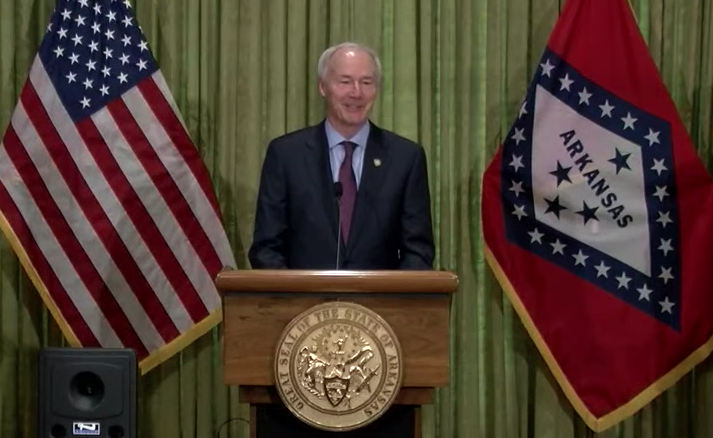

Gov. Asa Hutchinson's administration Thursday cut its forecast for net general revenue available to state agencies in the coming fiscal year by nearly $206 million to $5.68 billion, citing a projected economic recession triggered by the coronavirus pandemic.

"The revised revenue forecast for next year reflects the new reality of dramatically reduced business activity and revenues to the state," Hutchinson said.

"The revised forecast for next year demonstrates that we will need to tighten our state budget in a number of areas and reduce spending in a number of areas," the Republican governor said in a written statement.

Hutchinson said he hopes that when the current health emergency is over, the state's economy will rebound quickly.

[CORONAVIRUS: Click here for our complete coverage » arkansasonline.com/coronavirus]

The state Department of Finance and Administration's cut Thursday in the forecast for fiscal 2021 came a week and a half after the department cut the general revenue budget for fiscal 2020 by $353.1 million, to $5.38 billion, because of economic changes brought about by the pandemic.

Fiscal 2020 ends June 30; fiscal 2021 starts July 1. The fiscal 2021 budget is to be considered in a legislative session that's set to start Wednesday.

PANDEMIC IMPACT

Hutchinson has attributed the fiscal 2020 budget cut to an expected reduction in tax collections in the last three months of the fiscal year, plus the extension of the state individual income tax filing and payment deadline from April 15 to July 15. The latter, keeping the state's deadline in sync with the federal government's extension of those deadlines, means the state will receive that revenue next fiscal year.

In a special session last week, the General Assembly enacted a law to create the covid-19 rainy-day fund with $173 million in surplus funds and allow the governor, with the approval of legislative leaders, to use the money to fill budget holes and cover unexpected needs linked to the coronavirus.

On March 4, the governor proposed a general revenue budget of $5.83 billion for fiscal 2021 and setting aside $54 million in surplus funds.

By comparison, the fiscal 2019 general revenue budget totaled $5.62 billion, according to Scott Hardin, a spokesman for the finance department.

General revenue helps finance state-supported programs, such as public schools, human services programs, prisons, the state police, and public two- and four-year colleges. The states' two largest sources of general revenue are individual income taxes, and sales and use taxes.

The finance department's cut in the fiscal 2021 forecast sets the stage for lawmakers and Hutchinson in the coming session to negotiate a budget and determine which programs get the top priority for funding.

Priorities are set in the Revenue Stabilization Act. Top spending priorities are placed in Category A. Funding flows to Category B measures only after Category A ones have been fully funded, and funding flows to Category C measures only after Category B ones have been fully funded. The goal of the act is to prevent deficit spending.

FISCAL 2021 CUT

Larry Walther, finance and administration secretary, on Thursday explained the $205.9 million fiscal 2021 cut in a letter to the Legislative Council co-chairmen.

"This revision is necessary because of economic recession predicted as a result of impact from business slowdown and negative labor market effects over much of [fiscal] 2021," Walther said in his letter to Sen. Cecile Bledsoe, R-Rogers, and Rep. Jeff Wardlaw, R-Hermitage.

"These extraordinary impacts were not in the prior forecast used in budget recommendations for the fiscal session. The Governor's announced shifting of tax filing and payment deadlines to early [fiscal] 2021 partly offset the effects of economic recession," Walther said in his letter.

John Shelnutt, the state's chief economic forecaster, said Thursday that the coronavirus is expected to trigger a recession in Arkansas that's also national and international in scope.

"We are assuming [the recession will last through] all of this calendar year that we're in," he said.

"Some aspects of it would continue on all the way to the middle of 2021, which would cover most of our fiscal year 2021, depending on which indicators you are looking at," Shelnutt said.

The department Thursday also cut its forecast for total general revenue in fiscal 2021 by $369.6 million to $6.89 billion.

Its revised forecast for fiscal 2020 totals $6.69 billion.

By comparison, in fiscal 2019, the state collected $7.14 billion in total general revenue.

For fiscal 2021, the finance department cuts its projection for individual income tax collections by about $330 million to $3.35 billion, and trimmed its projection for sales and use tax collections by $80 million to $2.56 billion.

However, it increased its projection for corporate income tax collections by $43.9 million, to $449.4 million.

The state has other sources of general revenue ranging from taxes on tobacco to insurance to casino gambling.

Act 182 of 2019 enacted Hutchinson's plan to cut the state's top individual income tax rate from 6.9% to 6.6% on Jan. 1 this year and will reduce that rate again to 5.9% on Jan. 1 next year. State officials projected that law would reduce revenue by $25.6 million in the current fiscal year, $48.5 million more in fiscal 2021 and then another $22.9 million in fiscal 2022.

In 2015 and 2017, the Legislature enacted Hutchinson's individual income tax cuts for middle- and lower-income Arkansans. State officials projected that those cuts would together reduce revenue by about $150 million a year.

'RIGHT THING'

Sen. Larry Teague, D-Nashville, a co-chairman of the Legislature's Joint Budget Committee, said in an interview that the finance department's fiscal 2021 cut "was the right thing to do, although revenue was OK in March."

March's general revenue collection largely reflected taxes paid to the state last month, based on income earned and consumers' purchases in February and before the outbreak of coronavirus in Arkansas.

Teague said he doesn't know whether Hutchinson's administration should have made a deeper cut in the forecast for fiscal 2021.

"I give him the benefit of the doubt," he added.

Asked about the cut, the Joint Budget Committee's other co-chairman, Rep. Lane Jean, R-Magnolia, said in an interview, "that's probably not a bad place to start.

"I think it is just too early to tell how much it is going to hit the economy," he said, adding, "I think it's going to be really bad."

Jean and Teague said the reduction in the forecast for fiscal 2021 could make negotiations more difficult between lawmakers and the governor on the proposed Revenue Stabilization Act.

Walther said in an interview, "we are going to be looking at each and every agency, and we are going to be looking at costs that we can move out of A into a B, a C, a D or a F category.

"We are just now talking about how to do that and try to move a significant amount of money out of [Category] A in the [Revenue Stabilization Act] that will be produced later this month," he said. "We'll be working with the agencies to do that."

Metro on 04/03/2020