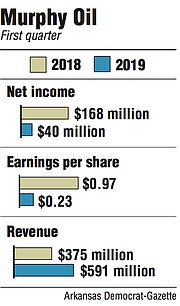

EL DORADO -- Murphy Oil Corp. on Thursday posted a first-quarter profit of $40 million, or 23 cents per share, down from $168 million, or 97 cents a share, for the same period in 2018.

The El Dorado company reported adjusted net income, excluding discontinued operations and other one-off items, of $27 million, or 15 cents per share.

Murphy announced March 21 the divestiture of its Malaysia assets and, beginning with the first quarter, reported those assets as "discontinued operations" and classified as "held for sale" for financial reporting purposes.

The company signed a purchase and sale agreement of $2.13 billion with Thailand's PTTEP for its oil and gas assets in Malaysia.

In announcing its exit from Malaysia, Murphy said it would use the proceeds from the deal to pay down debt, buy back shares and fund potential projects in the United States. The transaction has an effective date of Jan. 1 and is expected to close in the second quarter, subject to normal closing adjustments. The company expects the deal to bring a book gain of up to $1 billion.

Thursday's results are for the three months that ended March 31. Total revenue was $591 million, up from $375 million for the first quarter of 2018.

Analysts with Seeking Alpha offered a consensus earnings per share estimate Wednesday of 11 cents and revenue of $557 million.

Roger W. Jenkins, president and chief executive officer, touted Murphy's deal-making acumen in the divestiture of Malaysia assets and the acquisition of deep-water Gulf of Mexico assets.

"We demonstrated again that we are proven deal-makers by successfully executing agreements to divest our Malaysia assets, which are becoming gassier, followed shortly thereafter by an agreement to re-deploy the expected proceeds by acquiring oil-weighted, tax-advantaged Gulf of Mexico assets further enhancing our ability to generate cash flow," Jenkins said in comments attached to the first-quarter financial and operating results.

The company announced April 23 that it had entered into a definitive agreement to acquire assets from LLOG Exploration Offshore LLC and LLOG Bluewater Holdings LLC for $1.375 billion with additional contingent consideration payments. The Gulf of Mexico assets currently produce about 38,000 barrels of oil equivalent per day net. The transaction date was effective Jan. 1 and is expected to close in the second quarter, subject to normal closing adjustments.

The company also obtained approval from regulators to operate Gulf of Mexico assets acquired from Petrobras America Inc.

"Over the past seven months Murphy has undertaken three major transactions as part of the strategic transformation to focus our company primarily in the western hemisphere with oil-weighted growth that can generate significant after-tax cash flow for many years," Jenkins said. "Viewed in combination, our sale of Malaysia along with the purchase of two Gulf of Mexico assets illustrates very compelling metrics across all fronts. We look forward to closing the transactions during the second quarter and executing on our new long-range plan."

Jenkins acknowledged that lower than planned production across North American business was disappointing but cited "one-off events" that "are now behind us."

Jenkins said production stabilized as the company moved into the second quarter.

"Following a weak production month for March in our Eagle Ford Shale business we are back on track with production increasing daily," Jenkins said. "With almost 80 percent of our planned wells to come online in the second and third quarters, we expect to see continued strong growth in this asset."

Jenkins also noted the early success this year of the company's drilling program in Mexico and Vietnam.

The company drilled a discovery with its first exploration test in the Salinas Basin, offshore Mexico. The Cholula-1EXP exploration well reached a depth of more than 8,800 feet in approximately 2,300 feet of water.

"Our drilling team did an outstanding job executing a pace-setter well in Mexico that allows us to dramatically improve the economics for the development of the block," Jenkins said.

Murphy reported that adjusted earnings before interest, taxes, depreciation and amortization from continuing operations attributable to the company, totaled $311 million, or $23 per barrel of oil equivalent sold.

Adjusted earnings before interest, taxes, depreciation, amortization and exploration expenses from continuing operations attributable to Murphy, totaled $330 million, or $24.43 per barrel of oil equivalent sold.

Murphy Oil shares fell 48 cents, or 1.9 percent, to close Thursday at $25.38.

Business on 05/03/2019