The price of gasoline in Arkansas has jumped 14 cents in the past month, and motorists will see little relief on average this summer when prices are expected to soften only slightly, according to a monthly government report released Tuesday.

The national average price of a gallon of gasoline will be $3.57 from now until September, down about a penny from the current national average, the U.S. Energy and Information Administration estimates.

“If Ukraine settles down, I think [prices] will fall,” said James Williams, an energy analyst and owner of WTRG Economics near Russellville. “Without some interruption… I would be looking for downward pressure maybe by the end of May.”

Retail gasoline prices are expected to drop from a national average of $3.66 a gallon in May to about $3.46 a gallon in September, according to the administration’s Short-Term Energy Outlook report.

However, analysts said the current maintenance season for refineries in the United States and geopolitical tensions are likely to lift gasoline prices before they drop for the summer driving season.

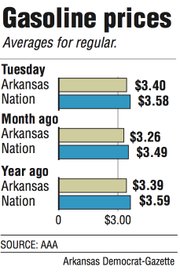

The average retail price of gasoline in Arkansas on Tuesday was $3.40 a gallon, up from $3.35 a week ago. The national average price was $3.58, an increase from $3.56 a week ago, according to AAA’s daily fuel gauge report.

Gasoline prices normally rise during this time of the year and then start to subside in May as refineries go back on line after shutting down for maintenance, said Phil Flynn, an energy analyst with Price Futures Group in Chicago.

“This is the time of year where we do see volatile gasoline prices,” said Mike Right, a spokesman for AAA. “This time of the year, chances are we’ll see gasoline prices head north.”

Even so, prices are expected to drop in 2015 to a national average of $3.37 a gallon, according to the energy administration’s report.

“If gas prices are low, even if it’s not the biggest portion by far of vacation costs, people tend to take longer vacations and that certainly benefits the travel industry,” Williams said.

For businesses that have high transportation costs, lower gasoline prices give them more profit in the short term, he said.

“If the expectations were for [lower] long-term oil prices, you would certainly have more investment,” Williams said.

For now, geopolitical tensions are pressuring crude-oil prices and are keeping gasoline prices elevated, analysts said.

“The fear of interruptions, not the actual amount of oil on the market, is what’s driving these price spikes,” Williams said. “The problems are geopolitical; they’re not fundamental supply and demand.”

Used by many refineries in the U.S., Brent crude for May delivery rose $1.85 to close Tuesday at $107.67 a barrel on the Intercontinental Exchange in London. West Texas Intermediate crude climbed 2.1 percent in New York to close at $102.56 a barrel, according to a Bloomberg News report.

Oil climbed Tuesday because of tension between the West and Russia over Ukraine, analysts said.

Russia told Ukraine to halt military preparations in the eastern part of the country or risk civil war.

‘The concern is that it’s more of a natural-gas concern,” said Jeff Mower, editor-in-chief of Oilgram Price Report at Platts. “If natural gas in any way gets cut off into Europe through the Ukraine, people who need natural gas could turn to oil.”

Speculation about oil exports from Libya is also weighing on prices. The country is currently the smallest producer in the Organization of Petroleum Exporting Countries, a result of war and disputes between the new government and rebels over exports, Bloomberg News reported.

“The market is still waiting to see something,” Mower said. “I think if you see ... Libyan crude return to the market and those exports return, you could see some downward pressure on the markets.”

Front Section, Pages 1 on 04/09/2014