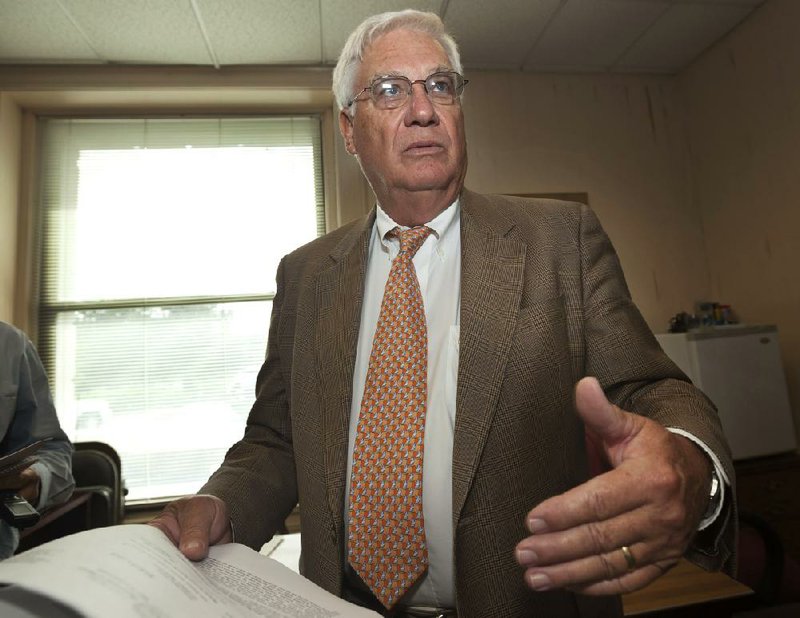

LITTLE ROCK — A record fiscal year-end surplus of more than $145 million can help Arkansas soften an expected shortfall in Medicaid funds next year as well as deal with other one-time needs, Gov. Mike Beebe said Tuesday.

Beebe said three possible priorities for spending the surplus are Medicaid, the governor’s Quick Action Closing Fund for economicdevelopment incentives and capital needs for higher-education facilities.

“The surplus should be used first for capital needs because it’s one-time money, but it can also be used on a stopgap measure to plug holes,” Beebe said. “There are several options. The Legislature will decide.”

Several legislators agreed that Medicaid is the logical recipient for some of the surplus.

Fiscal 2012, which ended Saturday, marked the second year in a row the state has finished its year with more money than it budgeted for.

The surplus, combined with money not already obligated from the fiscal 2011 surplus, will give the Legislature $191 million in one-time money in next year’s legisla- tive session, according to the state Department of Finance and Administration.

Department Director Richard Weiss estimated that there could be more than $200 million available by the time the session starts in January, once additional year-end payments and interest are factored in.

“This will go toward the often stated wish by the General Assembly and the governor both to save up a good chunk of money to deal with the Medicaid crisis,” he said. “This will go a long way to help that.”

General revenue comes mainly from the taxes on income and sales. It amounts to about 20 percent of the state’s $25 billion-a-year budget, which includes federal funds, special revenue such as the gasoline tax, cash funds such as college tuition and fees and other money.

The Department of Finance and Administration’s monthly revenue report showed that for the entire fiscal year, gross general revenue for the year was $5.92 billion, which is $250.8 million (or 4.4 percent) more than was collected in fiscal 2011 and $125.8 million (2.2 percent) above the state’s most recent forecast.

After refunds to taxpayers and distributions for about a dozen other purposes were taken off the top of gross general revenue, state agencies were left with a “net” of $4.75 billion available to spend. That’s a state record and an increase of $178.7 million (3.9 percent) from fiscal 2011, and $51.1 million (0.9 percent) above the forecast.

The revenue report indicates that collections increased in the major components of the state’s general revenue. Individual incometax collections of $2.9 billion were 5.7 percent above fiscal 2011 and 2.1 percent higher than the forecast; corporate income taxes of $435.3 million were 11.2 percent higher than fiscal 2011 and 11 percent above forecast; gross receipts collections, which are derived from the sales and use tax, were $2.13 billion — 2.7 percent above last year and 0.5 percent above forecast.

“I’m really happy with the trend, because the trend reflects several months of increased taxes in virtually every category. And the one I like the most is individual withholding because it means people are working, people have jobs,” Beebe said.

Arkansas’ unemployment rate rose to 7.3 percent from April to May, but has come down from 8.1 percent in May 2011.

Weiss said the July report reflects some economic recovery but noted that the figures reflected the state’s cautious approach to budgeting.

“I mean, we have been super conservative in our forecasting and budgeting for the last several years,” he said.

After the April revenue report showed that revenue was $93.6 million above projections for the first 10 months of the fiscal year, Beebe revised the official forecast upward to fully fund the budget enacted by the 2011 Legislature.

That meant more money went to state general revenue and was available for the Medicaid program, the state’s higher education institutions, and some other state agencies.

Medicaid was on many minds after the year-end figures were released Tuesday. The state Department of Human Services has estimated that Arkansas will face a $250 million to $400 million Medicaid shortfall as soon as fiscal 2014r, which begins in July 2013.

During the fiscal session earlier this year, some Republican lawmakers advocated putting what was left of the fiscal 2011 surplus into the Medicaid trust fund to head off the projected shortfall.

Beebe said at the time that he didn’t philosophically disagree with that idea but wanted to wait.

“I said just cool it. It will still be there, nothing can happen until the Legislature decides and we’ll be able to do that going forward if that’s what the Legislature wants to do. Obviously, I support that,” Beebe said Monday.

Beebe said he did not know how much of the combined two-year surplus would be set aside for Medicaid, but said he expects it to be more than the $40 million the Legislature discussed earlier this year.

“What the Legislature talked about with $40 million set aside is agreeable with me, and I suspect it may be more than that,” Beebe said.

House Republican leader Bruce Westerman, R-Hot Springs, said he did not see much choice but to use the surplus to chip away at the Medicaid shortfall.

“I don’t see we have a lot of choice with the situation we’ve allowed ourselves to get into, to use whatever funds are available to get us on the right track so real reforms can actually bend the cost curve over time,” he said.

The Legislature passed six tax cuts in 2011 that state finance officials estimated would reduce general revenue by $44.7 in fiscal 2013, and many Republican lawmakers said that was not enough. Beebe has said he’d favor continuing to chip away at the grocery tax.

Sen. Larry Teague, a Democrat from Nashville who is in line to become president pro tempore of the state Senate, said some of the surplus will likely have to go toward Medicaid, but he is also “convinced” it can be used to eliminate the 1.5 percent tax on groceries.

“I think it’s a good sign we’ll be able to do away with the rest of the grocery tax, assuming the economy keeps ticking along,” Teague said, adding that he’s not opposed to lowering other taxes if there’s enough money available.

Rep. John Burris, R-Harrison, said he wanted to see the income tax lowered.

“I would say there is no doubt there’s going to have to be increased funding for Medicaid. The question is whether or not we simply continue to throw more money at a problem that’s bankrupting us and bankrupting the country, or whether we try to make substantive changes,” he said.

Weiss cautioned that despite the upward trend throughout the past year, it’s too soon to consider the economy to have recovered.

“We still have a lot of folks out of work in this country. We still have a very shaky economic time in this country. Anybody who would say we’ve crossed over into some time where we can cut all the taxes and not have any income and everything is going to be rosy, I don’t think you can read into that at all,” Weiss said.

JUNE REVENUE

Gross general-revenue collections for the month of June set a new record, passing the one set in June of last year. Collections last month totaled $581.5 million, $29.9 million (5.4 percent) higher than the same month in fiscal 2011.

That was 25.5 percent higher than the forecast.

Net revenue available for state agencies to spend was $509.6 million in June, $35.8 million or 7.6 percent above last year.

Both net and gross general revenue includes excess collections from the first ten months of the year before the forecast was revised, according to the report.

Individual income taxes increased by $18.5 million (7.9 percent) over the same month last year to $253.8 million, exceeding the forecast by $61.4 million (31.9 percent). Gains in estimated payments of 11.7 percent by investors and the self-employed accounted for much of the growth, while withholdings increased by 6.4 percent, the department said.

Gross receipts increased by $14.4 million (8.6 percent) over the same month last year to $180.8 million, exceeding the forecast by $9.1 million (5.3 percent).

Corporate income taxes increased by $8.8 million (12.1 percent) over the same month last fiscal year to $81.8 million, exceeding the state’s forecast by $39.9 million (95.1 percent).

Special revenue of $156,275,593.78 was collected in June, an increase of 6.2 percent.

Information for this article was contributed by Sarah D. Wire of the Arkansas Democrat-Gazette.

Front Section, Pages 1 on 07/04/2012