This story is a part of The Article, your guide to Arkansas news and culture, presented by the Democrat-Gazette. Sign up for The Article's twice-weekly newsletter here or to see stories that have appeared in past newsletters, go here.

Little Rock voters could be asked to weigh in on three different tax proposals in the coming months, one from the city, one from the Central Arkansas Library System and one from the Little Rock School District. Here are the basics.

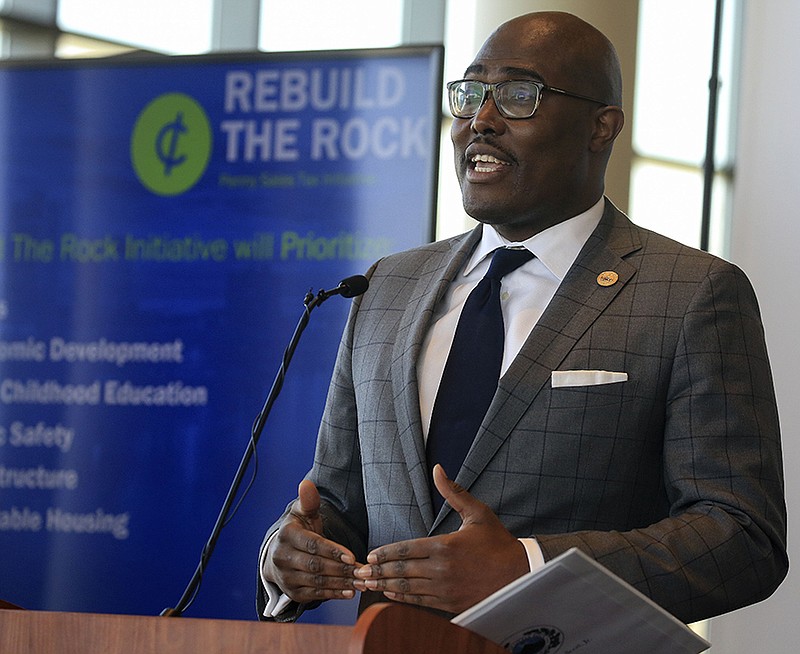

Mayor Frank Scott’s tax increase proposal

What it is: Scott is seeking a permanent one percentage-point increase to the city's sales-tax rate. However, because an existing three-eighths-cent sales tax is set to expire in December, the net increase to the city's sales-tax rate would be five-eighths of a cent (0.625).

What it would fund: The mayor’s proposal doesn’t have full details, but roughly $53 million would pay for improvements to parks, the Little Rock Zoo, public-safety initiatives and infrastructure.

Where it is in the process to get on the ballot: The mayor’s proposal is being reviewed by the city directors. A majority of the 10 directors must approve the proposal for it to get on the ballot, or in the case of a 5-5 vote, the mayor would break the tie.

When voters might weigh in: The mayor is pushing for a July 13 special election but that depends on what the Board of Directors decides.

Read more on this proposal from city reporter Joseph Flaherty, and read about what the Chamber of Commerce has said about it.

Central Arkansas Library System millage proposal

What it is: A proposal to draw more property-tax revenue to the library through a millage increase. The amount that the millage would increase and how long it would last have not yet been set.

(A “millage” is a tax on properties. It is measured in mills, which is one thousandth of a dollar or one tenth of one cent. A rate of 10 mills means that $10 in property tax is levied for every $1,000 in value).

What it would fund: The millage is meant to address increased operating expenses associated with electronic materials.

Where it is in the process to get on the ballot: CALS Executive Director Nate Coulter has pitched the idea to the library’s board. The library board would need to approve the idea, and then pitch it to the city directors, who ultimately make the decision on whether to call a special election.

When voters might weigh in: Coulter is seeking a fall vote.

Read more about the proposal, also from Joseph Flaherty.

Little Rock School District millage extension proposal

What it is: The school board is seeking to extend a current levy of 12.4 debt service tax mills slated to end in 2033 for another 18 years. Property owners would not see an increase in taxes from their current rate.

What it would fund: The millage extension would generate up to $220 million for school construction and renovations.

Where it is in the process: The School Board is discussing the proposal. If a majority of the board votes in favor, the millage extension will be sent to voters.

When voters might weigh in: Board members discussed having an election in September.

Read more about the proposal from reporter Cynthia Howell.