|

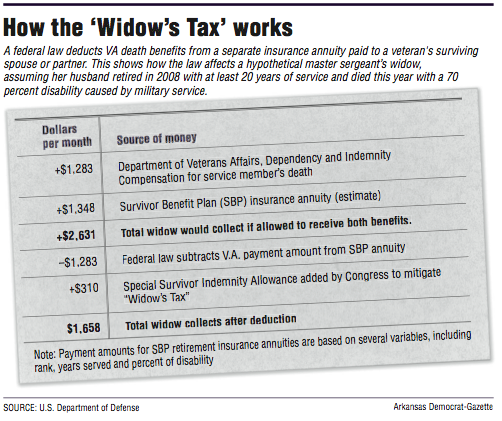

With the "Widow's Tax" law in place, 64,600 military widows and widowers see their potential annuity incomes reduced by about $7,300 on average per year, according to the Department of Defense.

Many lose $10,000 and more.

Without the federal law, these surviving spouses would get both payments in full — their annuity and VA compensation — as many other federal government employees’ survivors do.

Spouses of lower-rank and long-retired service members, in particular, say the reduction in expected income leaves them struggling to survive.

Virtually all who are affected by the law — 99 percent — are women, according to Defense Department data.

More than 85 percent are age 62 and older.

Widows and veterans have tried for at least 20 years to repeal the statute. Members of Congress have expressed sympathy and even passed legislation to mitigate it.

Still, the “Widow’s Tax” persists.

State delegation all for law’s repeal

Veterans groups and their lobbyists applaud Arkansas as the only state where all Congressional members have co-sponsored bills to repeal the “Widow’s Tax” in both 2015 and 2017.

“The widows and children of our service members have sacrificed in service to our country, and they deserve the very best,” Sen. Tom Cotton said through a spokesman about his support of “Widow’s Tax” repeal.

|