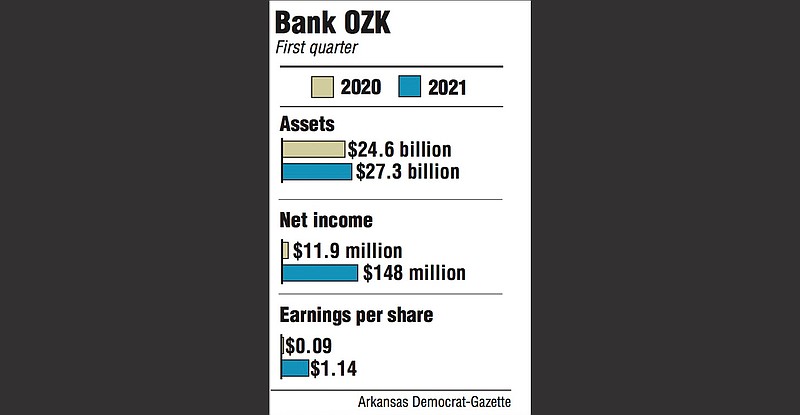

Bank OZK achieved record earnings in the first quarter, reporting Thursday that net income was $148 million and earnings per share were $1.14.

The bank blew past Zacks analysts' consensus of earnings of 87 cents per share.

"We are pleased to report excellent results for the first quarter of 2021, including record quarterly net income, strong net interest income, continued improvement in our core spread, excellent asset quality and an efficiency ratio among the best in the industry," George Gleason, chairman and chief executive, said in a news release.

In 2020's first quarter, as OZK and other banks increased loan loss reserves to adjust for the pandemic, net income was $11.9 million and earnings per share were 9 cents.

Total assets for the quarter ending March 31 were $27.3 billion, up 11% from $24.6 billion over the same period a year ago.

OZK recorded $5.8 million in gains during the quarter from the sale of branches in South Carolina and from bank-owned life insurance.

The bank also reported improvements in its total allowance for credit losses, leading to negative provision for credit losses of $31.6 million during the first quarter of 2021. That reduced the bank's allowance for credit losses from $377.3 million at year's end to $342.3 million as of March 31.

"Our results for the first quarter of 2020 reflected the substantial build of our allowance for credit losses (ACL) associated with the Covid-19 pandemic and the related actual and expected economic impacts at that time, and our results for the quarter just ended reflect some release of our ACL resulting from improved economic conditions," the bank said in management comments released in conjunction with earnings.

Net interest income for the quarter was $234.6 million, up 11.9%, or $24.9 million, from the same period a year ago. That was just $3 million below the record net interest income the Little Rock bank sent in the fourth quarter of 2020. Net interest margin was 3.86%, down from 3.96% last year.

"Our combination of strong earnings and robust capital gives us great opportunity to increase shareholder value," the management comments said. "Options for deploying our excess capital include organic loan growth, adding new business lines, continuing to increase our cash dividend, share repurchases and financially attractive acquisitions for cash or some combination of cash and stock."

At the end of the first quarter, the bank had $268.1 million set aside for loan losses, about 1.43% of its total outstanding loans. The bank recorded total loans of $18.7 billion in the quarter, up 2.7% from $18.2 billion in 2020.

"Our loan portfolio has performed very well in recent quarters, as our net charge-off ratio for total loans has remained excellent and continue to be in the lower end of the range experienced over the last eight years," the bank said in the management comments. "We have built our portfolio in a conservative manner with the goal that it would perform well in adverse economic conditions and our consistent discipline has been evident in recent results."

Deposits in the quarter reached $21.3 billion, up 13% from $18.8 billion a year ago.

OZK's management team is scheduled to host a conference call at 10 a.m. today to discuss the results. Dial-in is available at (844)-818-5110. Callers should ask for the Bank OZK conference call. A recorded playback of the call will be available for one week at (855)-859-2056, passcode 4472527, or through the bank's investor relations website at ir.ozk.com.