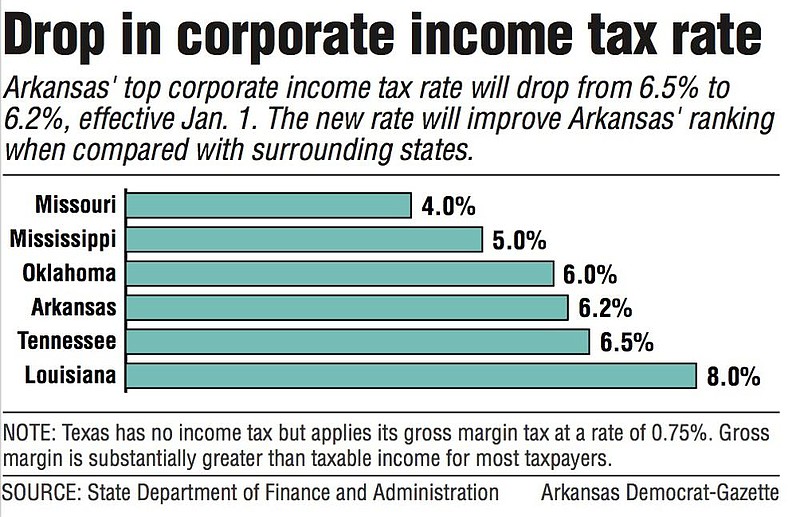

The state's top corporate income tax rate declines from 6.5% to 6.2% today.

The cut is part of a plan to phase in a reduction in the top corporate income tax rate over two years.

Under Act 822 of 2019, the rate is to drop again, to 5.9%, starting Jan. 1, 2022.

Today's top rate cut applies to income exceeding $100,000. With the 2022 rate cut, the income minimum will drop to $25,000.

State Department of Finance and Administration officials originally projected that the rate cut would reduce general revenue by $9.8 million in the current fiscal year, 2021, which ends June 30, and by $19.7 million more in fiscal 2022 and $9.9 million more in fiscal 2023.

Gov. Asa Hutchinson said his priority has always been reducing the individual income tax rate because that benefits the most people.

"But I am always pleased when we can lower other tax rates as well," he said.

Act 822 of 2019 was sponsored by Sen. Bart Hester, R-Cave Springs.

When Hutchinson signed Act 822 in April 2019, the governor said, "I applaud our legislators because they wanted to put this as a priority. Mine has been concentrated on individual income tax rate reductions, but they want to make sure that we are competitive in our corporate income tax rate."

At that time, the governor said the Tax Reform and Relief Legislative Task Force's substantive and lengthy work in recent years "set the stage for this [2019] session and, once that stage was set, we've lowered the income tax rate, we've had comprehensive corporate tax reform as well as property tax relief reform."

The top corporate tax of 6.2% will be the 27th-highest in the nation, said Katherine Loughead, a senior policy analyst at the Washington, D.C.-based Tax Foundation.

A total of 2,900 corporate taxpayers filed corporate income tax returns in 2019 and reported more than $100,000 in taxable income, said Scott Hardin, a spokesman for the finance department.

The average tax cut from reducing the top corporate rate to 6.2% is $7,362, Hardin said. The total corporate income tax cut based on returns filed in 2019 is $21.3 million for a full year, he said.

The average tax cut for 1,744 corporations earning between $100,000 and $500,000 is $375, while the average cut for 408 corporations earning between $500,001 and $1 million is $1,800, he said.

The average tax cut for the 748 corporations earning more than $1 million is $26,687, Hardin said.

Among other things, Act 822 of 2019 also required out-of-state internet retailers to collect sales and use taxes, which started July 1, 2019, and extended the net operating loss carry-forward period from five to eight years for losses occurring in the tax year starting by Jan. 1, 2020, and to 10 years for losses in tax years starting by Jan. 1, 2021.