Three days before an election that will decide the fate of two Go Forward Pine Bluff-sponsored sales tax initiatives, the local branch of the NAACP on Saturday revealed a draft of its long-promised alternative plan that would be paid for through a variety of funding initiatives.

The 67-page report, titled "The People's Plan: A People & Place-Based Development Strategy," was informed by input from a series of town hall meetings that were held in each of the city's four wards over the past several months.

"The People's Plan ... is a people-based and data-driven approach to community and economic development that focuses on placemaking and improving the quality of place as a fundamental development strategy for the City of Pine Bluff," states the executive summary of the report. "Quality Places are places where people and businesses want to be."

The report, which was released to an NAACP focus group gathered at the Pine Bluff Library on Saturday, touches on many facets of Pine Bluff -- the problems, such as crime and lack of tourism -- while drawing attention to what the NAACP says are the problems with the Go Forward plan, which has been in place since 2017.

"The regressive sales tax GFPB supports has the greatest economic impact on low and fixed-income residents," the report states. "The combination of the impact ... creates a perverse public policy strategy that taxes the poor to benefit the rich."

Go Forward has defended its plan as being one that, among other things, helps low-income people gain a foothold in the local economy by allowing them to purchase houses through low-interest financing the nonprofit engineered.

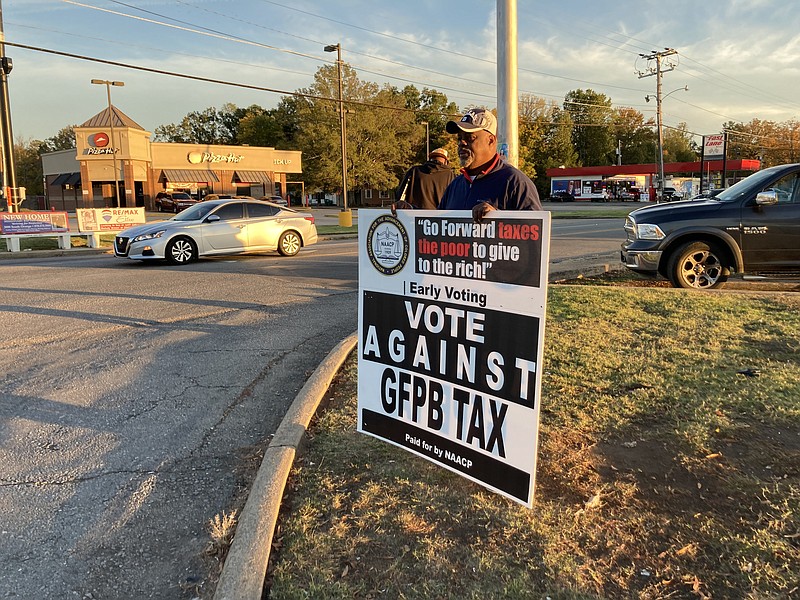

Ivan Whitfield, president of the local chapter of the NAACP, and other members of the group were holding up signs on Hazel Street on Saturday afternoon urging a "no" vote on the Go Forward taxes. He said his goal is to have the plan taken up by those on the City Council "after the tax fails."

"My hope is that these elected officials on the council who have forsaken the public's trust will look at what the public has said and take it to heart," Whitfield said. "If not, then a fresh group of people on the council would be a much better hope for the future of the city."

The NAACP report goes into Pine Bluff's storied history as a once-booming town that now finds itself making negative national headlines that call it such things as the "most miserable" (Chicago Tribune), the "least safe" (Newsweek), and the "fastest shrinking" city in the United States (The New York Times).

Other cities, such as Hot Springs, Las Vegas, New Orleans, Chicago and New York, also have crime problems, but crime, the report states, is not the only narrative those cities have.

"These cities are some of the most violent cities in Arkansas and America," states the report. "They are also some of the hottest tourist destinations in the country as well."

By extension, some of Pine Bluff's problems could be rectified if the city were able to ramp up its tourism game, which falls to the Advertising & Promotion Commission. The problem there, the report says, is that the A&P Commission is hamstrung by having to heavily support "the decaying (money pit) convention center. This effectively prevents A&P from competing with other cities for tourism. We never get to tell OUR STORY and as a result we have become Crime Bluff.

"We have the ability to promote additional stories and develop alternative narratives to reduce the perception of crime, while we implement new youth initiatives to reduce the incidence of crime over time," states the report.

The plan also draws distinctions between Go Forward's plan and an improvement plan in El Dorado that has gotten local attention. The El Dorado plan includes scholarships for high school graduates as well as an improvement plan that, according to the NAACP report, is preferable because the Go Forward plan, in many ways, lacks transparency.

Police staffing and visibility, gangs and guns, crime hot spots, street light improvements, youth intervention, beautification, drainage and flooding, housing, small business development, culinary tourism, development of people and places, and historic preservation were a few of the many topics that were included in the report and were analyzed and presented as areas where improvements could and should be made.

To pay for those improvements, the plan calls for a variety of funding mechanisms, including the issuance of $35 million in bonds for upgrades and improvements to the Pine Bluff Convention Center, a sales tax and a local income tax. Currently, Go Forward projects are supported by a five-eighths-cent sales tax and the private dollars that Go Forward attracts.

The bond money for the Convention Center would allow the A&P Commission to devote its resources to its chief mission, which is to attract tourism, according to the plan.

"We believe that our public dollars should go to support the Convention Center and NOT a private hotel owner/developer," states the report, referring to a Marriott hotel being planned for construction adjacent to the convention center.

A local income tax would attempt to recoup some of the other taxes lost when people work in Pine Bluff and live elsewhere.

"In recent years, over $600,000,000 of salaried income has gone to individuals who choose to work in Pine Bluff but refuse to live here," states the report, adding that the city loses sales taxes and other economic benefits because of the situation. "Worse, it shifts the burden of paying for municipal services disproportionately on the businesses and residents living in Pine Bluff through higher property taxes and sales taxes. Therefore, we propose a new local income tax on income earned in the city."

The income tax would be progressive, the report states, and would be "based on income above $20,000 to $30,000 and/or exempt local residents. If we collect 1% of the salary leakage each year that is $30 million over five years.

"Ultimately, the GFPB plan is duplicative and conflicts with prior/existing economic development plans and strategies, lacks transparency and accountability, and ignores best practices for public administration and social policy," states the report. "In May, voters agreed GFPB had not lived up to its promises and should be voted out. There has been nothing done in the interim to warrant a change in the voters' decision. Thus [the People's Plan] represents a better way forward."