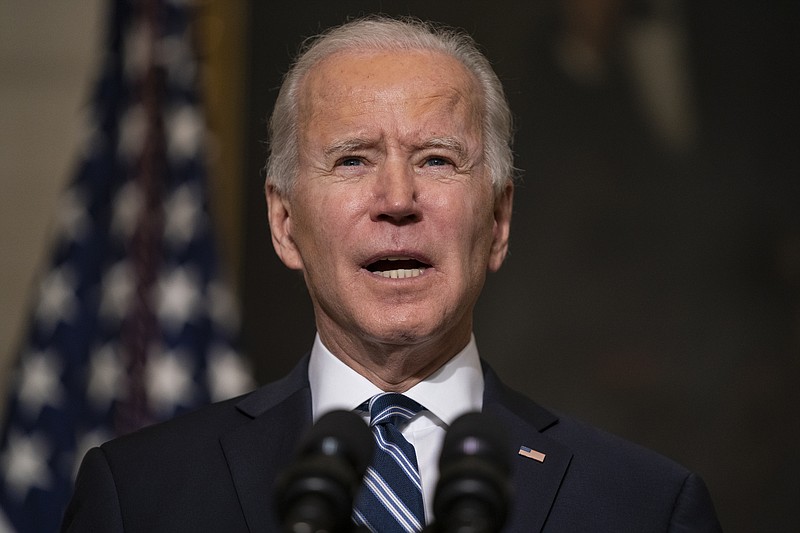

As the prospect of President Joe Biden canceling student debt continues to dominate public discourse, new proposals are bringing into focus the administration's broader plans for overhauling a federal lending system that is widely considered broken.

But higher education experts and lawmakers are torn on whether the changes will deliver meaningful reforms for borrowers.

"The Biden administration has made tremendous progress," said Sen. Elizabeth Warren, D-Mass. "The Department of Education was not on the side of working families and struggling borrowers, and that has changed."

Warren, other congressional Democrats and liberal advocates say Biden is making great strides in cleaning up programs, like Public Service Loan Forgiveness and Borrower Defense to Repayment, that have unfairly left too many borrowers stuck in repayment. They are calling on the Education Department to use its authority to make additional bold changes.

Conservatives, meanwhile, are critical of what they say is a power grab by the administration.

"This isn't about fixing the loan program, this is an attempt to carry out mass loan forgiveness and keeping taxpayers in the dark about it," said Rep. Virginia Foxx of North Carolina, the top Republican on the House Education Committee.

A new Government Accountability Office report, requested by Foxx, shows that the federal government is on track to lose $197 billion in revenue from the lending program, and that's before accounting for Biden's proposed changes.

Until now, the Biden administration has focused on targeted debt relief -- temporary reprieves to give public servants, defrauded students or disabled borrowers a better chance of having their loans forgiven. Those efforts have been paired with promises of long-term reforms that are starting to take shape.

Last month, the Department of Education released two packages of proposals, including one that would limit the ways interest can inflate student loan costs and others that simplify the discharge of debt in cases of fraud, school closure or permanent disability. The agency will take public comment on the proposed rules before finalizing and implementing them next July.

On a call with reporters earlier last month, Undersecretary of Education James Kvaal said, "These improvements will continue to solve long-standing problems in the loan repayment and forgiveness programs and serve borrowers over the decades to come."

The federal student loan system is a dizzying array of repayment plans and forgiveness programs with rules that can be difficult to navigate. Efforts over the years to give borrowers more options have added more complexity and confusion.

The Biden administration's proposals amount to some of the most significant updates to the federal student loan repayment system in years. Still, Jared Bass, senior director for higher education at the Center for American Progress, described the effort as "asking [the administration] to fix a dam during a hurricane" because of the breadth of changes needed.

"This administration has the dual path and responsibility of not only undoing harmful practices of the former administration but also making government work," Bass said. "It is taking steps where it can ... but it shouldn't be in this alone."

Bass and other higher education experts say Congress must play a role to achieve sweeping overhaul of the system, in part, because the Department of Education has limited authority. While the department can make some administrative changes through rulemaking, many of the statutes governing federal student aid are largely the purview of legislators.

Take income-driven repayment plans, which cap monthly payments to a percentage of earnings and eventually forgive the balance. While the administration can propose a new version of the program -- as it is slated to do in the coming weeks -- it has no authority to fold the existing suite of income-driven options into one simplified plan. That requires Congress.

"Legislation should prioritize replacing the overly complex system of loan repayment with a single repayment plan for all borrowers that bases monthly payments and total amount due to be repaid on the borrowers' income," said Beth Akers, a senior fellow at the conservative American Enterprise Institute. "I would encourage the president to provide the leadership necessary for Congress to achieve legislative reform."

Attempts over the years to reauthorize the main law governing higher education have stalled on Capitol Hill. Members of Congress have introduced a spate of bills to fix the federal lending system in recent months, but none have gained traction.

Some experts say the intense focus on broad debt cancellation has further politicized federal student lending in a way that is undermining any chance of bipartisan reforms in Congress. That observation resonates with Marc Goldwein, senior vice president of the Committee for a Responsible Federal Budget, a group that advocates lower deficits.

"It's toxified the conversation," Goldwein said of the debt cancellation movement. "We're having silly conversations about what amounts to Band-Aid solutions. If we can move past that, there'd be opportunities for bipartisan reforms to the system."

But Persis Yu, policy director and managing counsel at the advocacy group Student Borrower Protection Center, said it is unfair to blame the debt cancellation movement for congressional inaction.

"Congress is having a lot of challenges on getting bipartisan consensus on a lot of reforms," Yu said. "The political system, as it is, is unlikely to bring about a lot of these reforms through Congress with the state that it is in right now. The department has a lot of room to make improvements."

Warren argues that there is no path to meaningful reform without providing immediate debt relief to people who have been harmed by the system. "We've got to deal with the overhang of debt that already exists and work through an effective plan to help people navigate post-high school education without getting crushed by another load of debt," she said.

Foxx and other Republicans say Biden has failed to engage Congress on federal student aid proposals and instead forged ahead with his own agenda. They argue that a lot more attention should be focused on curbing borrowing and reigning in the costs of education.

"We allow borrowers to take out as much debt as schools tell them to for degrees that simply have no return on investment, leaving students in 20 years of ballooning balances until the debt is written off," Foxx said. "Schools are well aware of these flaws, which is why the cost of college has skyrocketed, because they know it will be taxpayers who will ultimately foot the bill."

Many congressional Democrats, including Warren, agree that colleges must be held to account for the exorbitant cost of higher education that has resulted in more than a trillion dollars in student debt. Warren has long been a proponent of requiring all colleges with high student loan default rates to reimburse the government some of the debt, an idea that resonates with some Republicans.

"There's plenty that Congress can do if they would come to the table and work on bipartisan legislation," said Michelle Dimino, senior policy adviser on education at the think tank Third Way. "But the department has authority to regulate and the approach so far has involved a series of stakeholders and sought to reach consensus with those groups through rulemaking."

Dimino said the federal lending system needs to be simple and streamlined for borrowers, with a focus on helping them move through each phase of the repayment process and ensuring they are not weighed down by unaffordable balances. In her estimation, the Biden administration has shown that ideal is attainable, but will require a lot of coordination between the department, Congress, colleges and states.