Home BancShares Inc. delivered profits of $69.3 million in the third quarter though net income and earnings per share were both down from a year ago, the bank reported Thursday.

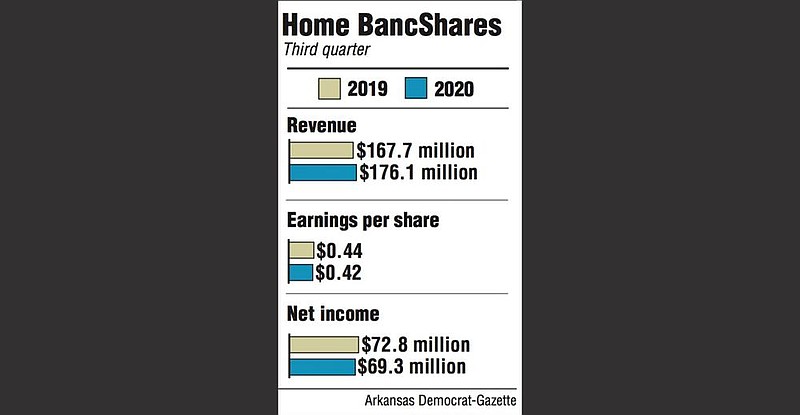

Net income of $69.3 million in the quarter ended Sept. 30 was down 5% from the $72.8 million reported in the same period last year. Similarly, earnings per share was down 4.5%, falling to 42 cents per share from 44 cents per share in 2019.

The results did top Wall Street consensus, which forecast earnings per share of 39 cents. Net income also beat the consensus of $64.6 million.

Home BancShares, which operates as Centennial Bank, blew past last year's revenue. The bank achieved revenue of $176.1 million in the quarter, up 5% from $167.7 million in the third quarter last year.

"I think we had another good quarter," John Allison, the chairman and chief executive, told analysts on a conference call Thursday afternoon. "I'm pretty pleased with the operations of the company."

The bank recorded $14 million in total credit loss expense "primarily due to the company increasing reserves on deferred loans resulting from ongoing uncertainties related to the covid-19 pandemic," it said in a news release.

"Due to the inherent risk associated with deferred loans, management recorded an additional reserve on the deferred loans," the statement said. The bank reported $933.8 million in deferrals on 330 loans at the end of the quarter.

Banks across the nation have increased deferrals to give customers more financial breathing room during the pandemic. Deferrals allow borrowers to suspend payments, typically for 90 days.

Stephens Inc. analyst Matt Olney reported Thursday that "core profitability remains excellent" for Home BancShares. He noted the company is producing strong pre-provision net revenue, which came in at $105.7 million.

The measurement is important because it is sensitive to economic conditions and demonstrates the bank's ability to remain profitable in a difficult economy like the current pandemic environment.

Expenses, recorded at $71.7 million, also beat analysts' consensus of $72.3 million.

Citing the expense control and overall bank performance, Little Rock banking analyst Garland Binns said Home BancShares had a strong quarter. "The third-quarter earnings results reflect that Home BancShares continues to perform well in the covid-19 environment," Binns said.

The pandemic remains a drag on earnings, said Treasurer and Chief Financial Officer Brian Davis, who noted "there has been a tremendous amount of liquidity in the market" related to covid-19. That diluted net interest margin by five basis points, he said.

Paycheck Protection Program loans also lower margins because interest rates of 1% are well below market rate. The company has $848.7 million in Paycheck Protection Program loans on the books.

Home BancShares reported net interest margin of 3.92% for the quarter, down from 4.32% in 2019. Excluding the Paycheck Protection Program loans, the bank said net interest margin was 3.98%.

Regarding the deferred loan amount of $933.8 million, Chief Lending Officer Kevin Hester said about half of the total is in the hospitality industry, which is one of the nation's most-troubled economic sectors in the pandemic. The bank is not considering, at this time, that it will have to charge-off delinquent loans.

"The vast majority are paying their interest up to date," Hester said. "That's very encouraging to me."

In other key metrics, the bank reported total assets of $16.5 billion, up from $14.9 billion last year. Net loans receivable were $11.4 billion compared with $10.7 billion in 2019. Total deposits reached almost $13 billion, up from $11 billion a year ago.

Asked about the potential to begin buying back its stock again, Allison said it is under consideration but no decision has been made. "The executive committee is in the middle of discussing that," he said.

Home BancShares' stock rose 11 cents to close Thursday $16.60. Earnings were announced before the stock market opened Thursday.