedite services.

Asset-light revenue was $267.8 million, a per-day increase of 4.7% from $253.7 million a year ago.

Operating income grew more than 60% to $5.8 million. Adjusted earnings before interest, taxes, depreciation and amortization was $8.6 million compared with $6.6 million in the same quarter last year.

ArcBest's roadside assistance business, called FleetNet, saw a decline in total events, which led to lower revenue and operating income from a year ago.

FleetNet revenue declined 6% to $50.5 million, and operating income fell 16% to $987,000.

ArcBest's consolidated cash and short-term investments, less debt, were $59 million as of Sept. 30. This is more than the $41 million net cash position held by the company at the end of the second quarter, reflecting an $18 million increase.

"Tremendous opportunity exists for us to sustain the momentum of the third quarter and continue to profitably grow our company," McReynolds said. "I am excited about what the future holds."

Part of ArcBest's success has come from placing an emphasis on spot-rate shipments in response to the volatile freight market. Asked if the company expects these levels to decline, McReynolds said that could happen but that she expects demand to increase once a coronavirus vaccine is made available.

ArcBest shares rose $2.05, or 6.5%, to close Tuesday at $33.50 on the Nasdaq stock exchange.