Arkansas' top corporate income tax rate will drop from 5.9% to 5.3%, starting today.

The top corporate income tax rate applies to corporate income exceeding $25,000, according to the state Department of Finance and Administration.

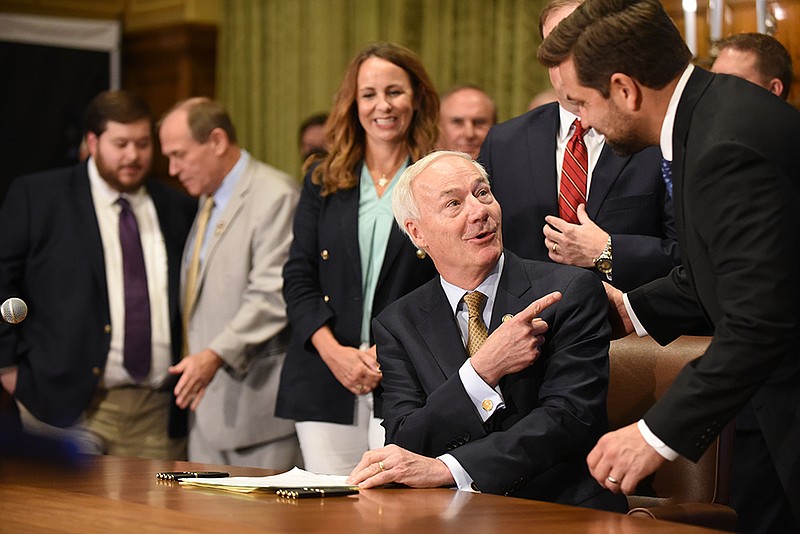

The reduction in the state's top corporate income tax rate is the result of Arkansas Gov. Asa Hutchinson and the Arkansas General Assembly enacting identical measures in the Aug. 9-11 special session to accelerate the reduction of the state's individual income tax rate from 5.5% to 4.9%, retroactive to Jan. 1, 2022, and the state's top corporate income tax rate from 5.9% to 5.3%, effective today.

Acts 1 and 2 also grant a temporary, nonrefundable income tax credit of $150 for individual taxpayers with net income up to $87,000 and of $300 for married taxpayers filing jointly with net income up to $174,000, and adopted the 2022 federal Section 179 depreciation schedule as it existed Jan. 1, 2022, which provides an income tax reduction for the expensing of certain property.

The measures are projected to collectively reduce state general revenue by $500.1 million in fiscal 2023 that started July 1, $166.6 million more in fiscal 2024, $69.5 million more in fiscal 2025, $18.4 million more in fiscal 2026 and $8.4 million more in fiscal 2027, according to the state Department of Finance and Administration.

Accelerating the reduction in the state's corporate income tax rate from 5.9% to 5.3% is projected by the finance department to reduce state general revenues by $18.5 million in fiscal 2023, $27.8 million more in fiscal 2024 and $9.2 million more in fiscal 2025.

The state's general revenue budget that supports programs such as the public schools, human service programs, colleges and universities and correctional programs is $6.02 billion in fiscal 2023. The finance department is projecting a $598 million general revenue surplus at the end of fiscal year 2023.

"More competitive corporate tax rates make Arkansas more attractive for job creators," said Randy Zook, president and chief executive officer for Arkansas State Chamber of Commerce/Associated Industries of Arkansas.

"We are more competitive than we have ever been," he said.

"The new rate makes us relatively competitive with everybody, except Texas, and if you look at the total per capita state and local tax burden we are below Texas. The difference is they are way up on property tax while ours is relatively low, ridiculously low," Zook said.

Bruno Showers, a senior policy analyst for the Arkansas Advocates for Children and Families, said the research on the economic benefits of cutting the state's top corporate income tax rate is ambiguous at best.

"Even the most generous assumptions show that it would boost the economy by the tiniest fraction," he said.

The corporate income tax cuts are mostly passed on to shareholders, and many people who own shares in companies that pay the Arkansas corporate income tax don't live in Arkansas themselves, Showers said. Of the small share that does go to in-state residents of Arkansas, most of the benefits go to those making $218,000 or more a year, he said.

According to senior state tax policy analyst Timothy Vermeer of the Tax Foundation, the top corporate income tax rate for Arkansas' surrounding states will be as follows beginning today:

• Texas, 0%.

• Missouri, 4%.

• Oklahoma, 4%.

• Mississippi, 5%.

• Tennessee, 6.5%.

• Louisiana, 7.5 %.

Arkansas' top corporate income tax rate dropped from 6.5% to 6.2% on Jan. 1, 2021, and then to 5.9% on Jan. 1, 2022. The top corporate income tax rate had been scheduled to drop to 5.7% today, to 5.5% on Jan. 1, 2024, and to 5.3% on Jan. 1, 2025, under state law until the governor and Legislature accelerated that cut in the August special session.

Arkansas' top corporate income tax rate will rank 12th-lowest in the nation in 2023 among states that levy the tax, said Vermeer.

For the past three years, an average of 5,294 companies paid the state's top corporate income tax rate, said Department of Finance and Administration spokesman Scott Hardin.

For the past three years, the finance department has received an average of 26,084 C corporation tax returns each year and these are corporations that pay tax on their earnings, Hardin said. In addition, there are an average of about 70,000 Sub-S corporation tax returns filed in Arkansas each year, and Sub-S corporations pass their income down to shareholders who report the income and pay the taxes on their personal returns, he said.

The average tax cut from reducing the state's top corporate income tax rate from 5.9% to 5.3% will be $13,601 a year for those paying the maximum corporate income tax rate, Hardin said.

Among other things, Acts 1 and 2 of the Aug. 9-11 special session reduced the state's top individual income tax rate from 5.5% to 4.9%, retroactive to Jan. 1, 2022.

The state's top individual income tax dropped from 5.9% to 5.5% on Jan. 1, 2022. The state's top individual income tax rate was scheduled to be cut to 5.3% today, to 5.1% on Jan. 1, 2024, and to 4.9% on Jan. 1, 2025, under the state law that was changed in the Aug. 9-11 special session.

Proponents of the tax cut package said it would make Arkansas' tax rates more competitive with other states and help the state in economic development, and put more money into the pockets of Arkansas taxpayers.

Opponents of the tax cut package said the chief beneficiaries of the package would be upper-income taxpayers and the money would be better spent on teacher raises, some underfunded state programs and for more tax relief for lower-income taxpayers.

Hardin said most taxpayers probably experienced increased paychecks beginning around October, if the taxpayer's employer adopted payroll withholding changes when shared by the finance department.

"That will be a portion of the benefit but the remaining, most significant portion will be through returns filed next year," he said.

Arkansas enacted an individual income tax in 1929 with a top rate of 5%. Act 221 of 1971 increased the top individual income tax rate to 7%.

Hutchinson has noted the state's top individual income tax rate was 7% when he was elected governor in 2014 and the top rate is now 4.9% under Acts 1 and 2 from the August special session.

According to Vermeer, the top individual income tax rates in Arkansas' surrounding states as of today are:

• Tennessee and Texas, 0%.

• Louisiana, 4.25%.

• Oklahoma, 4.75%.

• Missouri, 4.95%.

• Mississippi, 5%.

Arkansas will have the 11th-lowest top individual income tax rate in the nation among states that levy the tax, Vermeer said.

In November, Hutchinson proposed a $314 million increase in the state's general revenue budget to $6.33 billion for fiscal year 2024, which begins July 1, 2023, and ends June 30, 2024. The departing governor earmarked $200 million of the proposed increase for the public schools to help boost teacher salaries.

That would leave a projected general revenue surplus of $254.9 million in fiscal 2024, he said.

At that time, state budget director Robert Brech said the governor's proposed general revenue budget would provide flexibility to at least raise the minimum teacher pay from $36,000 to $40,000 a year and there is leeway in the proposal to increase that salary threshold. The proposed budget would provide all teachers with a $4,000 raise, he said.

The Senate and House education committees have recommended $4,000 teacher pay raises in their respective educational adequacy recommendations and increasing the annual minimum teacher salary from $36,000 to $40,000.

The House committee's proposal calls for the salary increases to begin before the end of the current fiscal 2023, while the Senate committee's proposal recommends waiting until fiscal 2024. The Senate committee's proposal also calls for merit pay raises under which districts could pay more for teachers who specialize in a needed subject such as physics or incentivize teachers to stay in the classroom rather than move into higher-paying administrative jobs.

In fiscal 2024, the finance department projects collecting $3.6 billion in individual income taxes, $3.3 billion in sales and use taxes and $492.9 million in corporate income taxes as part of its forecast for general revenue collections of $8 billion. The department projected individual income tax refunds of $542 million and corporate income refunds of $76.7 million in fiscal 2024.

Gov.-elect Sarah Huckabee Sanders will be sworn in Jan. 10, succeeding Hutchinson. Sanders and Hutchinson are both Republicans.

Asked whether the Arkansas Chamber of Commerce/Associated Industries of Arkansas has any particular proposals to further cut individual and/or corporate income taxes for lawmakers to consider in the coming regular session, Zook said that "We are supportive of the Governor-elect's plans to continue to mitigate the impact of taxes on Arkansas folks and businesses."

Showers, of Arkansas Advocates for Children and Families, said Arkansas currently has the third-highest sales tax rate based on the Tax Foundation's analysis.

"While we oppose further reductions of the top income tax rate, due to the large costs and the skewed benefits, we do support efforts to exempt necessities from the sales tax," he said. "One example of that would be the elimination of sales taxes on period products."

Sanders spokesman Judd Deere said "Governor-elect Sanders has spoken many times about her priority to responsibly phase out the state's income tax to ensure Arkansas remains competitive with our neighbors and so Arkansans are keeping more of their hard-earned money.

"During the transition, she has continually engaged with her legislative partners as she develops a budget that makes government lean and efficient, allowing taxes to be cut," he said in a written statement.

Incoming Senate Revenue and Taxation Committee Chairman Jimmy Hickey, R-Texarkana, said "we are going to try to see where we are at with education and prison and then look at taxes."

He said he wants to know the projected costs for education and prison programs before determining numbers for a tax-cut proposal and would like financial triggers tied to tax cuts.

Sen. Jonathan Dismang, R-Searcy, who serves on the Senate Revenue and Taxation Committee and as co-chairman of the Joint Budget Committee, said he recommends setting a four-year target for tax cuts amid uncertainty with the economy.

He said he expects a focus on cutting individual income taxes for Arkansans who make at least $20,000 a year.

Rep. Lane Jean, R-Magnolia, who serves on the House Revenue and Taxation Committee and as co-chairman of the Joint Budget Committee, said legislative leaders and Sanders need to figure out what the state can afford in tax cuts and then prioritize the tax cuts.