Boosted by rising individual income and sales and use tax collections, Arkansas' general revenue increased in October by $75.7 million or 11.9% over the same month a year ago to $710.7 million.

The month's collections beat the state's forecast by $66 million, or 10.2%, the state Department of Finance and Administration reported Wednesday in its monthly revenue report.

October's total collections of $710.7 million is a new high collection level for the month with the previous high $634.9 million in 2021, said Whitney McLaughlin, a tax analyst for the finance department.

"Sales Tax collection remains particularly strong across the state with double-digit percentage gains over October 2021," finance department Secretary Larry Walther said in a written statement.

"All major revenue categories are above forecast and exceed last year in a testament to broad-based expansion going into the holiday shopping season," he said.

Tax refunds and some special government expenditures are taken off the top of total general revenue collections, leaving a net amount that state agencies are allowed to spend up to the amount authorized by the state's Revenue Stabilization Act.

The state's net general revenue in October increased by $56 million, or 10.2%, over a year ago to $604.8 million, exceeding the state's forecast by $49.2 million, or 8.9%.

October is the fourth month of fiscal year 2023, which started July 1.

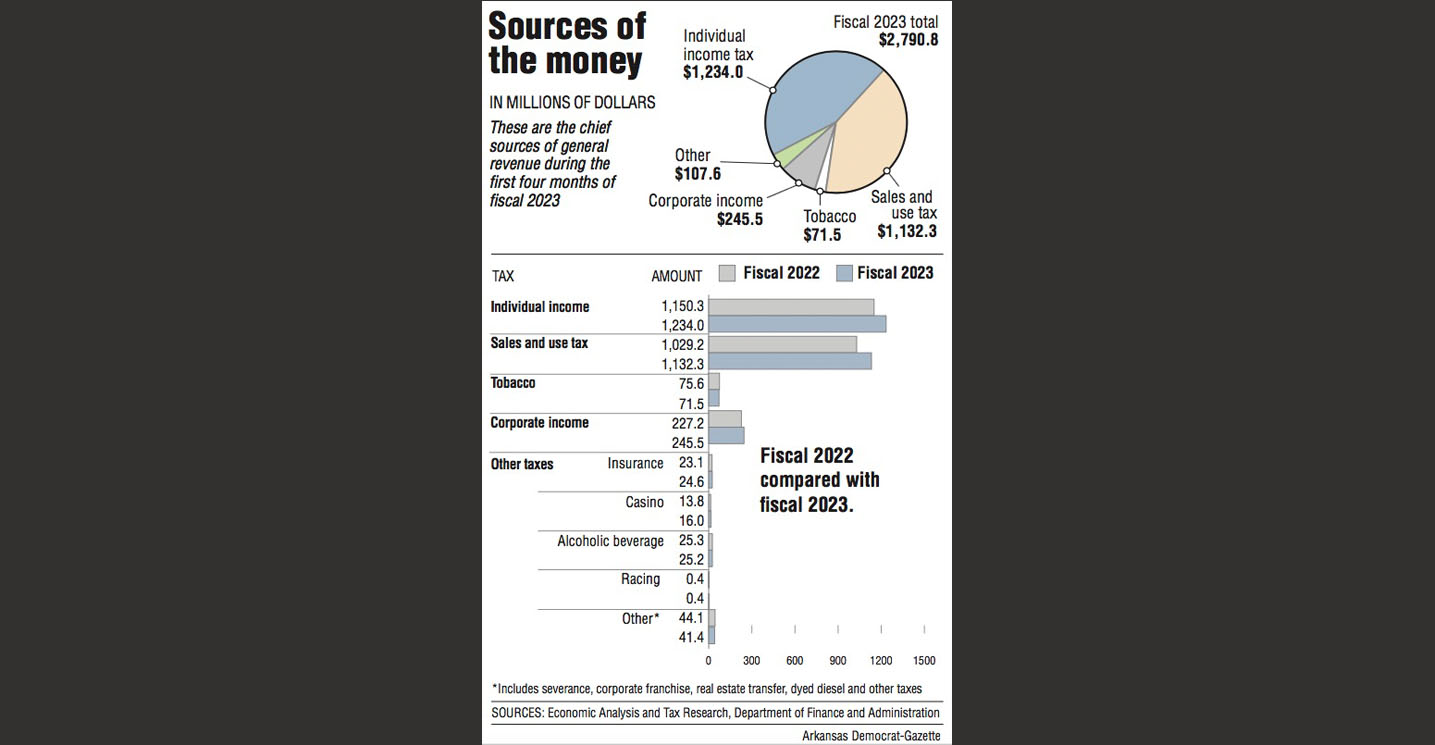

In the first four months of fiscal 2023, the state's total general revenue increased by $201.7 million, or 7.8%, over the same period in fiscal 2022 to $2.7 billion, outdistancing the state's forecast by $241.2 million, or 9.5%.

So far in fiscal 2023, the state's net general general revenue increased by $182 million, or 8%, over the same period in fiscal 2022 to $2.4 billion, beating the state's forecast by $224 million, or 10%.

Gov. Asa Hutchinson said Wednesday that "Arkansas continues to reflect a much stronger economy than we see nationally.

"Inflationary pressures are reducing the buying power of Arkansans, which means that our individual citizens are not enjoying the same growth in revenue as does state government," the Republican governor said in a written statement.

"This fact reinforces the importance of the decision earlier this year to return over $400 million to Arkansans in the form of tax relief," Hutchinson said.

FISCAL YEAR 2023 SURPLUS

In the fiscal session earlier this year, the General Assembly and Hutchinson authorized a general revenue budget of $6.02 billion for fiscal 2023 -- up by $175.1 million from fiscal 2022's general revenue budget with most of the increases for the public schools and human service programs.

The finance department's latest forecast May 18 projected a $914 million surplus at the end of fiscal 2023 on June 30.

That was before the Legislature and Hutchinson in the Aug. 9-11 special session enacted a four-pronged tax cut package that the finance department projected would reduce state general revenue by $500.1 million in fiscal 2023, by $166.6 million more in fiscal 2024, by $69.5 million more in fiscal 2025, by $18.4 million more in fiscal 2026 and by $8.4 million more in fiscal 2027.

The tax cut package accelerated the reduction of the state's top individual income tax rate from 5.5% to 4.9%, retroactive to Jan. 1, 2022, and will accelerate the state's top corporate income tax rate from 5.9% to 5.3%, effective Jan. 1, 2023.

The package also grants a temporary, nonrefundable income tax credit of $150 for individual taxpayers with net income up to $87,000 and of $300 for married taxpayers filing jointly with net income up to $174,000, and adopts a federal depreciation schedule for businesses.

As a result of the top individual income tax rate immediately declining to 4.9% and the low-income tax credit, the finance department in September notified the state's 80,000-plus employers of changes to the payroll withholding tables, said finance department spokesman Scott Hardin.

"As companies implement these withholding changes, Arkansans will see paychecks increase," he said in a written statement. "Additionally, taxpayers will continue to benefit when tax returns are filed in early 2023 (for tax year 2022). The top rate acceleration to 4.9% will result in taxpayers keeping an additional $295 million in their pockets over the course of the next year. The timing of the benefit may vary for taxpayers as companies continue to formally adopt these changes."

Opponents of the tax cut package in the Aug. 9-11 special session said the chief beneficiaries of the tax cut package would be upper-income taxpayers and the money would be better spent on teacher raises, some underfunded state programs and for more tax relief for lower-income taxpayers

Hutchinson declined to put teacher raises on the call for the special session, citing the lack of support in the Republican-dominated Legislature to consider teacher pay raises in the special session. His decision came after he floated proposals to boost teacher salaries in the special session, and House and Senate Democrats and some Republicans said they wanted to consider raising teacher salaries in the special session.

At that time, Republican legislative leaders said they wanted lawmakers to consider increasing teacher pay during the 2023 regular session, starting Jan. 9, after the House and Senate education committees complete their biennial educational adequacy review. The House and Senate education committees have differing plans for teacher pay raises.

During the Aug. 9-11 special session, House Revenue and Taxation Committee Chairman Joe Jett, R-Success, said enactment of the tax cut measure would leave a projected general revenue surplus of roughly $400 million in fiscal year 2023.

But the state's general revenue surplus in fiscal 2023 could be larger than that because the state's net general revenue collections during the first four months of fiscal year 2023 have exceeded the state's forecast by $224 million.

On Nov. 10, the finance department is scheduled to release an update to its May 18 general revenue forecast and Hutchinson's proposed general revenue budget for fiscal 2024 that begins July 1, 2023, and ends June 30, 2024. Hutchinson's successor as governor will take office in January.

In advance of the regular session, the Legislative Council and Joint Budget Committee have been holding budget hearings for state agencies. The budget hearings started Oct. 11 and are scheduled to end Nov. 21.

OCTOBER DETAILS

According to the finance department, October's general revenue included:

• A $43.4 million, or 14%, increase in individual income tax collections over a year ago to $354.1 million, beating the state's forecast by $32.3 million, or 10%.

The largest category of individual income tax collections is withholdings.

Individual withholding tax revenue increased by $20.6 million, or 8.6%, over a year ago to $259.5 million, outdistancing the state's forecast by $2.8 million. John Shelnutt, the state's economic forecaster, said there was one more Friday payday in October compared with the same month a year ago.

Collections from returns and extensions increased by $23.3 million over a year ago to $81.1 million, and beat the state's forecast by $28.6 million.

Collections from estimated payments dropped by about $500,000 from a year ago to $13.6 million, but exceeded the forecast by $1 million.

• A $29.4 million, or 11.6%, increase in sales and use tax collections to $283.1 million, which beat the state's forecast by $22.8 million, or 8.8%. Most major reporting sectors of sales tax displayed high growth over a year ago, reflecting continued economic expansion in many sectors.

"We did not expect that kind of continuing growth in sales tax," Shelnutt said.

He said some of the increase in the state's sales tax collections is a result of inflation, "but with such high growth you have to attribute some of it to real fundamentals" with the state's low unemployment rate and tight job market.

• A $2.5 million, or 7.1%, increase in corporate income tax collections to $38.6 million, which beat the state's forecast by $8 million, or 26.2%.

Asked whether he is seeing any signs of a recession in Arkansas, Shelnutt said "it's all theoretical at this point."

"Certainly, there is a caution flag out there for the economy," he said, but his peers in other Southern states don't see evidence of a slowdown either.