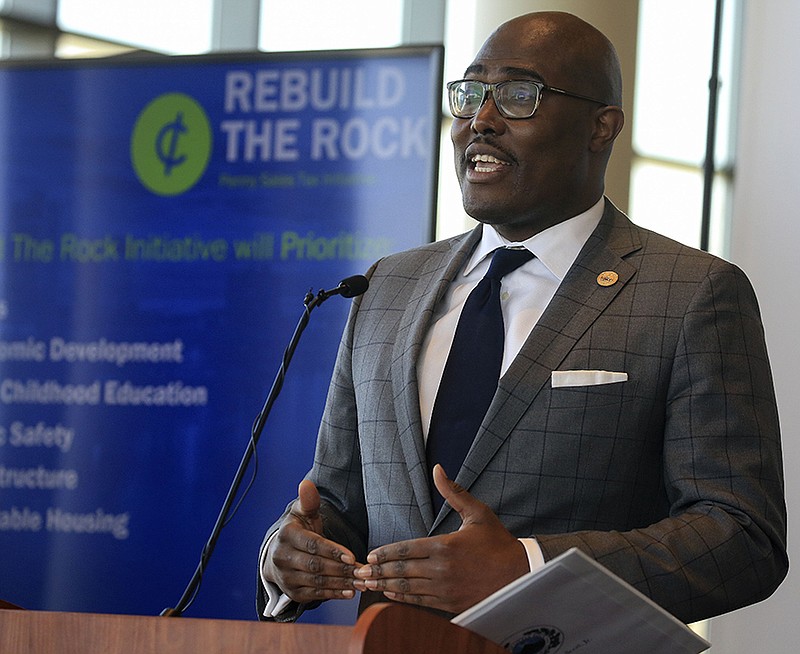

Little Rock Mayor Frank Scott Jr. indicated Wednesday during a news conference to pitch his plan for a permanent 1 percentage point sales-tax increase that a special election on the measure could occur as soon as this summer.

The plan, he said, is to provide city directors with an ordinance "as soon as possible to call for a summer election."

Scott unveiled details of his tax-increase proposal in a presentation to city directors Tuesday evening that outlined spending categories and specific improvements to the city's parks and infrastructure and efforts related to economic development.

Should the Board of Directors call for an election, voters must approve the measure for the sales-tax increase to go into effect.

In his State of the City broadcast last week, Scott again urged voters to adopt an increased sales tax after he abandoned a similar proposal last year amid the covid-19 pandemic.

[Gallery not loading above? Click here for more photos » arkansasonline.com/41mayor/]

His new proposal would add a percentage point to the city's current sales-tax rate of 1.5%. However, a three-eighths percent sales tax designated for capital projects expires at the end of December, so if voters approve the increase later this year, then the city's sales-tax rate would likely land at 2.125% in 2022.

When accounting for state and county sales taxes, consumers in Little Rock would pay 9.625% on most purchases.

For the purpose of special city elections called during the rest of 2021, state law says the votes must be held on the second Tuesday of the month except when the Tuesday is a legal holiday.

Potential dates this year include June 8, July 13 and Aug. 10.

A state requirement says a special election for a local sales-tax measure must be held no later than 120 days after the local governing body approves the ordinance calling for the election.

For example, if city directors debate Scott's tax-increase proposal for the rest of April and on April 30 approve an ordinance calling for an election, then the election would have to be held by Aug. 28.

The tax is estimated to generate roughly $53 million in new annual revenue, a sum that would result in a significant boost to Little Rock's annual budget.

The approved general-fund budget for 2021, which city directors voted to adopt in late December, was balanced at approximately $210 million, and $53 million per year would represent an injection that amounts to about 25% of the current level of planned annual spending.

Quality-of-life improvements Scott has proposed include major renovations to War Memorial and Hindman parks, an early-childhood education framework, new exhibits at the Little Rock Zoo and more money for public-safety initiatives.

According to the plan presented to the Board of Directors this week, total expenditures for capital improvements and associated operating expenses would total $525.5 million over the first 10 years of the tax increase.

Scott was joined at the news conference at the Robinson Center on Wednesday by the director of the Little Rock Zoo, Susan Altrui, and the city's chief education officer, Jay Barth.

Scott, flanked by artistic renderings of some of the proposed construction projects, suggested the tax increase would "transform" Little Rock.

"Much like when you think about cities like Atlanta, think about cities like Charlotte, [N.C.,] you think about cities like Austin, [Texas,] they all had pivotal points -- in Oklahoma City -- where leadership took calculated risk to forward the future," Scott said.

Asked about the potential effect of a sales-tax increase on low-income residents, Scott said that "is always a concern."

"We understand that sales tax can be considered a regressive tax, but there are only so many tools that the city of Little Rock has," he said.

He described the tax increase as a way to invest in the city and increase per-capita income. Scott added that proposed investments hit every category of residents, whether their income is low, moderate or high.