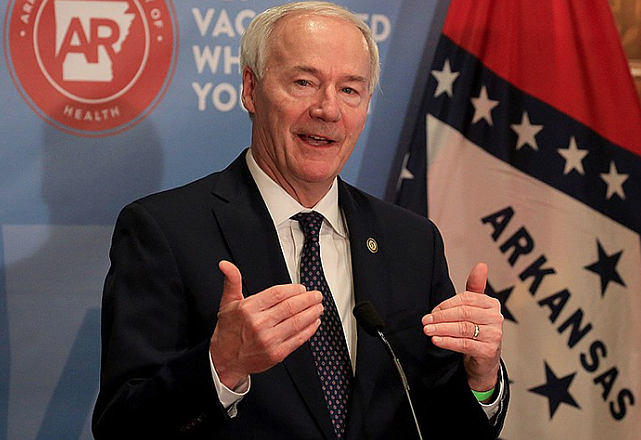

Gov. Asa Hutchinson says he wants to reduce the state's top individual income-tax rate from 5.9% to 5.5% over two years, and wants to reach a consensus with lawmakers on a tax plan to consider before calling a special legislative session in the fall.

Under a proposal drafted by the state Department of Finance and Administration's Revenue Division, the top rate would drop to 5.7% on Jan. 1 and then to 5.5% on Jan. 1, 2023.

The rate reduction would affect about 580,000 taxpayers, said Scott Hardin, a spokesman for the finance department. Roughly 1.4 million Arkansans file individual income-tax returns each year.

For Arkansans making between $22,900 and $82,000 a year, the top rate now applies to income above $38,500, Hardin said. For Arkansans making above $82,000 a year, the top rate is paid on income above $8,300 a year, he said. (The portion of income below those amounts is taxed at lower rates.)

The proposal includes an adjustment for what is called a tax table cliff, in which a person's income goes up a small amount, but is enough to push the taxpayer into the next highest tax table and cause a large jump in taxes, relative to the increase in income, Hardin said. The proposal would be for the lower- to middle-income tax table, he said. A cliff adjustment from the middle- to upper-income table already was implemented, he said.

For example, in 2020, the cliff occurs at the net taxable income level of $22,900. A taxpayer with a net taxable income of $22,899 has a tax of $535, while a taxpayer with a net taxable income of $22,900 has a tax of $720, or a tax increase of $185 based on $1 more in net taxable income, he said.

The overall proposal, with its tax cut and cliff adjustment, is projected by the finance department to reduce state general tax revenue by about $30 million in fiscal 2022, which begins July 1; by about $57 million more in fiscal 2023; and about another $27 million more in fiscal 2024.

The total impact would be $115 million in fiscal 2024, the Republican governor said in a written statement.

MEETING IN MAY

Hutchinson said he met with the finance department leadership in early May, "and of the tax-cut plans presented, I want to pursue the plan which will reduce the tax rate from 5.9% to 5.5% over two years."

Revenue Commissioner Charlie Collins sent the proposal to finance department Secretary Larry Walther on May 7. The Arkansas Democrat-Gazette obtained a copy under the Arkansas Freedom of Information Act.

Hutchinson said he has asked finance department officials to meet with legislators to determine whether they would support that plan.

"I would like to come to an agreement with the General Assembly about a tax-cut plan before calling a special session," the governor said.

Walther said he provided a copy to House Revenue and Taxation Committee Chairman Joe Jett, R-Success; Senate Revenue and Taxation Committee Chairman Bill Sample, R-Hot Springs; and Senate Revenue and Taxation Committee Vice Chairman Sen. Jonathan Dismang, R-Searcy. Dismang also is a co-chairman of the Joint Budget Committee.

"It's our way to get them to start thinking about something that is going to happen in the fall," Walther said in a recent interview.

Walther said the governor and legislators probably will have other proposed income-tax cuts to evaluate as they try to reach consensus.

Hardin said department officials are scheduled to meet with legislative leadership this week to determine whether there is support for the 5.9%-to-5.5% reduction.

"While the revenue impact was provided to legislators, this will be the first meeting to discuss and receive their feedback," Hardin said Friday. "The Governor reviewed the revenue impact and asked DFA to evaluate legislative support for this plan."

Walther said the state has a projected surplus of $17 million in fiscal 2022.

The earliest that a tax cut enacted this fall could become law would be Jan. 1,, halfway through fiscal 2022, he said.

"We are conservatively forecasting," Walther said. "At this point in time all the indicators both federally and state look good for '23 as well as '22 in terms of our forecast."

LAWMAKERS' REACTION

Jett said he wants to look at cutting the top individual tax rate to 5.7%, fixing the tax cliffs and raising the standard deduction, "as opposed to going all the way to 5.5%."

He said he has envisioned an income-tax cut that would ultimately reduce revenue by about $120 million a year, but that doesn't mean everybody else agrees.

Jett said he likes a bill proposed earlier this year by Rep. David Ray, R-Maumelle, to link the change in the standard deduction to the change in the consumer price index.

The finance department projected House Bill 1190 would have reduced general revenue by $900,000 in fiscal 2022. based on a consumer price index increase of 1.5032%. That percentage would have increased the current standard deduction of $2,200 to $2,230.

Dismang said tax simplification and the smoothing of the income-tax brackets are a priority to him.

He said he wants to consider lowering the top rate, increasing the standard deduction and possibly changing the state's itemization deductions to mirror changes in those deductions in federal law.

Dismang said it's too early to say how much the state can afford in income-tax cuts.

"We need to see what the revenue forecast would look like before we know," he said.

As for the proposal drafted by the Revenue Division, Sample said, "I really don't like it. ..."

"We ask them for advice, but it's the Legislature's job to do that," he said, referring to the finance department. "If we think there is money to do that, we can make those decisions in the fall."

Sample said he hasn't determined how much the state can afford to cut income taxes.

Referring to the federal coronavirus stimulus dollars coming to the state, Sample said, "My worry is when this funny money goes away, what everything is going to look like."

Senate Democratic leader Keith Ingram of West Memphis said reducing the top tax rate is a great long-term goal.

He said he would like to review "a mixture" of cutting the top rate and Jett's proposal to eliminate the low-income tax table.

House Bill 1011 by Jett would have exempted from the income tax people with a net taxable income below $22,200 a year for tax years starting on or after Jan. 1, 2021. The finance department projects it would have reduced general revenue by $86.5 million in fiscal 2022.

Regarding his proposal, Jett said, "I'm not pulling down my proposal by any means. I am trying to be a team player to get something passed."

Ingram said, "I would like to see some triggers put in [income-tax cut legislation] to protect us in case there is a dramatic downturn when the spigot is turned off on the money from Washington," referring to federal coronavirus stimulus funds.

"We have to be very, very cautious," Ingram said. "It's more important to error on the side of caution."

SURPLUS FUNDS

In the regular session that recessed a month ago, the General Assembly enacted a Revenue Stabilization Act that will distribute $5.84 billion in general revenue in fiscal 2022 to state-supported programs. Most of the increase over fiscal 2021's budget will go to human services, public schools, colleges and universities, and correctional programs.

The fiscal 2022 budget was based on projected net general revenue of $6.06 billion. Enacted tax-cut measures will collectively reduce projected net revenue by about $203 million, according to legislative records. The fiscal 2022 budget projects a surplus of $17 million.

The tax cuts in fiscal 2022 include $179 million from Act 248, which is covid-19 relief program tax deductions and loan forgiveness; and $3.1 million from Act 254, which exempted unemployment benefits from income taxes, according to the finance department.

On April 22, Hutchinson said state officials expected a surplus of about $600 million at the end of fiscal 2021 and similarly strong growth in tax collections in fiscal 2022 because of the federal stimulus funds.

During the first 10 months of fiscal 2021, net general revenue has beat the state's April 2, 2020, forecast by $716.8 million, or 15.1%. The May revenue report is to be released Wednesday.

State officials have estimated that the long-term reserve fund, which has a balance of $209.9 million, could increase to $711.1 million, with the help of surplus funds.

AXING INCOME TAX

The Republican-controlled Legislature has enacted the governor's plans to cut taxes for middle-income people in the 2015 session, lower-income people in the 2017 session, and upper-income people in the 2019 session.

Act 182 of 2019 trimmed the top individual rate from 6.9% to 6.6% on Jan. 1, 2020, and then to 5.9% on Jan. 1 this year. State officials had projected that cut would reduce general revenue by about $97 million after it was fully implemented.

Hutchinson has been governor since 2015 and is barred from running for reelection in 2022 by the state term-limits amendment.

About two weeks ago, Republican gubernatorial candidates Leslie Rutledge and Sarah Huckabee Sanders said they favor eliminating Arkansas' income tax.

Rutledge had said she hopes to eliminate the tax during her time as governor, "whether it takes four years or eight years." She said she would release a plan to do so in the summer.

Sanders' campaign manager, Chris Caldwell, said in a written statement that Sanders is looking into different ways to end the tax.

Individual income and sales and use taxes are the state's two largest revenue sources for its general revenue budget. The general revenue budget is distributed largely to public schools, public colleges and universities, human-services programs and correctional programs.

During this year's regular legislative session, Sen. Trent Garner, R-El Dorado, introduced Senate Bill 522, which would have cut all individual tax rates to zero, effective Jan. 1, 2022.

SB522 would have led to a $1.5 billion reduction in general revenue in fiscal 2022, and a $3 billion reduction in fiscal 2023, based on net tax amounts reported on 2019 returns, according to a financial impact statement from the Department of Finance and Administration.

The general revenue budget that Hutchinson has proposed for fiscal 2023 is about $6 billion, so eliminating the income tax would cut half its revenue.

Asked about Rutledge's and Sanders' aim to eliminate the income tax, Hutchinson said Friday, "Our focus on cutting income taxes in this administration has resulted in record income tax reductions for Arkansans at every level of income."

"Most importantly, the focus on cutting income taxes has placed hundreds of millions of dollars back in the pockets of taxpayers, while state government continues to fund essential state services," he said.

"In the future, I am confident that we can reduce the income tax rate down to 5% without raising other taxes such as sales or property taxes," Hutchinson said in a written statement. "This will allow us to fund education and other needs and be competitive with our surrounding states.

"As the Arkansas economy continues to grow, there is the potential for additional income tax cuts and I am pleased that further reductions and how we get there will be part of the discussions in the 2022 election," Hutchinson said.

Among surrounding states, the top individual tax rate on Jan. 1 of this year is 5% in both Mississippi and Oklahoma, 5.4% in Missouri and 6% in Louisiana, according to the Federation of Tax Administrators. Tennessee and Texas don't have a state income tax.

In November, Mississippi Republican Gov. Tate Reeves called for eliminating that state's income tax by 2030.