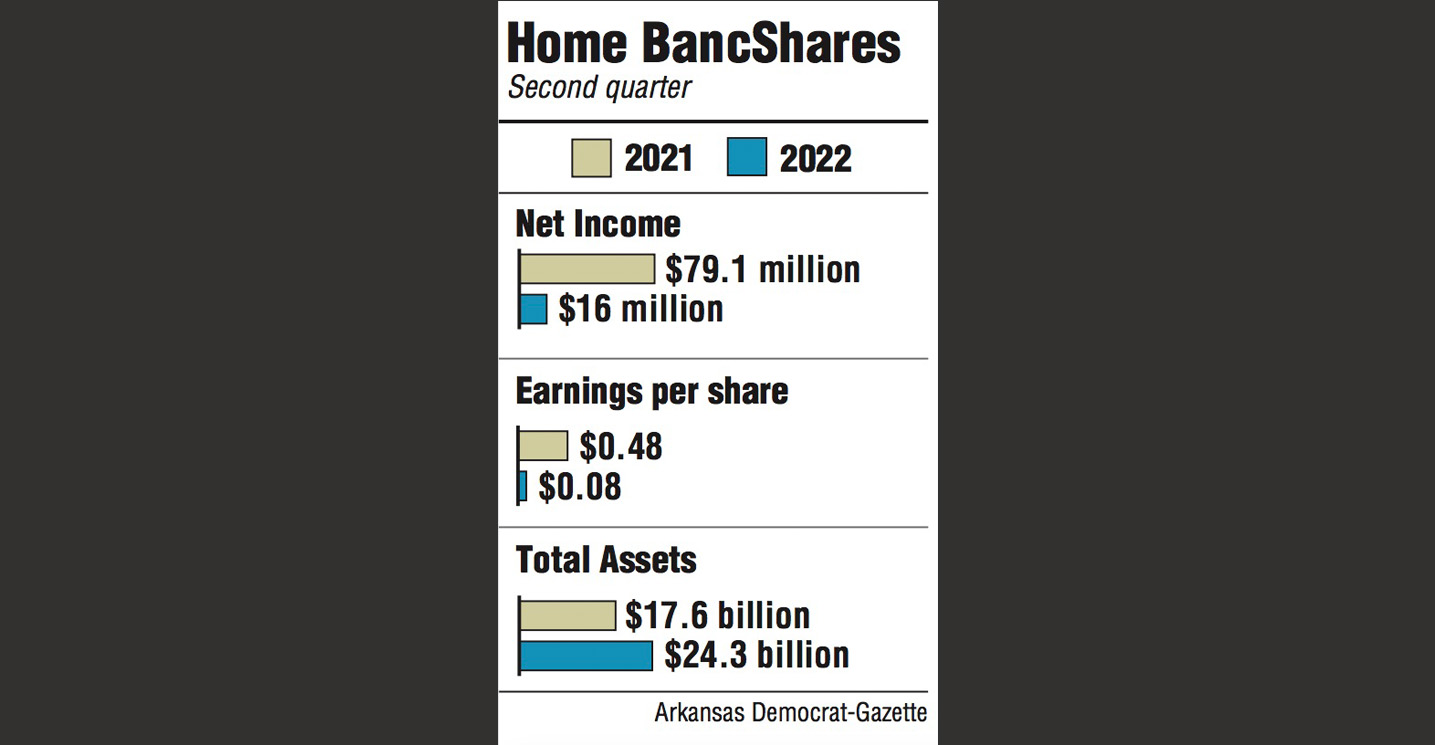

Home BancShares Inc.'s expansion into Texas during the second quarter sliced into profits, with the Conway bank reporting Thursday that one-time expenses related to its acquisition of Happy Bancshares Inc. shrank net income to $16 million compared with $79.1 million a year ago.

Earnings per share in the quarter ended June 30 fell to 8 cents, compared with 48 cents in the same period a year ago. Eliminating the merger costs, earnings per share reached 47 cents, blowing past the 38 cents projected by the Wall Street consensus analysis produced by Zacks Investment Research.

Revenue, deposits and loans all increased during the quarter. The company's performance was "very efficient in these volatile economic times," Chairman and Chief Executive Officer John Allison told industry analysts on a conference call Thursday. "We're very proud of the performance of the company."

Revenue in the quarter was a record $243.3 million, up from $172.4 million a year ago. Deposits increased to $19.6 million, up from $13.9 million last year. Total loans increased to $13.9 billion, up 37% from $10.2 billion in the second quarter of 2021.

"It's one of the best quarters in the company's history," Allison said on Thursday's call.

In early April, the lender closed on the $961.9 million acquisition of Happy Bancshares Inc. of Amarillo, which operates as Happy State Bank in the Texas panhandle and other key markets in Texas such as Dallas and Austin. Home reported Thursday that expenses related to the deal reduced earnings by $107.3 million and earnings per share by 39 cents.

"It was a very busy quarter, and I'm very pleased with the operating results," said Terry French, president and chief executive officer of Centennial Bank. "We are much farther ahead than I thought we would be after only one full quarter of the combined company."

Home BancShares operates as Centennial Bank in local markets except Texas, where it retained the Happy Bank brand.

Home BancShares has taken a disciplined financial approach over the past 18 months that has shored up the bank to prepare for the economic challenges associated with spiraling inflation and any downturn that may occur in the coming months, Allison said, noting the company has a "powerful balance sheet."

"We have remained disciplined and implemented our defensive initiatives: not making low-rate loans, not deploying all of our cash in low-rate securities, paying off debt and managing our loan to deposit ratio, among other things," Allison said in the company's earnings announcement. "As it appears, the pendulum is about to swing back toward defensive stocks from growth stocks, and when it does, [Home BancShares] is sitting in the catbird seat."

Industry observers have kept a watchful eye on banks as they report second-quarter earnings, looking for any increases in loan loss reserves that would signal an expectation of an economic downturn and lead to troubled loans.

Allison said Thursday that Home BancShares' conservative approach and previous moves to preserve its loan loss provisions provides the bank with a secure position against any potential economic troubles. "If there is a recession ... we may not have to add as many dollars to reserves as some people do," he added.

The company is considering options to invest the $2.5 billion in cash it has on hand. "We're picking our spots to deploy the cash" Allison said. "We'll continue to repurchase stock when the market puts it on sale." The bank repurchased more than 1 million shares in the second quarter.

The company achieved net interest income of $198.7 million, which was above consensus forecast and up nearly 41% from $141.2 million last year. Net interest margin improved to 3.64% from 3.61% in the same quarter a year ago.

Looking forward, the company said it has room to grow in Florida and, particularly, in Texas with the addition of Happy Bancshares. "The earnings power of the two companies is really pretty significant," Allison said.

Home operates 76 branches in Arkansas, has local banks across Florida and Texas and operates five branches in Alabama and one in New York City. The bank's shares fell 37 cents Thursday to close at $22.03.