Selling houses to millennials, who are shouldered with college debt that is triple the amount their parents faced, is one of the major challenges real estate agents face in Arkansas, according to speakers at a homeownership conference Tuesday.

The issue of debt is compounded by a national housing market with rising prices and dwindling stock, especially for first-time homebuyers, attendees at the first Governor's Conference on Homeownership said.

"The big obstacle is the lack of affordable homes that are at that moderate range," said Lawrence Yun, the senior vice president for the National Association of Realtors and the Little Rock event's keynote speaker.

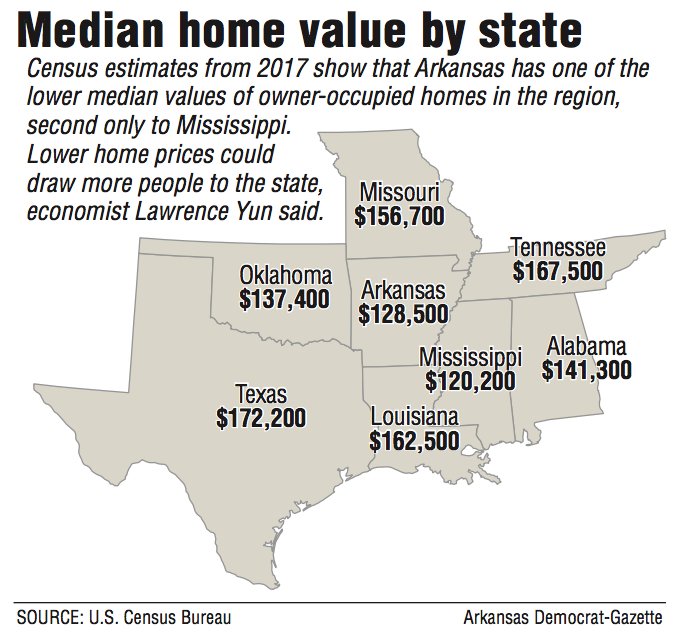

But Yun added that because Arkansas still has comparatively low prices for homes, people from other states could relocate to Arkansas. Census estimates from 2017 showed that Arkansas' median price for an owner-occupied home was $128,500. Surrounding states have higher medians, except Mississippi at $120,200.

About 200 real estate agents, mortgage bankers and other homeownership specialists attended the conference, said Derrick Rose, public information officer for the Arkansas Development Finance Authority. The authority organized the conference to educate and train attendees about new loan application forms and tax changes affecting real estate agents.

The finance authority provides loan-payment assistance to first-time homebuyers, one of a few housing programs it administers. From 2016 to 2018, the amount of loans it doled out increased from $42 million to $100 million, Rose said.

Yun said that, compared with many parts of the nation, buying a home in Arkansas is cheaper. He thinks that now that the housing market has bounced back from the 2008 crash, more companies may be looking to relocate to places where their employees can afford homes.

"I think some people will look toward Arkansas as a possibility," he said in a later interview.

He added that he expects the national housing market to remain fairly steady in 2019 while Arkansas' begins to grow.

When others at the conference referenced difficulty selling to younger generations, Yun rebutted stereotypes about millennials who don't want to buy houses.

Many reasons mentioned for younger generations not buying houses are "unfounded," he said.

A 2018 survey from NeighborWorks showed that most adults still see homeownership as a part of achieving the "American dream." NeighborWorks is a Washington, D.C.-based nonprofit that creates "places of opportunity in communities across the country" by connecting and supporting other groups, according to its website.

But the cost of attending college prevents many young adults from purchasing houses, Yun said.

More people should consider attending trade school, he said, adding that a lack of truck drivers and construction workers has driven up the cost of building a house. The increased cost has led to fewer and pricier homes.

In Arkansas, more than half of students who graduate from a four-year university are nearly $27,000 in debt, according to the Institute for College Access and Success, a nonprofit that researches and advocates for affordable higher education.

Nationally, Americans have about $1.5 trillion total in student-loan debt.

Gov. Asa Hutchinson, who also spoke at the conference, said the lack of homes that first-time buyers can afford is a "constant worry" but that he was confident the economy and job opportunities in Arkansas would translate into more buyers.

"From an Arkansas standpoint, I want you to know I've never been more optimistic about our future," Hutchinson said.

The lack of affordable housing extends beyond first-time homeowners. Housing advocates have said that people who have the lowest incomes and rent homes are the most affected.

No state has enough rental homes for people with incomes at or below the federal poverty line, according to a 2018 study from the National Low Income Housing Coalition. The group advocates for affordable and safe housing. The 2019 federal poverty line is $12,140 per year for one person and $25,100 for a family of four.

Arkansas is short 59,445 rental homes for people with low incomes, according to the coalition's study.

"If we don't have adequate inventory, you can have the greatest economy, but people simply cannot buy homes," Yun said.

Metro on 02/06/2019