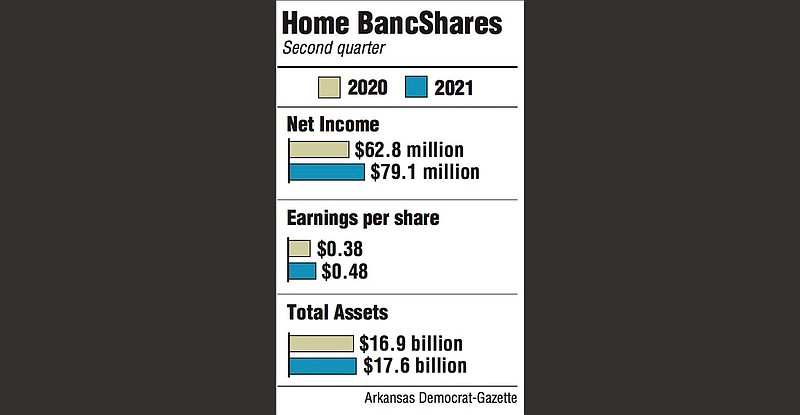

Home BancShares Inc. reported soaring profits for the second quarter as net income climbed nearly 26% to $79.1 million. Earnings per share also was up 26.3% to 48 cents compared with the same period a year ago, the Conway bank announced Thursday.

Adjusted for non-recurring gains, earnings were 46 cents per share, matching Wall Street projections as reported by Zacks Investment Research.

"The performance in the second quarter was another solid quarter for our company," Chairman and Chief Executive Officer John Allison told analysts on a conference call Thursday afternoon.

Net interest income and net interest margin (NIM), however, were below analysts' expectations and loan demand is down, according to an analysis from Stephens Inc. Home BancShares generated strong non-interest income growth of $28 million, beating analysts' consensus of $26 million.

Net interest income of $143 million failed to meet analysts' projections of $147 million and net interest margin fell 41 basis points to 3.61% from 4.11% in the same quarter last year. The margin was lower than analysts' predictions of 3.92%.

"Revenue trends remain challenged as core loan growth and NIM were each disappointing," Stephens analyst Matt Olney wrote in a report Thursday before the bank's earnings call with analysts.

During the call, Home's management team fielded several questions about the slowdown in loan growth, and bank officials responded that they are confident a disciplined approach will pay off in the long run. The bank will not, officials said, respond to market pressure to make loans at unacceptable interest rates.

Total loans receivable in the quarter was $10.2 billion, down significantly from $11.9 billion a year ago.

"Loan demand is the frustrating part of the equation," Allison said at the beginning of the call, noting the bank's strong profitability and asset quality.

Home BancShares, which operates as Centennial Bank in its markets, will continue to remain disciplined in lending practices, officials said.

"One of the hardest things we do is maintain our discipline, and although loan growth might seem a little slow, we too plan to be patient as we do not intend to sell the future of our company," Tracy French, Centennial Bank president and chief executive officer, said in the earnings news release. "We won't be one to reach out in the market for short-term gain to create long-term pain."

On the call with analysts, chief loan officer Kevin Hester said the bank's loan pipeline is strong and he expects loan activity to gain steam in the second half of the year.

Hester noted "growth is elusive" with excess liquidity flooding the market. "All along we felt it would be the second half of 2021 before we would see any loan growth and we still feel that way," he added. "The good news is our production pipeline is stronger than it was 90 or 180 days ago."

Loans in the hotel sector that were modified during the pandemic are in better shape today, Hester said. "Recovery is definitely underway with virtually all of the modified properties experiencing a significant improvement in cash flow," he said.

Meanwhile, Home BancShares continues to hunt for merger and acquisition opportunities though none have materialized.

"We have worked on a couple of interesting opportunities but to no avail so far," Allison told analysts, adding that the bank is interested in deals that are non-dilutive to stockholders. "We'll continue to look for like-minded partners in the space."

The bank is now in negotiations with a potential mergers and acquisitions partner that Allison said he hopes will be announced soon, though he did not give a specific timetable for a deal.

"We're very active on M&A," Allison said. "We're a little further along on an M&A deal at this point than we've been in some time."

In the quarter, Home BancShares reported total assets of $17.6 billion, up 4% from $16.9 billion in the same period last year. Revenue was $172.4 million, down slightly from $173.7 million in the second quarter last year.

The bank's shares fell 16 cents to close Thursday at $23.29 as the Dow Jones Industrial Average inched up 53.79 points. The company has 160 bank branches in Arkansas, Florida, Alabama and New York City.