This story is a part of The Article, your guide to Arkansas news and culture, presented by the Democrat-Gazette. Sign up for The Article's weekly newsletter here or to see stories that have appeared in past newsletters, go here.

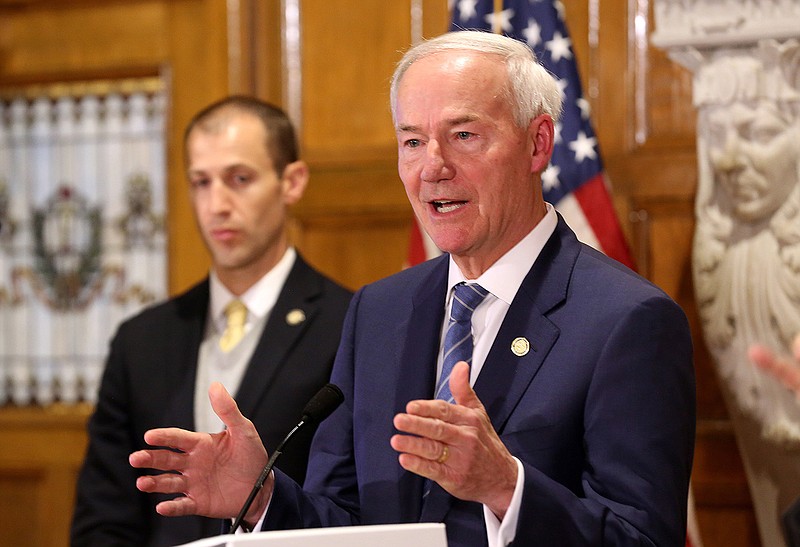

Gov. Asa Hutchinson will call the General Assembly for a special session next week on proposed tax cuts, but some legislators are hoping to introduce legislation on other topics, including abortion and critical race theory.

(Before jumping in, go here to read about how Arkansas’ income taxes currently work).

How would individual income tax rates change?

The bill that the General Assembly will consider would reduce the top individual income tax rate for 2022 from 5.9% to 5.5%. The rate would drop again in 2023, to 5.3%. The rate could drop further in 2024 to 5.1% and in 2025 to 4.9%, if certain triggers are met.

The bill would also consolidate the low- and middle-income tax tables so there will only be two income tax tables: one for those with income equal to or below $84,500 and one for Arkansans with income greater than $84,500.

What other changes are in the bill?

It would create a nonrefundable low-income tax credit of up to $60. The full credit would be available to those with income at or below $23,600 and phase out gradually based on income, up to $24,700.

Another part of the legislation would smooth the tax cliff between tax tables. These adjustments ensure someone who just barely qualifies for the high-income tax bracket doesn’t pay dramatically more than they would on the lower income tax bracket.

The bill links the standard deduction to the consumer price index.

Business income taxes would also decrease under the bill. The top corporate income tax rate would drop from 5.9% to 5.7% in 2023, and it could drop further in 2024 and 2025 if certain triggers are met.

The state Department of Finance and Administration has projected that the proposal would reduce state general revenue by $135.25 million in fiscal 2022, which started July 1. The total reduction in general revenue is projected to increase to $307.4 million in fiscal 2023, $383.2 million in fiscal 2024, $459 million in fiscal 2025 and $497.9 million in fiscal 2026.

What about other topics legislators want to cover?

The governor said he intends the session’s focus to be tax cuts, but a vote by two-thirds of each chamber would allow legislation on another topic to be introduced.

Sen. Jason Rapert, R-Conway, said he is drafting legislation to mimic Texas’ new law allowing citizens to sue someone involved in an abortion after 6 weeks of pregnancy.

Sen. Trent Garner, R-El Dorado, and Rep. Mark Lowery, R-Maumelle, said separately they plan to file legislation that would ban schools from teaching critical race theory, an academic and legal framework that shows that systemic racism is part of American society.

Go here to read more about the plans for the special session, and sign up for our politics newsletter to stay up-to-date throughout the meeting of the General Assembly.