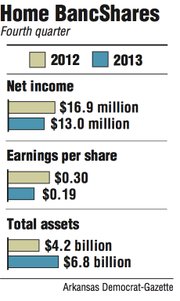

Net income for Home BancShares, the owner of Centennial Bank, dropped 23 percent in the fourth quarter last year to $13 million compared with $16.9 million in the same period in 2012, the Conway bank said Thursday.

That equals earnings of 19 cents per share for the quarter, down from 30 cents per share in the fourth quarter of 2012.

The decline in earnings was attributed to $17.3 million in expenses related to the $280 million purchase of Liberty Bancshares of Jonesboro, the largest purchase by an Arkansas bank of an instate financial institution. That deal closed in October.

Excluding the merger related expenses, Home BancShares earned 37 cents in the fourth quarter, beating the expectations of 33 cents a share projected by seven analysts surveyed by Thomson Reuters.

Shares of Home Banc-Shares fell 57 cents, or 1.7 percent, to close Thursday at $33.99, in trading on the Nasdaq exchange.

For the year, Home Banc-Shares earned $66.5 million, up from $63 million for 2012. Earnings per share for the year were $1.14 compared with $1.11 in 2012.

John Allison, chairman of the bank, said he expects significant improvements in Liberty Bank’s operations in January.

If that occurs, “I’ll become very active in February” in search for more acquisitions, Allison said.

“The deals are there,” Allison said. “We just need to go wrap some of them up at our price. We’re not going to get crazy and get pricey.”

The bank could make some smaller purchases but if necessary could handle an acquisition of a bank with $2 billion in assets, Allison said.

Home BancShares’ performance in the fourth quarter was good, said Matt Olney, an analyst with Stephens Inc. who owns no stock in the company.

In addition to the purchase of Liberty in the fourth quarter, Home BancShares managed to merge Liberty Bancshares’ computer operations into its own in December, a rare accomplishment, Olney said.

If Home BancShares had failed to complete the conversion in December, the bank wouldn’t have been able to finish it until March, said Randy Sims, chief executive officer.

“It would have cost us several millions of dollars in savings we now can enjoy in the first quarter,” Sims said.

The $17.3 million that Home BancShares spent in the quarter on the purchase of Liberty was slightly higher than Olney expected, he said.

“But there probably will be a lot more savings we’re going to see in the next few quarters,” Olney said. “You just can’t get that the first few months after a deal closes.”

More important than the costs, investors will be interested in future earnings that Home BancShares makes off the Liberty purchase, Olney said.

“We’re a lot more focused on that than the one-time expenses,” Olney said.

Centennial Bank added 46 branches in Arkansas in the fourth quarter with the purchase of Liberty and subsequently closed four branches. It also closed one branch in Panama City, Fla.

Centennial has 88 branches in Arkansas, 53 in Florida and seven in Alabama. At the end of the quarter, Home BancShares had 71 percent of its assets in Arkansas, 26 percent in Florida and 3 percent in Alabama, Sims said.

Business, Pages 31 on 01/17/2014