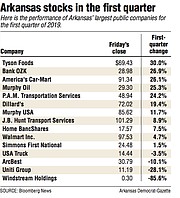

Tyson Foods posted the best return of any stock on the Arkansas Index in the first quarter this year, leaving a difficult 2018 behind.

Shares of the Springdale-based company closed Friday at $69.43, ending the first quarter up 30 percent.

The rough year for Tyson Foods in 2018 was attributed large in part to the United States trade dispute with China, said Chris Harkins, managing director with Raymond James & Associates in Little Rock.

Some of the growth in Tyson's stock price was based on analysts' focus on fundamentals, Harkins said.

"Add to that the hope of a resolution on trade issues," Harkins said.

Tyson is expected to release its next earnings report on May 9, Harkins said.

Bank OZK was by far the best performer among Arkansas' publicly traded banks, with a 26.9 percent increase in the first quarter, said Garland Binns, a Little Rock banking attorney with the firm of Dover Dixon Horne.

Home Bancshares saw an increase of 7.5 percent for the quarter, and Simmons First National had a modest increase of 1.5 percent for the quarter.

No bank acquisitions were announced by any of the three publicly traded banks during the quarter, Binns said.

Despite Bank OZK's shares soaring in the first quarter, they still remained 40 percent lower than a year ago, Harkins said.

Analyst consensus at Thomson Reuters shows a 20 percent upside from here with Bank OZK's investors looking forward to the first quarter's earnings report on April 17, Harkins said.

America's Car-Mart, the Bentonville-based buy here, pay here used car company, had the best annual performance of Arkansas Index companies in 2018 with a 62 percent gain. It beat that pace in the first quarter this year, closing up 26.1 percent.

Car-Mart is up more than 80 percent from a year ago, Harkins said.

"[Car-Mart's] customer demographic appears strong in our current economic environment," Harkins said.

Car-Mart's customers often do not have access to traditional vehicle financing because of poor credit or no credit history.

The company operates about 145 dealerships in Alabama, Arkansas, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Oklahoma, Tennessee and Texas. It's next earnings release is expected on May 21, Harkins said.

The Arkansas Index rose about 12.5 percent for the first quarter.

Only four of the 15 companies in the index lost ground during the first three months of the year. One of them, Windstream Holdings, saw its stock drop 85.6 percent.

"Windstream declared bankruptcy during the first quarter after a negative court ruling in a dispute with one of the company's largest bondholders," Harkins said.

Yahoo Finance reported that hedge fund Aurelius Capital Management filed a notice of default against the telecom in 2017, Harkins said.

"[Aurelius] argued that the spinoff action that created Uniti Group was a breach of the covenants regulating a bond deal between the company and the hedge fund," Harkins said.

The Windstream fallout continues and shares of Uniti remain under intense pressure, Harkins said.

"On top of the rough ride for shareholders, Thomson Reuters analysts' mean target is 15 percent lower than the current stock price," Harkins said. "Uniti also announced the reduction of its dividend by 90 percent."

Despite an almost 10 percent jump in fourth quarter revenue, ArcBest's net income and earnings per share fell more than 60 percent over the previous year's results, Harkins said.

ArcBest's stock fell 10.1 percent in the first quarter.

Thomson Reuters analysts' mean target on ArcBest stock is more than 20 percent higher or nearly $39 a share, Harkins said. The next earnings report is due on May 1, Harkins said.

Business on 03/30/2019