One widow almost lost her home. Another is selling hers.

A federal law known as the “Widow’s Tax” or “DIC Offset” reduces about 64,600 military widows’ and widowers’ federal annuity benefits by thousands of dollars per year.

It’s a reduction other federal employees and survivors in similar circumstances don’t face.

Struggling to stay in their homes and pay bills is often the result, the widows say.

Here’s what these five women interviewed by the Arkansas Democrat-Gazette say about how the federal law affected them.

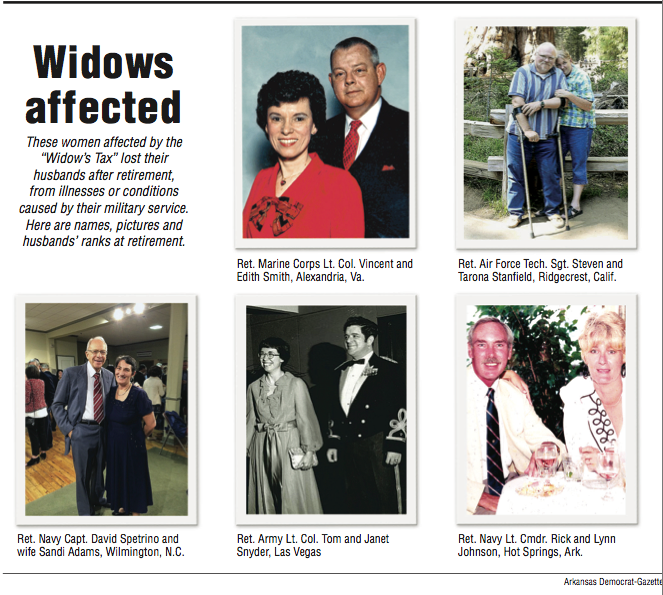

Sandi Adams, 58, Wilmington, N.C.

Adams learned about the “Widow’s Tax” last November after her husband, Retired Navy Capt. David Spetrino, died from lymphoma at age 79. The Department of Veterans Affairs linked the disease to a Navy chemical testing program he was involved in.

David “went through folders with me the month before he died,” Adams wrote in an email. He “was expecting I would be getting full Survivor Benefit Plan” insurance annuity payments. That would have amounted to 55 percent of his retirement pay.

Then she learned the government would deduct her VA death benefit of about $1,280 per month from her annuity payment.

The “Widow’s Tax” is “one of the reasons I have to sell the house right away,” Adams wrote. “Not enough to pay the mortgage now.”

Lynn Watkins Johnson, 70, Hot Springs

Navy Lt. Cmdr. Rick Johnson was a naval aviator who retired in 1988 to fly for a commercial airline.

After about four years, he “began having health problems, especially with his voice. Eventually, he was diagnosed with neck cancer and was terminal,” his wife wrote in an email.

She learned about the “Widow’s Tax” through Veterans Affairs’ monthly briefings for service members and their families leaving the military.

It didn’t “affect me as much financially as it did emotionally,” she wrote.

“The government took stuff from me — my husband who died of cancer attributed to Agent Orange and his time in Vietnam, as well as my faith and confidence in my government for misdiagnosing his cancer until it was too late.

“And, for a final insult, they took away a lawfully-paid-for insurance program meant to assist me and others like me for life.”

Rick Johnson died in 1994, at age 47.

“I was 46. We had two devastated girls who were 14 and 22,” his widow says.

Edith Smith, 77, Springfield, Va.

Smith started visiting nearby Washington, D.C., and Capitol Hill 20 years ago to lobby against the federal law that penalizes widows soon after their husbands die.

Lt. Col. Vincent Smith, who retired from the U.S. Marine Corps, died at age 60 in 1998. After three tours in Vietnam and 21 years of military service, his heart disease discovered at retirement was pronounced service-related, she said.

She has never quit lobbying for repeal of the “Widow’s Tax.” She made another visit to Congress as recently as March 23.

It will take many more widows — more “squeaky wheels,” she said recently, to get the federal law finally repealed.

Janet Snyder, 77, Las Vegas

In retirement, she and her husband, retired Army Lt. Col. Tom Snyder, decided to cancel some of their insurance policies.

“We thought the Survivor Benefit Plan annuity would be enough for me to live on,” she said. She learned about the “Widow’s Tax” after he died. She estimates it subtracts about $1,000 a month from her annuity payment.

Snyder has been politically active since her husband died at age 74 of prostate cancer and diabetes, related to Agent Orange exposure.

She’s worked with Gold Star Wives, the Society of Military Widows and Military Officers Association of America to lobby for “Widow’s Tax” repeal.

“Honor the service and sacrifices of those military service members who contributed to the Survivor Benefit Plan,” she tells congressional members. “They did not want to die, but they did.”

Tarona Stanfield, 62, Ridgecrest, Calif.

Steve and Tarona Stanfield were high school sweethearts. In 1972, at ages 19 and 17, they married just after he graduated from Air Force basic training.

A retired technical sergeant, Stanfield died in 2009 at age 55 from injuries related to his military service. He spent most of his last three years in and out of hospitals. Tarona was 53 then.

After she learned that she would receive a VA death compensation benefit, she got a letter saying she would lose all of her Survivor Benefit Plan insurance annuity.

“I was in total shock! For over 15 years my husband paid the premiums monthly,” she said in an email. “Those premiums were paid in good faith. Not once in the meeting selling us” the Survivor Benefit Plan annuity did anyone mention an “offset” or “Widow’s Tax.”

“Thank God my husband had some life insurance on himself. I would have had to sell my house.”