WASHINGTON — Factory orders for durable goods fell 1.1 percent in May, the Commerce Department said Thursday, largely the result of a drop in demand for commercial aircraft.

Excluding the volatile transportation sector, orders rose 0.9 percent after falling in April. Contributing to the strength was a 2.1 percent increase in business spending.

Companies are spending again, and that could mean better economic times ahead, analysts said. Businesses have invested more money in machinery, computers, steel and other metals in three of the past four months. The uptick is fueling economic growth in the second quarter and may lead to more jobs later this year.

The growth in corporate spending comes at a critical time for the recovery. While the pace of layoffs slowed last week, the number of people seeking first-time joblessness benefits remains about the same as in January, and the unemployment rate has been stuck near double digits all year.

Consumers are more cautious about spending, the housing market is slumping without home-buying tax credits and the European debt crisis has rattled investors. But none of that seems to have dampened companies’ outlook for the rebound.

Corporate investment “is not only growing but accelerating, which is an encouraging sign that business remains in an expansive mindset,” Michael Feroli, an economist at JPMorgan Chase, wrote in a note to clients.

The number of people filing first-time claims for jobless benefits fell last week by 19,000, the largest drop in two months.

New claims declined to a seasonally adjusted 457,000,the Labor Department said. The four-week average dipped to 462,750, the first drop in six weeks.

The stubbornly high level of requests for unemployment aid is a sign hiring remains weak even as the economy recovers. Initial claims have dropped steadily after reaching a peak of 651,000 in March 2009. But claims need to fall closer to 425,000 to signal sustained job growth, many economists say.

The reports come amid mixed news on the health of the economic recovery. New home sales tumbled in May after government incentives for homebuyers expired and sales of previously owned homes also fell last month.

The Federal Reserve on Wednesday provided a more cautious outlook while keeping interest rates near record lows. The Fed said the economic recovery is “proceeding,” a more reserved judgment than in April when it said economic activity had strengthened.

“The double-dip fears should be eased somewhat after today’s reports,” Jennifer Lee, an economist at BMO Capital Markets, wrote in a note to clients.

Employment is likely to remain sluggish. Economists at Deutsche Bank forecast that the June jobs report, due next week, will show employers cut 150,000 jobs after five months of gains. Those losses will reflect layoffs of temporary census workers. Private companies are expected to add 100,000 jobs, but gains at that pace aren’t sufficient to reduce the unemployment rate.

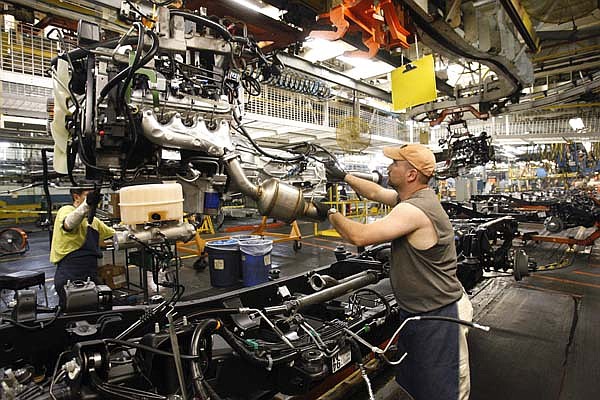

One area that could see job growth is manufacturing, as companies are investing in costly machinery. The increase was driven by a 5.6 percent uptick in orders for machinery.

As manufacturers grow confident, they are investing in equipment and repairs that they put off during the recession, said William Dunkelberg, chief economist for the National Federation of Independent Business.

“Things are wearing out, and we haven’t done a lot of spending for a long time,” he said. “We will be replacing more and more machinery and repairing facilities, because the corporate sector does have a lot of cash and they’re sitting there looking for things to do with that money.”

Analysts say orders for Boeing Co. fell in May after surging in April. That decline offset gains for machinery, raw metals and computers.

Communications equipment orders fell 9.4 percent. It was that sector’s largest decline since December 2008, at the peak of the financial crisis.

The U.S. manufacturing sector faces some unsettling issues.

The European fiscal crisis has strengthened the dollar against the euro. That makes American products more expensive for international buyers, driving down export demand.

At the same time, Europe’s financial instability has led consumers and businesses overseas to spend less. Exports are crucial for manufacturers of planes, cars and heavy machinery.

Jobless claims could be elevated for several reasons. Many economists say laid off workers are more likely to seek benefits in a weak economy than in a strong one,because they have less hope of finding work. That would keep claims high even if layoffs aren’t increasing.

Other analysts note that home construction has fallen sharply in recent months. That could cause higher claims by construction workers.

The total number of people receiving benefits, meanwhile, dropped 45,000 to 4.5 million, the Labor Department said.

But that doesn’t include about 5.3 million people who received extended benefits paid for by the federal government in the week that ended June 5, the latest data available.

During the recession, Congress added up to 73 weeks of extra benefits on top of the 26 weeks typically provided by states.

But those extensions expired earlier this month, leaving about 900,000 people without unemployment benefits, according to the department.

That figure is expected to grow to 1.25 million by the end of this week.

The House approved legislation to restore the 73 extra weeks, but the Senate is still debating the bill.

Business, Pages 27 on 06/25/2010