WASHINGTON - The U.S. posted its smallest budget deficit in five years as employment gains and higher taxes propelled revenue to a record, while spending fell by the most since the Eisenhower administration.

Outlays exceeded receipts by $680.3 billion in the 12 months ending Sept. 30, the narrowest gap since 2008, compared with a $1.09 trillion shortfall in fiscal 2012, the Treasury Department said Wednesday. In September, the U.S. recorded a $75.1 billion surplus, little changed from the surplus in the same month a year earlier.

Stronger hiring has helped shrink the country’s deficit as a share of gross domestic product by more than half in the past four years, narrowing it from a record $1.42 trillion in 2009.

“It is now less than half of what it was when the [President Barack Obama] took office,” Treasury Secretary Jacob Lew said in a statement.

Higher payroll taxes that Congress allowed in January bolstered revenue, while spending was restrained by across-the-board cuts known as sequestration, which lawmakers failed to prevent in March.

“It is a reflection of the shifting fiscal paradigm in which higher tax rates and the improving economy are driving higher revenue intake,” said Millan Mulraine, director of U.S. rates research at TD Securities USA LLC in New York. “At the same time, there is a thrust towards cuts in government spending.”

Revenue jumped 15.2 percent to $301.4 billion in September from a year earlier, taking the annual figure to an all-time high of $2.77 trillion compared with $2.45 trillion in 2012, Wednesday’s report showed. Spending increased 21.5 percent to $226.4 billion last month, contributing to a 12-month total of $3.45 trillion that declined from $3.54 trillion a year earlier, it showed.

The 2.4 percent drop in annual spending for the fiscal year was the steepest since 1955, according to Treasury data compiled by Bloomberg News.

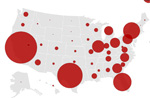

The unemployment rate fell to an almost five-year low of 7.2 percent in September, the Labor Department reported last week. Payrolls have grown by 1.6 million workers so far this year.

“Our deficits are getting smaller,” Obama told high school students in Brooklyn, N.Y., last week as he campaigned for his budget goals. “We don’t have to choose between growth and fiscal responsibility. We’ve got to do both.”

Congress is working toward a new budget agreement after a battle between Tea Party-allied Republicans and the Obama administration over limiting debt led to partial shutdown of federal operations earlier this month.

The agreement reached after the 16-day government shutdown set a Dec. 13 deadline for budget negotiations.

The mandatory cuts don’t touch benefit payments for programs such as Social Security, Medicare and Medicaid. Many Republicans want to replace the automatic cuts with reductions in spending on these entitlement programs that account for most of the nation’s long-term debt. Democrats including Obama have indicated they’re open to some of these ideas as long as they are paired with new tax revenue, which Republicans oppose.

“Congress must build on this progress by crafting a pro-jobs and pro-growth budget agreement that strengthens the economy while maintaining fiscal discipline,” Lew said in the statement.

The Treasury Department said the 2013 deficit amounted to 4.1 percent of GDP. The shortfall was forecast to be3.9 percent of GDP this year, according to Congressional Budget Office projections last month, down from 10.1 percent in 2009.

A short-term shrinkage of annual budget deficits isn’t enough to reverse the 25-year growth of U.S. debt that requires Congress to choose among spending cuts, tax increases or a combination of both.

The Congressional Budget Office estimates rising spending on Medicare and Social Security will widen the deficit to 6.5 percent of GDP in 2038, greater than any year between 1947 and 2008. Economists, including former Federal Reserve Vice Chairman Alan Blinder, have said changes in the entitlement system are necessary.

“Unless that happens, the budget deficit as a share of GDP and therefore the national debt as a share of GDP is headed off for the wild blue yonder,” Blinder said Oct. 17. “And that is what we need to stop.” Information for this article was contributed by Roger Runningen, Richard Rubin and Heidi Przybyla of Bloomberg News and by Martin Crutsinger of The Associated Press.

Front Section, Pages 1 on 10/31/2013