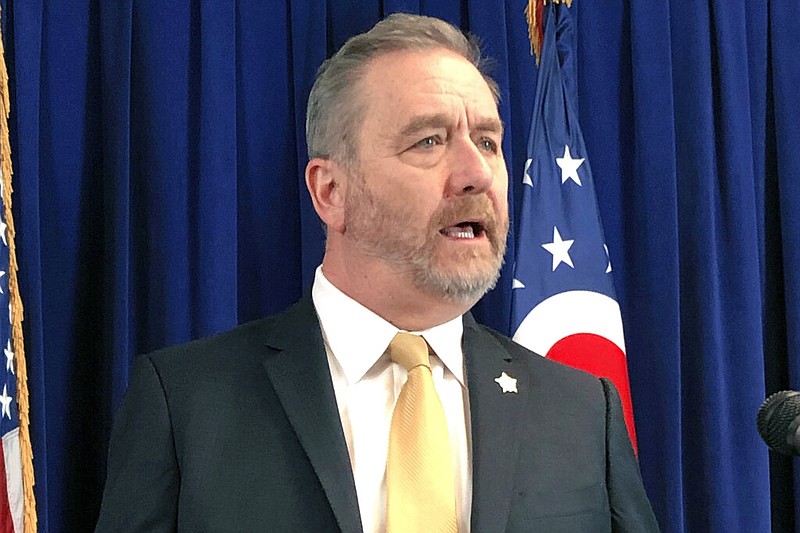

WASHINGTON -- Ohio Attorney General Dave Yost sued the Biden administration Wednesday over its $1.9 trillion coronavirus relief package, alleging the federal government sought to impose "unconstitutional" limits on states' ability to access some of the aid.

The lawsuit from Yost, a Republican, was filed a day after 21 other GOP attorneys general, including Arkansas Attorney General Leslie Rutledge, issued their own legal threat in a move that increased tensions between states and Democratic policymakers in Washington over one of the largest rescue measures in U.S. history.

"This is a massive $1.9 trillion economic aid package, but its restrictions are an invasion of state sovereignty and we are telling the Treasury it must act now before Arkansans suffer," Rutledge said in a statement.

The Ohio lawsuit centers on a $350 billion fund meant to help cities, counties and states cover the costs of responding to the coronavirus pandemic. The stimulus law opened the door for cash-strapped local governments to tap federal aid to pay for expenses, including for first responders, though it prohibited states from using the money to directly or indirectly offset new tax cuts.

To Ohio, though, the restriction on cutting taxes is overly broad, putting states that had planned any tax cuts -- even those that predate the pandemic -- in jeopardy of losing access to the federal relief money. Yost said the federal government had no right to make a such demand, and the attorney general asked a federal court in Ohio to grant a preliminary injunction preventing the portion of the stimulus law from being enforced.

"The Tax Mandate thus gives the States a choice: they can have either the badly needed federal funds or their sovereign authority to set state tax policy. But they cannot have both. In our current economic crisis, that is no choice at all," Ohio's lawyers wrote in the court filing.

Yost, in an interview, said the "plain meaning of the statute is unconstitutional."

The lawsuit echoes the criticisms raised by other Republican leaders, who wrote Treasury Secretary Janet Yellen on Tuesday to ask her to clarify the law's application by Tuesday -- or face "appropriate additional action." The letter from the attorneys general of Arizona, Georgia, West Virginia and 18 other states said the stimulus, absent clarification, "would represent the greatest invasion of state sovereignty by Congress in the history of our Republic."

Responding to concerns from state officials, the Treasury Department said Wednesday that states can cut taxes without penalty under a new federal pandemic relief law -- so long as they use their own funds to offset those cuts.

A treasury spokesman said the provision isn't meant as a blanket prohibition on tax cuts. States can still offset tax reductions through other means.

"In other words, states are free to make policy decisions to cut taxes -- they just cannot use the pandemic relief funds to pay for those tax cuts," the Treasury Department said.

The treasury's application of the law could provide clearance for some tax cuts, such as Missouri legislation that would expand online sales taxes to offset proposed income tax reductions in 2023.

Arkansas Gov. Asa Hutchinson said formal guidance from the Treasury Department will be critical in determining how much flexibility exists for states. The Republican governor, however, wants lawmakers to move forward with his proposal to set aside $50 million for tax reductions, including a cut to sales taxes on used vehicles.

"We should not let federal restrictions weigh in on that direction we're going as a state," Hutchinson said.

Separately, the Treasury Department says it has sent out 90 million economic impact payments totaling $242 billion since President Joe Biden signed the $1.9 trillion pandemic relief plan last week.

The bulk of those payments were made by the IRS as direct deposits, which recipients starting seeing in their bank accounts last weekend, officials said Wednesday.

In addition, the Treasury Department has mailed out roughly 150,000 checks worth about $442 million.

Processing of the payments began Friday, the day after Biden signed the American Rescue Plan, which authorized direct payments of up to $1,400 to qualifying individuals.

The Treasury Department said the first batch of payments went to eligible taxpayers who provided direct-deposit information on their 2019 or 2020 tax returns.

Officials said additional batches of payments will be sent in coming weeks by direct deposit and through the mail as a check or debit card.

Information for this article was contributed by Tony Romm of The Washington Post; by David A. Lieb, Josh Boak, Jeff Amy, Jeffrey Collins, Andrew DeMillo, Sophia Eppolito, Melinda Deslatte, John Hanna, Sean Murphy, Emily Wagster Pettus and Martin Crutsinger of The Associated Press.