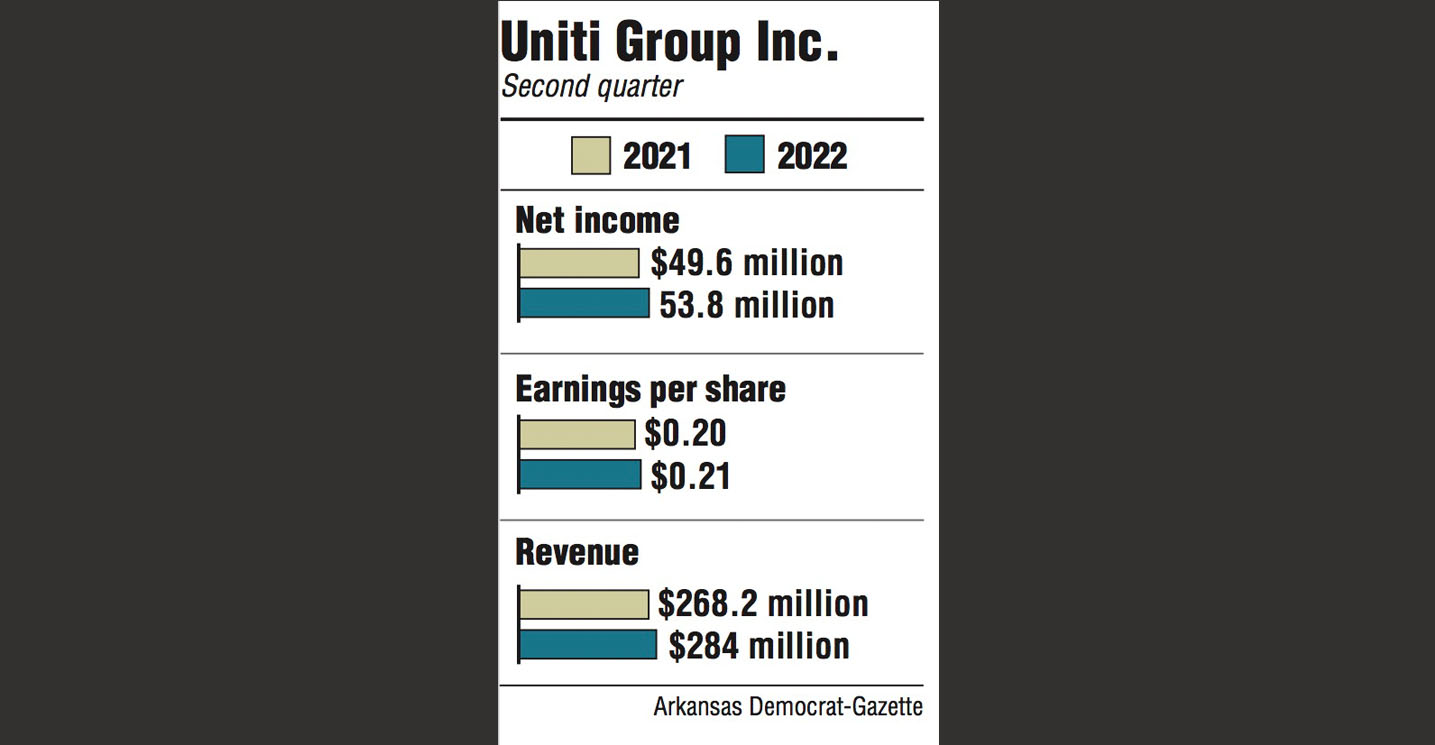

Uniti Group Inc. of Little Rock reported an 8.3% gain in profitability in the second quarter, boosted by net income of $53.8 million and a bump up of a penny in earnings per share, the company announced Thursday.

Uniti, the nation's 8th-largest fiber optic cable provider, reported earnings per share of 21 cents in the quarter ending June 30, up 5% from 20 cents in the same period last year. Adjusted funds from operations registered 44 cents per share, besting the Wall Street forecast of 43 cents.

Revenue for the quarter was up nearly 6% to $284 million, an increase from $268.2 million last year.

Overall company performance improved across the board, President and Chief Executive Officer Kenny Gunderman told industry analysts on a call Thursday. In the second quarter, new sales bookings and installs "were both the highest levels we've ever achieved in company history," he said.

"The demand for our mission-critical fiber infrastructure continues to accelerate across virtually all of our customer segments," he said. "Our results in the second quarter exceeded our expectations and we continue to be enthusiastic about our prospects for the second half of the year."

Company officials said they are confident of continued growth, with opportunities to light up its dark, or unused, fiber, as well as growing business with customers that are increasing investments in 5G wireless networks and fiber-to-the-home initiatives.

Moreover, Uniti should be insulated from any economic woes that economists are predicting for the second half of the year, Gunderman said, noting the company is "relatively immune to swings in the economy."

New sales are up for the fifth consecutive quarter, and there are abundant growth opportunities because of the broadband explosion across several industries. Dark fiber is a $1.5 billion market opportunity in North America and projected to grow to $4 billion by 2030.

Uniti has a "robust national network" available to take advantage of the growth, Gunderman said. "We have a unique opportunity to capitalize on this growing demand in the fiber market," he added.

Uniti's enterprise business reaches about 25 metro areas, with an average market share of just 5%. Yet the company has available fiber that can serve about 300 metro markets. That opens the door for expanded use and "provides us with a long runway to increase our market share substantially over the next several years," Gunderman said.

The company has been under pressure from the investors to increase merger-and-acquisition activity, and officials fielded several related questions on Thursday's call. Uniti, Gunderman said, has no need to act quickly.

"We're going to continue to be patient and opportunistic like we always have," Gunderman said, pointing out that the company does engage in conversations around M&A that will be "very favorable and very fruitful for Uniti in the future."

As for a potential economic downturn, Uniti is prepared to get through it successfully, Gunderman said, adding that any national economic woes should have "little to no impact" on Uniti's business.

Labor and material costs will go up but that should not slice into the company's financial performance, officials said Thursday. "Given that our business continued to perform exceptionally well during the depths of the pandemic we expect to execute at a similar level during any potential recession or economic downturn," Gunderman said.

Uniti is a real estate investment trust that builds and acquires communications infrastructure and provides fiber and other services to some of the nation's leading wireless providers and technology companies. In addition to fiber, the company holds other communications real estate throughout the U.S.

The company's stock closed Thursday at $9.85, down 36 cents or about 3.5%.