First-quarter earnings declined nearly 3.5% at Simmons First National Corp., the Pine Bluff bank reported Thursday, though the company said it also is experiencing a "return to more normalized levels of loan demand." Earnings per share fell nearly 6.5% in the quarter.

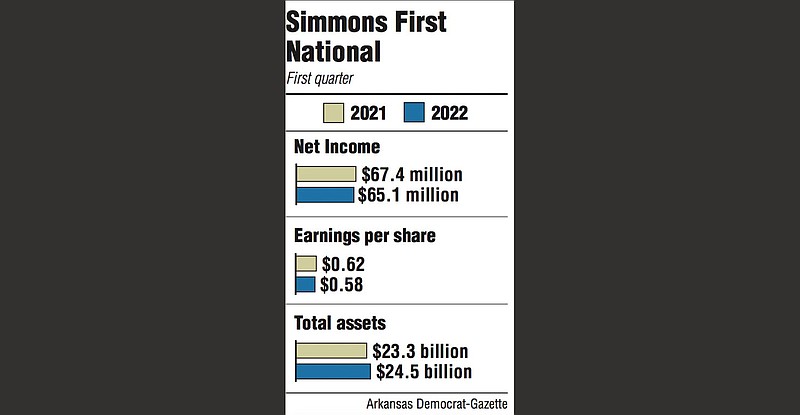

Simmons First reported net income of $65.1 million for the quarter ended March 31, compared with $67.4 million in the first quarter of 2021. Earnings per share was 58 cents in the quarter compared with 62 cents over the same period a year ago.

"Simmons posted solid results in the quarter driven by accelerating loan demand across our footprint and continued growth of low-cost deposits," George A. Makris Jr., Simmons' chairman and chief executive officer, said in a news release.

Simmons beat Wall Street consensus on earnings per share, which was projected at 51 cents.

Bank officials, in presentation materials, touted the company's "solid start to 2022 while navigating a challenging interest rate and economic environment."

Simmons said its commercial loan pipeline continues to strengthen, reaching $2.4 billion at the end of the quarter, up from $2.3 billion at the end of the fourth quarter of 2021. It was the sixth consecutive quarter of increased commercial loans.

A report issued by Stephens Inc.'s banking analysts shortly after earnings were released noted that Simmons missed on key loan metrics, including core loan growth, as net interest income was below forecast of $148 million.

Simmons, in the presentation supplement, noted net interest income was down because Paycheck Protection Program loans are going off the books and the bank is realizing lower yields on new production compared to yields on maturing loans. The lender also cited fewer days in the quarter as a factor.

Simmons produced net interest income of $145.6 million in the quarter, down slightly from $146.7 million over the same period a year ago. Net interest margin fell to 2.76% from 2.99%.

In the quarter, Simmons reported total loans of $12 billion, down slightly from $12.2 billion in the first quarter of 2021.

On a conference call with industry analysts Thursday, Makris said Simmons will fully focus on organic growth over the next three to five years and pull back on merger-and-acquisition activity. The bank, he said, has gobbled up most of the high-growth markets in or adjacent to its footprint over the past decade, making 14 acquisitions over that time.

Now, Simmons will turn inward to push growth. "We've got some buildout that we've got to do," Makris said, noting the bank will engage in an "aggressive hiring" campaign to add investment advisers, mortgage origination specialists and concentrate on agricultural lending, among other areas.

"We're like the dog that caught the car -- now what do you do with it?," he said.

Simmons will not be in the merger-and-acquisition market for a while, the chairman said. "We're at the point now where we're ready to focus on organic growth," Makris said. "We believe we are well positioned to provide aggressive revenue growth over the next several years."

In other key metrics, total deposits continued to climb at the bank, reaching $19.4 billion in this year's first quarter compared with $18.2 billion a year ago. Total assets were $24.5 billion, up from $23.3 billion in the first quarter of 2021.

Simmons repurchased 514,000 shares of stock at an average price of $31.25 during the quarter, an initiative that will continue, Chief Financial Officer Jay Brogdon said Thursday. "We'll continue to be very opportunistic around share buyback," Brogdon said.

The bank is authorized to repurchase up to $175 million in shares under a program approved by its board in January.

Earlier this month, Simmons completed the acquisition of Spirit of Texas Bancshares Inc., which more than doubles Simmons' size and scale in the Lone Star State. Simmons expanded its presence in Dallas-Fort Worth and gained new markets in Houston, Austin, San Antonio, Corpus Christi and College Station.

Included in first-quarter 2022 results were $2.1 million in net after-tax merger related and net branch right-sizing costs, while first quarter 2021 results included a $3.4 million net after-tax benefit primarily associated with a gain on sale of branches in Illinois. Excluding the impact of these items, core earnings for the first quarter of 2022 were $67.2 million, compared to $64 million for the first quarter of 2021. Core diluted earnings per share were 59 cents for both the first quarter of 2022 and the first quarter of 2021.

On Wednesday, Simmons announced a cash dividend of 19 cents per share, payable on July 5. The dividend rate represents a penny increase, or 6%. The bank also cited research noting it is one of only 23 U.S. companies that have paid dividends for 100-plus uninterrupted years.

Simmons shares rose 14 cents to close Thursday at $24.76.