Bob Iger was adamant that he was done.

On the evening of Nov. 5, the former chief executive officer of Walt Disney Co. dined alongside Hollywood royalty at a gala hosted by the Los Angeles County Museum of Art. His retirement stubble was on show at the black-tie affair, and when asked between courses of beef tortellini and steamed cod whether he missed being CEO of the world's largest entertainment company, Iger answered emphatically: "No."

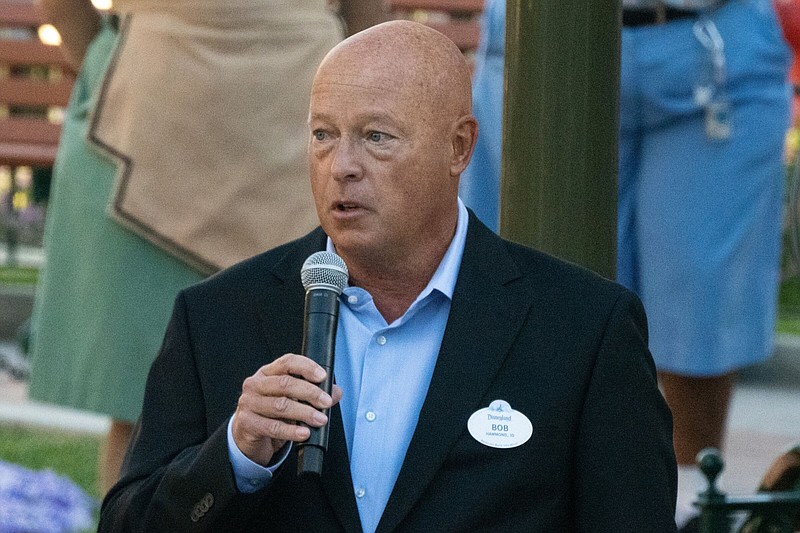

Elsewhere in the Disney empire, however, loyalists were missing him. Within days, Iger would be back at the helm of the company he ran for 15 years, and Bob Chapek, his hand-picked successor, would be gone, news that Disney announced to the world on Nov. 20.

While Chapek's rise to the CEO spot in February of 2020 came as a surprise to many, his departure last week was even more shocking. It came just five months after the board had unanimously voted to extend his contract. A series of missteps throughout his nearly three years as chief executive led to his ouster, but when the end came it happened very quickly, according to people familiar with the events of the past week. Representatives for Disney and Iger declined to comment.

A Disney veteran with a reputation for figuring out new ways to squeeze more money out of theme park guests through price hikes and special events, Chapek was something of a dark horse in the long race to replace Iger. The covid-19 pandemic started almost immediately after his ascension to the top job, forcing him to send lay off notices to tens of thousands of employees he had only briefly led.

But even outside the fog of crisis, Chapek made decisions that were unpopular among staff. Those choices included failing to initially take a stand against a Florida law barring discussion of gender identity in schools and reorganizing Disney's management structure so that longtime heads of the company's TV and film units no longer had authority over when and how to release their work.

A backlash among Disney's senior executives grew to the point it reached the company's board. Susan Arnold, Disney's chair, contacted Iger about the souring testimonials and sought his input. At the time, Iger was observing Disney's performance as a shareholder, but he had no intention of returning. Instead, he planned to mentor entrepreneurs like those at Josh Kushner's Thrive Capital venture capital firm, where he became a partner in September. He had also been in talks to join Gerry Cardinale's RedBird Capital investment company as recently as last week.

Just days after the gala in Los Angeles, however, Disney reported dismal fourth-quarter earnings that stunned Iger and Wall Street. The company disclosed a $1.47 billion loss at its direct-to-consumer business, led by the Disney+ streaming service. The following stock sell-off was Disney's worst in two decades. CNBC host James Cramer began calling for a new CEO.

Chapek responded by announcing a cost-cutting drive, the severity of which surprised many inside and outside the company. He instituted a hiring freeze, told staffers to avoid all but essential travel and said job losses were to come. Several staffers at the company's film division, who had been working on the marketing campaign for the company's Avatar sequel, were astounded to find out they could not go to the film's premiere in London.

Executives, including Chief Financial Officer Christine McCarthy, began discussing with the board their loss of faith in Chapek. Nelson Peltz's Trian Fund Management assembled a stake in Disney worth about $800 million and was seeking changes, the Wall Street Journal reported. It was the second such activist after Dan Loeb expressed his concerns to Chapek earlier in the year. In an agreement with Loeb, the company added Carolyn Everson, the former president of Instacart, as a board member in late September.

After reviewing options with her fellow directors, Arnold contacted Iger late last week and asked if he would consider returning to lead Disney. Over the weekend, they agreed to a contract that includes $27 million a year over the two years Iger's in charge. Upon agreeing to the terms, the board dismissed Chapek, effective immediately.

"It is with an incredible sense of gratitude and humility -- and, I must admit, a bit of amazement -- that I write to you this evening with the news that I am returning to the Walt Disney Company as chief executive officer," Iger said in an email to Disney employees at 9:42 p.m. EST on Sunday.

Iger began the first full day of his second run as Disney CEO last week from New York, where he is planning to stay through the Thanksgiving holiday. He wasted no time in reversing Chapek's work: In the first edict of his new tenure, he told employees he would be working in partnership with executives, including McCarthy, on designing a new corporate structure "that puts more decision-making back in the hands of our creative teams." Kareem Daniel, a Chapek protege who headed the company's film and TV distribution business, was shown the door.

Bank of America's Jessica Reif Ehrlich, a longtime follower of the company, said she wants the leadership transition to go more smoothly when Iger leaves again.

"Bob Iger is a smart, savvy executive. [He'll] have to truly pick a successor in the next go around," Reif Ehrlich said. "He'll need to groom someone."