WASHINGTON — President Barack Obama and House Speaker John Boehner met for 50 minutes Thursday at the White House on the budget stalemate.

INTERACTIVE

Treasury Secretary Timothy Geithner also attended the meeting, according to an administration official who sought anonymity. The White House and Boehner’s office released almost identical statements that said the meeting was “frank” and that“the lines of communication remain open.”

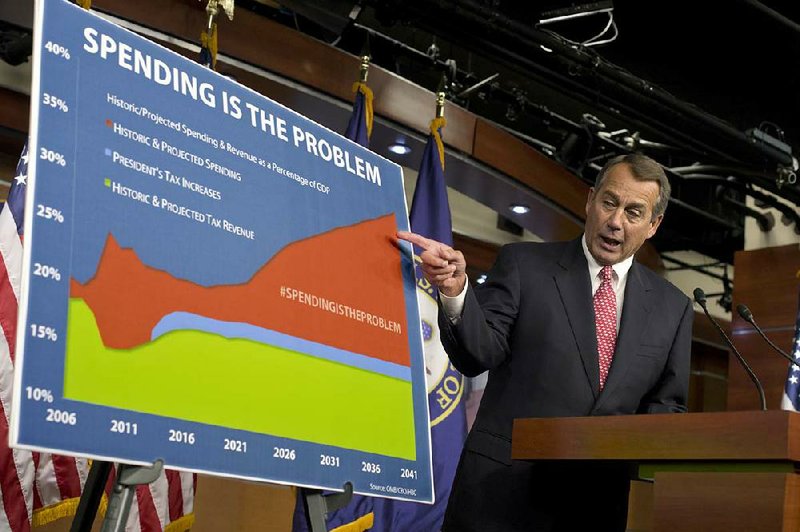

Earlier Thursday, Boehner repeated his insistence that the president’s budget proposal is “anything but” balanced, and accused Obama of not being serious about cutting spending.

Still, the speaker, during his weekly news conference, didn’t rule out allowing a House vote on extending tax cuts for incomes up to $250,000 a year for married couples, as Obama has demanded, if a broader tax-and spending deal isn’t reached soon.

“The law of the land today is that everyone’s income taxes are going to go up on Jan. 1,” Boehner said when asked by reporters if he would rule out such a vote. “I have made it clear I think that is unacceptable. Until we get this issue resolved, that risk remains.”

Boehner dug in on demands that Obama lay out more concrete cuts to Medicare and other entitlements as the price for tax increases on the top earners.

Obama and Boehner have been stymied in negotiations over how to avert more than $600 billion in spending cuts and tax increases, the “fiscal cliff,” scheduled to start taking effect in January.

The president, walking across Pennsylvania Avenue to Blair House on Thursday for a holiday party, waved and said the budget talks were “still a work in progress” when asked whether he thought there would be a deal by Christmas.

Obama this week reduced his demand for new tax revenue to $1.4 trillion from $1.6 trillion. Boehner said the plan wouldn’t pass the House.

Boehner has offered to raise his opening bid of $800 billion in increased tax revenue over 10 years, but only if the president makes a significant commitment to overhaul entitlements and slow their growth. The White House’s opening bid committed to pressing changes next year to federal health-care programs that would save $400 billion over 10 years. The speaker wants a far larger pledge and a firm commitment that the president will put his political weight behind substantive changes to Medicare and the tax code.

The president, he said, appears intent on squandering “a golden opportunity to make 2013 the year that we enact fundamental tax reform and entitlement reform to begin to solve our country’s debt problem and, frankly, revenue problem.”

Washington now faces three potential outcomes to the fiscal impasse, lawmakers from both parties say. A broad deal could be reached in which some taxes go up immediately and some cuts are secured to stop the broader tax increases and halt the across-the-board tax cuts - and to lock in targets for entitlement savings and revenue produced by changes in tax policy to be worked out next year.

If no deal is reached, Republicans are increasingly talking about a more hostile outcome in which the House passes legislation that extends tax cuts for the middle class, sets relatively low tax rates on dividends, capital gains and inherited estates, and cancels across-the-board defense cuts, but leaves in place across-the board domestic cuts. Then House Republicans would engage in what Boehner, in a private meeting last week, called “trench warfare,” a running battle with the president on spending, first as the government approaches its statutory borrowing limit early next year, then in late March, when a stopgap government spending bill runs out.

Finally, many Republicans say it is now possible that the government will plunge into the fiscal unknown. Rep. Patrick McHenry, R-N.C., said Boehner had given Republicans no indication “that he’s going to budge.”

“He’s not going to raise rates in any way, shape or form,” he said. “That has not changed.”

Obama, in an interview during the day with WCCOTV in Minneapolis, said that he was hopeful of a “change in attitude” from Republicans on raising taxes on the top earners. “It shouldn’t be hard to get resolved,” he said.

He added that the notion of not raising taxes “has become sort of a religion for a lot of members of the Republican Party. I think Speaker Boehner has a contentious caucus, as his caucus is tough on him sometimes so he doesn’t want to look like he’s giving in to me somehow because that might hurt him in his own caucus.”

Republicans who have advocated giving in on rate increases now say their party appears to be preparing for the worst. Rep. Charlie Bass, a New Hampshire Republican who was defeated for re-election last month, said the pain for Republicans would not be immediate because the tax increases would not be apparent to most Americans that quickly. But “by the third or fourth week of January, their life will be so miserable,” he said, “their life will be so unbearable, they’ll just want to get done with it.”

There’s increasing resignation within the GOP that Obama is going to prevail on the rate issue since the alternative is to allow taxes on all workers to go way up when George W. Bush-era tax cuts expire Dec. 31.

“He’s got a full house and we’re trying to draw an inside straight,” said Sen. Johnny Isakson, R-Ga. When it was observed that making a straight would still be a losing hand, Isakson said: “Yeah, I know.”

Sen. Jim DeMint, a South Carolina Republican who is stepping down early next month to head the Heritage Foundation, a conservative think tank in Washington, said Thursday that Obama will “probably get his tax increases one way or another.”

“We’re going to be raising taxes not just on the top earners,” he said on CBS’ This Morning program. “Everyone’s going to pay more taxes next year.”

Even as Boehner intensified his public campaign to pressure Obama to specify reductions in spending for Medicare and other entitlement benefit programs, the Republicans continued to be mute on what reductions they favor.

On Thursday, Senate Majority Leader Harry Reid said the Senate won’t consider a limited bill to avoid an expansion of the alternative minimum tax or a cut in Medicare reimbursements to physicians if a broader budget deal isn’t reached.

Reid, a Nevada Democrat, said the Senate won’t address tax or spending provisions that expire at year’s end unless Republicans agree to let tax rates rise for the top 2 percent of earners.

“As long as they do something on rates, I am happy to talk to them about anything,” Reid said in an interview. Pressed on whether he would refuse to advance a smaller scale bill if Republicans won’t budge on rates, Reid said, “That’s right.”

Reid spoke by telephone with Obama earlier Thursday, according to a Senate Democratic aide who spoke on condition of anonymity because negotiations are private.

House Minority Leader Nancy Pelosi, a California Democrat, said talk of deeper spending cuts demanded by Republicans should await discussions on a tax-code overhaul next year.

“Don’t even think about using” an increase in the Medicare eligibility age to reduce spending, Pelosi said. Democrats won’t throw “America’s seniors over the cliff to give a tax cut to the wealthiest in America,” she said.

The alternative minimum tax, a parallel tax system created to ensure that a few wealthy individuals couldn’t avoid all taxes, is scheduled to affect about 28 million more households for tax year 2012, up from about 4 million otherwise.

Without legislation to prevent that, the Internal Revenue Service has said it would delay tax filing scheduled to start in January until at least late March for more than 60 million filers. Action isn’t required, though inaction would cost taxpayers $92 billion in early 2013, according to the nonpartisan Joint Committee on Taxation.

If Congress doesn’t act by Jan. 1, Medicare payments to physicians will drop by 26.5 percent. Lawmakers regularly act to prevent the cut or restore it retroactively in what has become known as the “doc fix.”

Meanwhile, one of Obama’s top Senate allies said Thursday that an increase in the Medicare eligibility age is “no longer one of the items being considered by the White House” in negotiations.

Sen. Dick Durbin of Illinois told reporters that he did not get the information directly from the president or the White House. But as the Senate’s No. 2 Democrat, Durbin is regularly apprised of the status of negotiations by key players such as Reid.

Senior White House aide Gene Sperling briefed Senate Democrats on the talks Thursday and declined to tell them whether the administration was taking the issue off the table, said a senator who was present. That senator spoke only on condition of anonymity since he was not authorized to describe a meeting that was confidential.

Increasing the eligibility age, currently 65, is a key demand by Republicans seeking cost curbs in popular benefit programs in exchange for higher tax revenue.

Durbin’s comments on the Medicare eligibility age were surprising, since negotiators including Reid have been careful not to preclude the possibility of agreeing to such an increase - perhaps as a late-stage concession in a potential deal between Obama and Boehner.

Information for this article was contributed by Roxana Tiron, Kathleen Hunter, James Rowley, Heidi Przybyla, Lisa Lerer, Peter Cook, Richard Rubin, Julianna Goldman, Roger Runningen and Lu Wang of Bloomberg News; by Jonathan Weisman of The New York Times and by Andrew Taylor and Jim Kuhnhenn of The Associated Press.

Front Section, Pages 1 on 12/14/2012