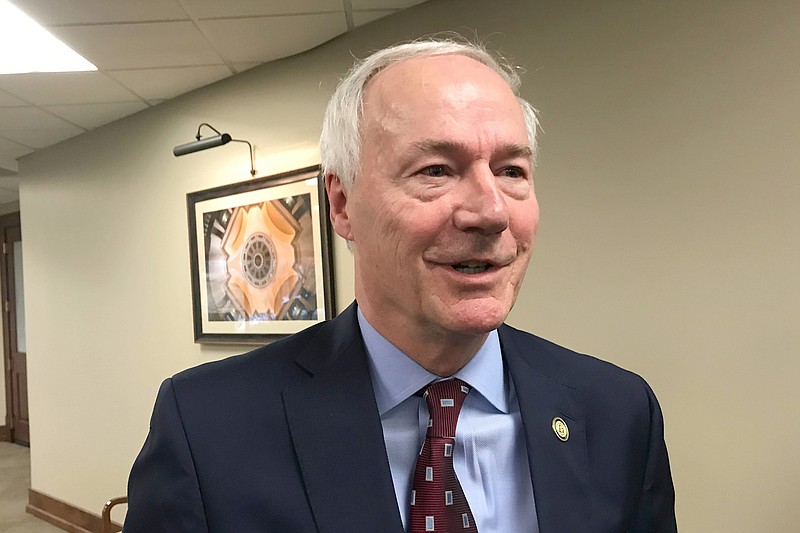

Gov. Asa Hutchinson said he understands that executive branch state employees are concerned about their merit pay raises and the prospect of paying increased health insurance premiums next year.

"I am evaluating this issue very carefully and will announce the merit percentage increases in the near future," the Republican governor said in a letter dated Thursday to John Bridges, executive director of the Arkansas State Employees Association.

Hutchinson said Friday he will decide later this month on the amount of the merit raises.

The governor noted in his letter to Bridges that the state Board of Finance on Tuesday voted on its recommendations to the Legislative Council for increased health insurance premiums and other changes in the health insurance plan for state employees.

The Board of Finance recommended a 5% increase next year in health insurance premiums for both current and retired employees, among other changes.

"We anticipate a vote on those recommendations when [the Legislative Council] meets later this month," Hutchinson said. The Legislative Council is scheduled to meet June 18.

Stable and affordable health insurance is of utmost importance not only for current employees and retirees but also for future employees, the governor said.

Hutchinson said a consultant hired by the Legislative Council is reviewing various options to secure the long-term financial health of the health insurance plans for state employees and public school employees. "Once their report is received, I trust the Board of Finance will make fiscally responsible decisions regarding premium costs."

Bridges said Friday night that he appreciates that the governor sees "the big picture."

"We hope for the best," he added.

Among other things, Bridges said in a letter dated May 19 to Hutchinson and three other state officials, "For active employees, we ask you to commit to a higher level of funding for performance pay" for fiscal 2022.

"In the past, the middle category of 'solid performer' has typically received a 2.5% increase for performance pay, with no cost of living increase," he wrote in his letter, which is also addressed to House Speaker Matthew Shepherd, R-El Dorado; Senate President Pro Tempore Jimmy Hickey, R-Texarkana; and state Department of Finance and Administration Secretary Larry Walther, who is acting chairman for the finance board.

Given the near-certainty that for state employees, their health insurance premiums will rise, along with a rise in the cost of their retirement contributions, a one-time increase in performance pay funding to a slightly higher level will significantly help to offset the higher benefits costs, Bridges said.

"Specifically, we call for a 4% for the 'solid performer' status, with other categories receiving increases accordingly," he wrote.

Hutchinson said each 1% merit raise for state employees in the executive branch appears to cost about $3.7 million in state general revenue, based on information from the state Department of Transformation and Shared Services.

About 24,500 executive branch employees are eligible for merit raises, said transformation department spokeswoman Alex Johnston. Their average salary is $44,433 a year, she said.

In addition, Bridges asked state officials to consider whether a portion of the state's general revenue surplus -- totaling $980 million in the first 11 months of fiscal 2021, which ends June 30 -- might be used to share the burden of the health insurance plan's financial problems so "they are not shouldered entirely by the state's employees and retirees."

He also asked them to commit to no changes in pharmacy benefits or spousal coverage for retirees in the insurance plan for 2022.

Bridges also asked that the Board of Finance's decisions for 2022 would maintain the status quo on health insurance plans until long-term decisions can be made and implemented with the participation and input of state employees.

Hickey said he hasn't responded to Bridges' letter.

Shepherd has not sent a direct response to Bridges' letter, but he's reviewing the requests and monitoring the ongoing work that's being done, House spokeswoman Cecillea Pond-Mayo said.

Some state lawmakers are on the health insurance plan for state employees.

RECOMMENDED CHANGES

In addition to recommending a premium increase, the Board of Finance proposed reducing the wellness credit for current employees from $50 to $25 a month and creating a $25-a-month contribution for employees who don't participate in the wellness credit.

The board also proposed to end on-site wellness clinics and have employees visit their primary care doctor for the wellness credit.

The finance board also called for increasing the state's monthly funding per employee by $50, from $450 to $500, and suggested the increase become effective Aug. 1 of this year instead of Jan. 1, 2022.

These changes are projected to eliminate the projected deficit of $33.3 million in 2022 for the health insurance plan for state employees, according to state officials.

The Milliman firm, actuary for the Employee Benefits Division, projected a 2022 reserve estimate of $38.6 million, based on the finance board's recommendations for changes to the insurance plan.

The finance board also recommended to the Legislative Council creating a $10 million set-aside in the restricted reserve fund for the health insurance plan in case that money is needed next year. If the Legislative Council opts not to adopt all of the finance board's recommendations, the board recommended that the council provide one-time state funding to cover the recommendations not adopted for next year.

COST INCREASES

Meanwhile, an Arkansas Legislative Audit report presented to the Legislative Joint Auditing Committee on Friday shows the claims and administrative costs for the insurance plan for state employees increased from $296 million in fiscal 2019 to $313.8 million in fiscal 2020.

The number of state employees, retirees and qualifying dependents on this plan declined from 60,946 on June 30, 2019, to 60,629 on June 30, 2020, the report showed.

Factors contributing to the increased costs include higher usage of plan services by the insured and changes in Health Advantage's contracted rates with providers, based on Arkansas Legislative Audit's discussions with state officials, according to the report.

In fiscal 2020, state agencies contributed $171.3 million to the state's plan for state employees, while the insured contributed $99 million in monthly premiums, according to Arkansas Legislative Audit. The plan received $22.9 million from a variety of other funding sources.

The people covered by the plan paid an additional $37 million to health care providers and nearly $20 million to pharmacies for copays, coinsurance and deductibles, the report showed.