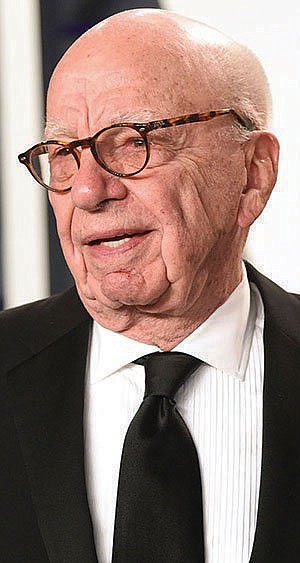

In a major reversal, Rupert Murdoch and Lachlan Murdoch have decided that the two companies controlled by their family will no longer seek to recombine.

News Corp., which owns the Wall Street Journal, New York Post and other newspapers, and Fox Corp., which oversees Fox News and Fox Sports, said late Tuesday the media mogul and his eldest son had concluded that the proposed recombination currently was "not optimal for shareholders."

The special committees that both companies formed to evaluate the potential combination have been dissolved. The move came after several shareholders objected to the deal.

A Murdoch trust owns about 40% of the voting stakes in both companies, which shared a governing structure until a scandal over Murdoch's London tabloid journalists hacking into the voice mails of public figures prompted the family to split the companies a decade ago, for fear government inquiries and civil suits threatened their entire empire.

But the companies have a structure that gives certain shareholders -- in particular, the Murdochs -- far more voting power than others, and since this past fall, they had been exploring a reunion at Rupert Murdoch's request.

Still, any deal would have required majority approval of the companies' other investors with super-voting shares. And dissent lurked even within the Murdoch family: Younger son James, who has left his executive roles in the family business but remains a beneficiary of the family trust, opposed a merger and wrote letters to both boards in the fall, raising questions about the deal -- a move first reported by the New York Times.

Merger talks were also complicated by a show of interest from an outside company that would like to acquire News Corp.'s $3 billion stake in digital real estate business Move, according to a person familiar with the discussions. Jim Kennedy, a spokesman for News Corp., declined to comment.

At the time of the 2013 split, the elder Murdoch promised it would "enable each company and its division to recognize their full potential -- and unlock even greater long-term shareholder value."

As recently as 2019, Lachlan Murdoch told Fox investors that the family had no plans to combine the companies. But his father raised the possibility last fall with his older son and assorted advisers, according to people who have spoken to him and who spoke to The Washington Post on the condition of anonymity to discuss private conversations.

In November, Irenic Capital Management, an activist investor, sent a letter to News Corp.'s special committee objecting to the merger. T. Rowe Price, a major News Corp. shareholder, told the New York Times that the proposed recombination would depress the value of the company, which was already trading below what it was worth.

On Tuesday night, Irenic Capital Management said it had reviewed a letter notifying them about the withdrawal of the proposed recombination.

Adam Katz, co-founder of Irenic Capital Management, said he was "encouraged" by the move.

News Corp. started as one company but split in 2013: 21st Century Fox with the entertainment assets and News Corp. with publishing and media assets, including HarperCollins Publishers.

The Murdoch family controls both corporations but had spun off the Fox properties into a separate company after selling a large part of the Fox entertainment empire to The Walt Disney Co. for $71 billion in a deal that closed in 2019.

In premarket trading Wednesday, shares of News Corp. added 1.8% while shares of Fox Corp. rose 3.9%. Overall, News Corp. closed at $20.64 per share for a 5.7% gain on the day, with Fox Corp. up 2.3% to $31.33 in New York.

Information for this report was contributed by staff of The Associated Press.