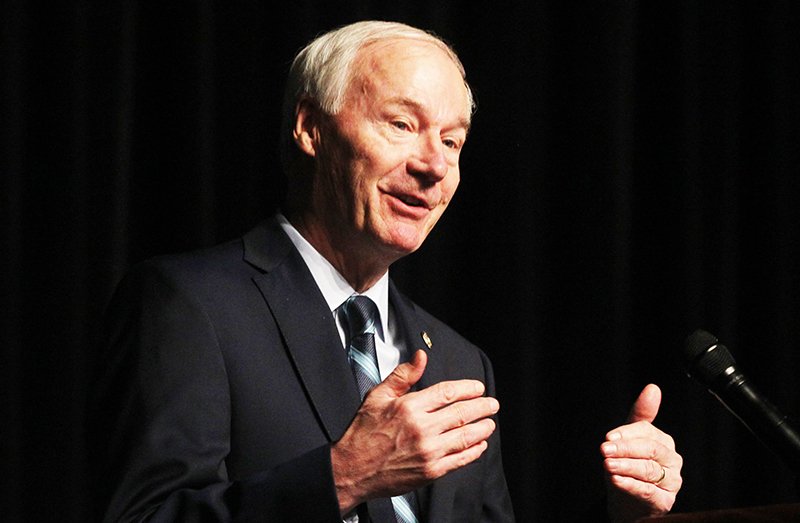

Gov. Asa Hutchinson said Wednesday he would take down a placard in his office referring to the 2019 regular session as "the greatest of all time" if voters reject the proposed constitutional amendment that would permanently extend the state's one-half-percent sales tax for highways and roads.

The proposed constitutional amendment is Issue 1 on the Nov. 3 general election ballot.

"If you come into my office, you will see behind in my cabinet there all the acts that were passed in the 2019 session of the Legislature and then you'll see the placard that says GOAT session," Hutchinson told about 40 people attending the annual meeting of the Arkansas Good Roads Foundation in Little Rock.

"That is really a source of pride for me because I know people have razzed me because you shouldn't be doing this, bragging about what happened," said the Republican governor, who first called the 2019 regular session the GOAT in April 2019.

[CORONAVIRUS: Click here for our complete coverage » arkansasonline.com/coronavirus]

"But it was the greatest of all time," Hutchinson said. "We had so many initiatives that were all geared around growth. It was about raising teacher pay, improving education. It was about [income] tax cuts that keeps us competitive. It is about transforming state government that is a good success story. But the fourth T was transportation."

In 2019, the Legislature enacted a law aimed at raising $95 million a year for state highways by imposing a wholesales tax on gas and diesel; increasing registration fees for electric and hybrid vehicles; and reallocating a minimum of $35 million in state funds, including casino tax revenue. That law also is projected by state officials to raise about $13 million a year each for cities and counties.

The 2019 Legislature also referred to voters the proposed amendment to permanently extend the half-cent sales tax for highways and roads. Voters in November 2012 approved that tax for a 10-year period.

State officials project the proposal, if extended in November, would raise about $205 million a year for highways and about $43 million a year each for cities and counties.

[RELATED » Full coverage of elections in Arkansas » arkansasonline.com/elections/]

"The mission of that session is not complete unless we can pass Issue 1," Hutchinson said.

"So we still have work to do and, if it doesn't pass, I'm taking the sign down, because it really is a critical part of what we accomplished in that session," he said.

Issue 1 would be a long-term solution for highway funding, Hutchinson said.

The covid-19 pandemic has increased the state's unemployment rate and that makes growth even more essential in the state because "we have to have continued growth to bring those jobs back more quickly and it takes Issue 1 to accomplish that," he said.

If voters reject Issue 1, cities and counties will lose nearly 30% of their current road budgets, Hutchinson said.

"We have organized opposition and ... as you go into the last 40 days of this campaign, do not take it for granted," he said. "You cannot say, 'Well, we are in good shape right now,' because it is a changing environment day by day in the national scene and the state scene as well."

The governor said the ballot committee promoting the proposed amendment commissioned a poll of 800 likely voters in Arkansas with a margin of error of plus or minus 3.5%. The poll was conducted Sept. 19-21, said Jon Gilmore, president of Gilmore Strategy Group, which conducted the poll.

Hutchinson said the poll shows that 53% of the respondents intend to vote on election day, while 44% intend to vote early. Of the early voters, 30% intend to vote in person, 13% intend to cast absentee votes and 1% already voted.

In the poll, 69% of the respondents expressed their support for Issue 1, while 18% were against it and 13% were undecided, he said.

He said he is gratified with the poll results, but he has both lost and won campaigns and "voters change their mind [and] there is going to be ads out there in opposition to it, so do not quit in terms of messaging."

Hutchinson said he and others plans to fly across the state to Jonesboro, Fort Smith, Northwest Arkansas, El Dorado and Little Rock on Oct. 19, the first day of early voting, to make pitches with others for Issue 1.

"We want to kick off our final push with that effort. That is critical as we go into the last parts of this campaign," he said.

The committee promoting the proposed amendment is called the Vote For Roads. Vote for Issue 1 reported raising $2.05 million and spending $195,830 through Aug. 31, leaving $1.84 million in funds.

Last month, the committee's top contributors included $30,000 from the Arkansas Farm Bureau Federation, and $25,000 apiece from Kiewit Infrastructure South Co. of Omaha, Neb.; Massman Construction Co. of Overland, Kan.; and HNTB Corp. of Kansas City, Mo., the committee reported.

The committee opposing the proposed constitutional amendment is called No Permanent Tax. No On Issue 1. The committee reported raising and spending $3,270.02 through Aug. 31. Americans for Prosperity, based in Arlington, Va., contributed that amount to the committee last month, according to the committee's report.

So far, the committee said its coalition includes Americans for Prosperity's Arkansas chapter, Arkansas Community Organizations, Arkansas Liberty Coalition, Arkansas Public Policy Panel, Audubon Arkansas, Central Arkansas Reentry Coalition, Central Arkansas Sierra Club, Downtown Little Rock Neighborhood Association, Garland County Tea Party and Northeast Arkansas Tea Party.

Ryan Norris, chairman of the No Permanent Tax, No On Issue 1 committee, said Wednesday afternoon in a written statement that the committee "is finding, across the growing community of partners who oppose Issue One, and the thousands of voters we have spoken to over the phone, email, and text, is that when voters are educated on what Issue One actually does and why our highways and bridges are in their current state, a strong majority of likely voters oppose Issue One."

When factoring in the new funds from the Arkansas Highway Improvement Act of 2016 and the new gas taxes, hybrid and electric car fee increases, and casino funds from Act 416 of 2019, the Arkansas Department of Transportation is already receiving nearly $180 million in additional revenue above the current half-percent sales tax, Norris said. That 2016 law is aimed at raising $50 million in state funds to match $200 million in federal highway funds.

Arkansans need to hear how this additional money is being spent, Norris said.

The Arkansas Department of Transportation "provides promises and colored lines on maps but no specific program that taxpayers and legislators can hold them accountable for," he said.