Arkansas' general revenue was down for the month of October compared to last year but exceeded the state's forecast, according to the latest revenue report released Thursday by the Arkansas Department of Finance and Administration.

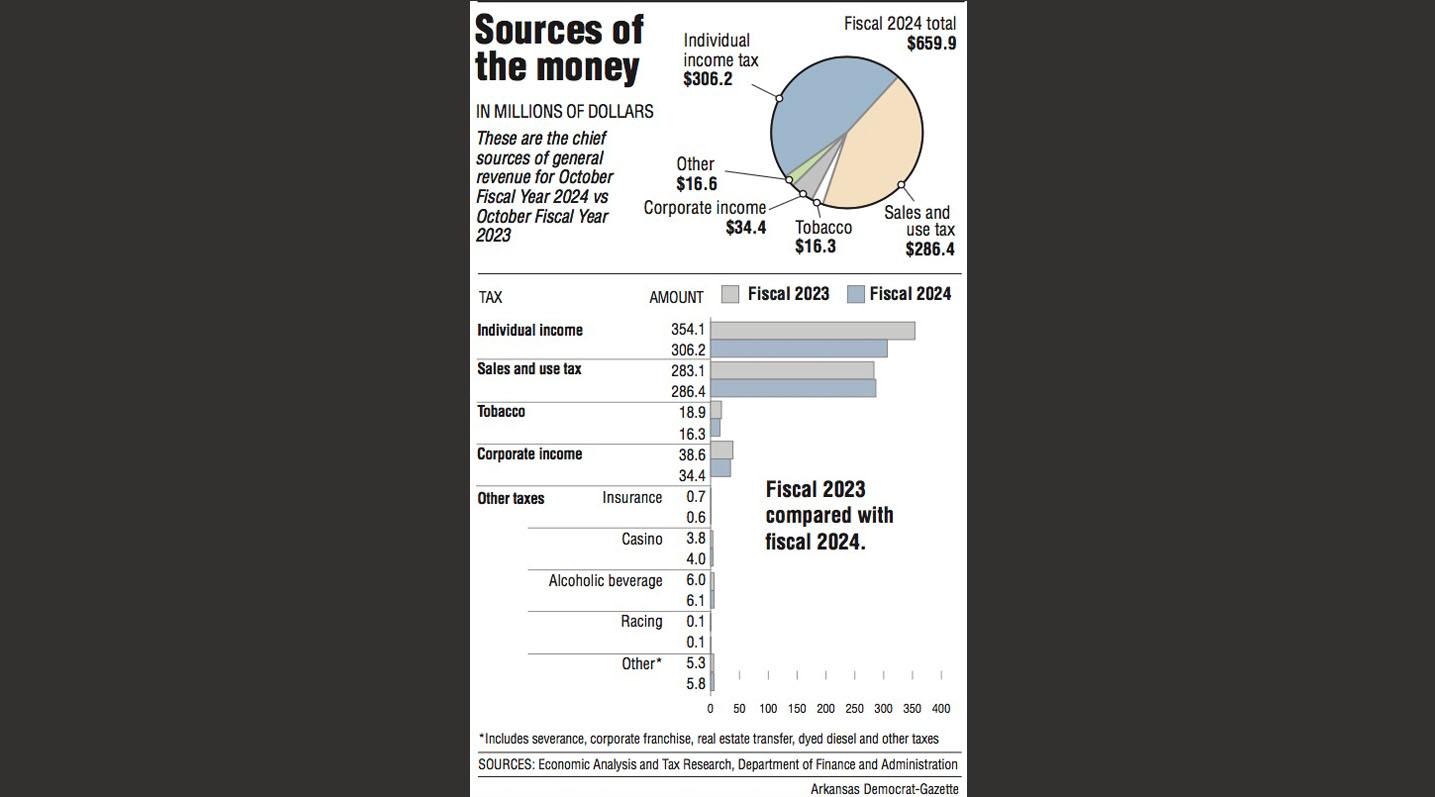

The state collected $659.9 million in general revenues in October, a $50.8 million decrease, or 7.1%, compared with same month last year. However, October's general revenue beat the state's forecast by $16.3 million, or 2.5%.

According to analysis from the finance department, gross revenue collection is down compared to the same period last year due in part to "tax rate reductions and lower income tax liability in adverse year ago comparisons for business earnings, bonuses, and capital gains." October's revenue report is similar to those from August and September, when revenue was down compared to the same time last year but still above the state's predictions.

October is the fourth month of the fiscal year, which began in July and ends in June 2024.

The lower tax revenues are mostly due to a drop in collection for income taxes, one of the state's main sources of revenue along with the sales and use tax. Individual income tax collections also were down in October compared to last year by 13.5%, totaling $306.2 million. Corporate income tax revenue totaled $34.4 million in October, a decrease of $4.2 million from a year ago.

John Shelnutt, an economic analyst at the finance department, said income tax revenues are down due to previous tax cuts the Legislature passed and slowing economic growth.

"Even before those rate cuts, we expected this year to be a transition year down off of unsustainable growth in the post-pandemic period with much less, no stimulus programs other than some infrastructure programs," Shelnutt said.

While down compared to October 2022, individual and corporate tax receipts were more than the state's economic analysts predicted, with the individual income tax revenue exceeding the state's forecast by 2.4% and the corporate income tax rate exceeding the forecast by 72.2%.

Revenues for individual income taxes "were driven largely by non-withholding tax categories." Individual withholding tax revenue decreased by 7.4% compared to last year "in part from withholding tax rate reductions and a negative payday timing effect compared to year ago," according to the finance department.

"A lot of these declines were expected in the forecast," Shelnutt said. "And so this is a story of being less negative than expected in some of the income tax categories."

As for the state's other main source of revenue, sales and use tax, revenues remain stable with only a 1.2% increase when compared to last year. In October, the state collected $286.4 million in sales and use taxes and slightly exceeded the forecast, compared to $283.1 million last year. The sales tax numbers reflect "continuing economic expansion in many sectors," according to the finance department.

Revenues for the Educational Adequacy Fund were up in October with $59.7 million collected, a 1.8% increase from last year's collection. The fund was passed in 2003, and increased the state sales and use tax rate from 5.125% to 6.0%. The additional sales and use tax revenues were set aside to ensure adequate funding for public schools.

STRONG ECONOMY

Economic analysts predicted a Federal Reserve interests hike, meant to combat high inflation, would slow economic growth more than it has. Instead, the lag time between the increased interest rates and slowed economic growth may be longer than some expected, Shelnutt said.

"The economy has just been a little bit stronger than expected at this point," Shelnutt said. "We expect it to slow down, though, in the rest of the fiscal year."

Year-to-date revenues are also down compared to a year ago but continue to exceed the state's forecast. Year-to-date net available revenue totaled $2.3 billion, which was 6.8% below levels from a year ago, but surpassed the state's projection by $115.8 million, or 5.3%.

Tax refunds and some special government expenditures are taken off the top of total general revenue collections, leaving a net amount that state agencies can spend up to the maximum authorized by the state's Revenue Stabilization Act. The act distributes general revenue to state-supported programs such as public schools, colleges and universities, corrections and human services.

Gov. Sarah Huckabee Sanders and the state Legislature increased spending through the Revenue Stabilization Act by $177.7 million to $6.2 billion in fiscal 2024 with most of the increase earmarked for education and correction programs.

"Year-to-date results exceed our forecast by $115.8 million, despite the revenue impact of recent tax cuts and the return of economic activity toward more normal levels," Jim Hudson, secretary of the Arkansas Department of Finance and Administration, said in a statement.

In the first four months of fiscal year 2024 individual income tax collections totaled $142.9 million, up by $67.4 million when compared to last year at this time, and exceeded the state's forecast by 16.9%. However, revenue from the corporate income tax is down by $50.4 million but surpassed analysts' predictions by 32.4%.

In recent years, Arkansas has maintained budget surpluses due to federal stimulus dollars and a growing economy after the covid-19 pandemic, Shelnutt said. But even with Arkansas and the country being in a more uncertain period revenues have exceeded the forecast and the state has remained on track for a budget surplus.

Shelnutt said October's revenue report shows the state remains on track for a healthy surplus by the end of the fiscal year, although the economic situation could quickly change. He predicts a decrease in revenues for the second half of fiscal 2024.

Recent tax cuts also have changed the forecast as the finance department predicted in May the state would have a $423.3 million general revenue surplus by the end of fiscal year 2024. However, after the Legislature passed tax cuts during a special session, the projection was changed to about $174 million surplus.

Act 6 lowered the state's top individual income tax rate from 4.7% to 4.4% and the state's corporate income tax rate from 5.2% to 4.8%, starting in tax year 2024, the third income tax cut lawmakers approved in 13 months. Act 6 also allows those making less than $90,000 a year a $150, one-time income tax credit.

Tax cuts passed under the prior administration are also starting to have an effect on revenues for those who filed extensions and for payroll withholding, Shelnutt said. Last year, Gov. Asa Hutchinson called a special session to accelerate an already planned cut to the state's income tax.