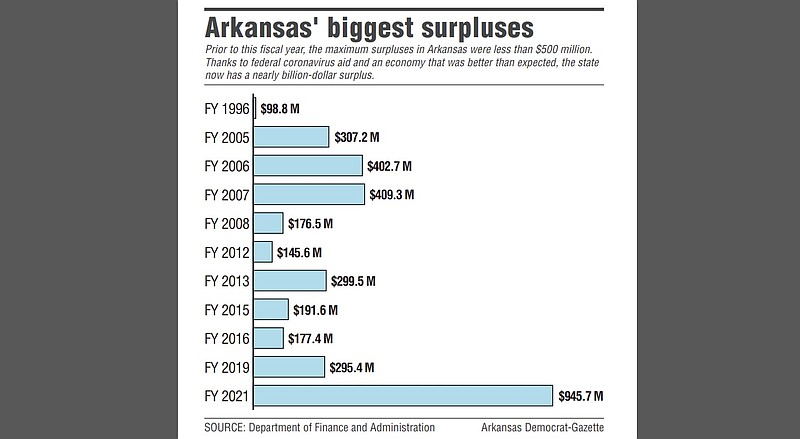

Arkansas' general-revenue surplus set an official record, totaling $945.7 million in the fiscal year that ended Wednesday, state officials said Friday.

The fiscal 2021 surplus is more than twice the previous record of $409.3 million in fiscal 2007, according to the state Department of Finance and Administration records.

Fiscal 2007 started July 1, 2006, when Republican Mike Huckabee was governor. Democrat Mike Beebe took over the office in January 2007.

Gov. Asa Hutchinson said the state finished the fiscal year stronger than ever with a record surplus.

"This allows the state to increase our reserves to more than $1.2 billion and increase our Medicaid trust fund as well to make sure we can continue our health care coverage for low income Arkansans," the Republican governor said Friday in a written statement.

"The most impressive part of the revenue report is that our individual income tax collections increased year over year despite lowering the tax rate to 5.9% at the beginning of the calendar year," Hutchinson said.

Act 182 0f 2019 cut the state's top individual income-tax rate from 6.9% to 6.6% on Jan. 1, 2020, and then to 5.9% on Jan. 1 of this year. State officials originally projected Act 182 would reduce revenue by $25.6 million in fiscal 2020; $48.5 million more in fiscal 2021; and $22.9 million more in fiscal 2022, which started Thursday.

"This showcases the fact that a growing economy along with conservative management of our resources allows us to fund education at a high level and other state services and to cut taxes at the same time," the governor said.

In the past few months, Hutchinson has repeatedly said he plans to call a special session this fall for lawmakers to consider more income-tax cuts and his top priority is to cut the highest rate further.

Sen. Jonathan Dismang, R-Searcy, a co-chairman of the Legislature's Joint Budget Committee, said Friday that he and other lawmakers are working through the Bureau of Legislative Research to determine "what's the real economy," how much of the state's economic growth is inflated by federal stimulus payments, and how much in tax cuts the state can afford.

FORECAST BEATEN

In fiscal 2021, the total general-revenue collection increased by $1.1 billion, or 16.6%, over fiscal 2020 to $8.1 billion and beat the state's April 2, 2020, forecast by $1.2 billion, or 17.8%, the finance department said Friday in its monthly revenue report.

The April 2, 2020, forecast had predicted a covid-19-spawned recession that would dampen tax revenue.

The two largest sources of general revenue are individual income taxes and sales and use taxes.

Individual income tax collections in the fiscal year exceeded the April 2, 2020, forecast by $610.1 million, or 18.2%.

Sales and use tax collections beat that forecast by $314.4 million, or 12.2%.

Corporate tax collections for the fiscal year outdistanced the forecast by $202.5 million, or 45.1%.

Individual collections were bolstered by the state shifting its 2020 tax filing and payment deadline from one fiscal year to the next. The original deadline, April 15, 2020, was in fiscal 2020 and the new July 15, 2020, deadline was in fiscal 2021.

The deadline for the 2021 tax year changed, but stayed in the same fiscal year -- from April 15 to May 17.

The deadline changes matched what the federal government did.

In addition to two filing deadlines in the same fiscal year, payroll withholding revenue exceeded expectations during a faster rebound in the state's economy.

Sales tax and use tax collections beat expectations from the combined factors of economic rebound, federal stimulus payments and base growth in online marketplace sales, the finance department said.

Corporate tax collections are a volatile source of revenue, but they also beat expectations.

NET REVENUE

Tax refunds and some special government expenditures are taken off the top of total general-revenue collections, leaving a net amount that state agencies are allowed to spend.

Net general revenue in fiscal 2021 increased by $1 billion, or 19%, over fiscal 2020 to $6.8 billion and exceeded the forecast by $1.1 billion, or 20.4%.

On Wednesday, the final day of fiscal 2021, the finance department increased the net general revenue forecast by $212.3 million, to $5.89 billion.

That fully funded the $5.89 billion budget enacted in the April 2020 fiscal legislative session.

The $212.3 million increase in the forecast also allowed for an $86.6 million transfer to the Medicaid trust fund, and various state agencies, including public colleges and universities and the Department of Education, to carry forward a total of $101.6 million.

The remaining $24 million was transferred to a long-term reserve fund.

Boosting the net general revenue forecast by $212.3 million left a surplus of $945.7 million.

The surplus resulted from two main factors at the start of the pandemic and over the course of the fiscal year, said chief economic forecaster John Shelnutt.

"At the outset, national and state economic forecasts overestimated the size and shape of the pandemic recession, mostly out of concern for the shutdown aspects of businesses during the pandemic and the hit to consumer confidence," he said in a written statement. "The forecasts were not tuned for a pandemic with this mix of sector impacts and unknown duration of impact on the employment base."

The second factor was the scale and stepwise nature of federal stimulus programs during the year with uncertainty about their adequacy relative to the need, Shelnutt said.

"Arkansas benefited in both accounts from less shutdown impact on sectors and higher relative benefit of the stimulus transfers compared to our prevailing wages and cost of living," he said.

"If the pandemic recession could be classified as a natural disaster with quick rebound in the absence of underlying structural financial or valuation problems, then Arkansas had a faster return to trend growth across more sectors," Shelnutt said. "Consumers in Arkansas spent locally and online in place of travel, so that also shifted consumption patterns. Staycation became a new, unofficial spending category during the pandemic."

USE OF SURPLUS

The $945.7 million surplus was combined with already accumulated surplus funds to boost the general-revenue allotment reserve fund to $1.1 billion, according to finance department records.

With the addition of $35.8 million left over from the restricted reserve fund and $6.5 million left over from a rainy-day fund, that increased the state's total reserve funds to $1.17 billion as of Wednesday under Act 1058 of 2021.

Under Act 1058, $171.4 million of the total reserve funds was transferred to various restricted reserve fund set-aside accounts for fiscal 2022 and $16.5 million was transferred to the rainy-day fund for fiscal 2022 on Thursday, according to finance department records.

(On June 18, the Legislative Council signed off on the state Board of Finance's revised request for $35 million from the restricted reserve fund in fiscal 2022 for the health insurance plan for public school employees and 13 requests from Hutchinson to transfer $62.5 million out of the restricted reserve fund in fiscal 2022 to various state programs and projects. The state hasn't transferred that money yet, said finance department spokesman Scott Hardin.)

Under Act 1058, the remaining $991.7 million in surplus funds was transferred to the long-term reserve fund on Thursday to add to its previous balance of $209.9 million, and the fund totals $1.201 billion, according to finance department records.

Hutchinson has described the long-term reserve fund as the state's long-term savings account.

JUNE FIGURES

Total general-revenue collections last month increased by $171.7 million, or 24.7%, over June 2020 to $867.7 million and exceeded the April 2020 forecast by $187.2 million, or 27.5%.

Last month's total general revenue represents a new high collection level for the month of June, said Whitney McLaughlin, a tax analyst for the finance department. The previous high was $743 million collected in June 2019.

Net general revenue in June increased by $150.9 million, or 25.6%, over the same month a year ago to $740.6 million and exceeded the forecast by $178 million, or 31.6%.

According to the finance department, June's general revenue included:

• A $26.5 million, or 8.8%, increase in individual tax collections over the same month a year ago to $328.8 million, which beat the forecast by $71 million, or 27.5%.

• A $29.4 million, or 12.9%, increase in sales and use tax collections over June 2020 to $256.8 million, which beat the forecast by $18.8 million, or 7.9%.

• A $51.7 million, or 81.7%, increase in corporate tax collections over the same month a year ago to $115 million, which exceeded the forecast by $44.9 million, or 64.1%.