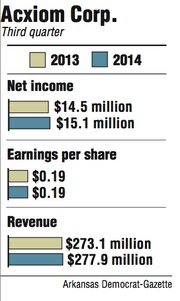

Acxiom Corp. on Wednesday reported a profit of $15.1 million for its fiscal 2014 third quarter, up 4 percent from the same period a year ago.

The Little Rock-based company reported $277.9 million in revenue during the period that ended Dec. 31, up from $273.1 million in the same quarter a year ago.

The company’s earnings per share attributable to shareholders for the quarter were 19 cents, the same as the previous year’s third quarter.

Excluding “unusual items,” Acxiom’s earnings per share would have been 25 cents. The company said in its financial report that it had a “tax-related adjustment” that increased both earnings-per-share measures by about 4 cents.

“The company’s doing well,” said Bob Williams, senior vice president and managing director of Delta Trust Investments Inc. in Little Rock. “All in all the company has done particularly well in light of the industry they are in.”

The “big data” industry has been under scrutiny by Congress and privacy advocates recently, especially after revelations about intelligence agencies collecting bulk of information and the Target Stores Inc. data breach in late November and December.

Acxiom continues to function mainly as a data broker, using information collected through public records and shopping habits to help with marketing campaigns and to connect its customers to consumers.

The company said its market and data services generated revenue of $207 million in the third quarter, up from $195 million during the same period a year ago.

Acxiom’s information technology infrastructure management business saw revenue fall11 percent to $62 million during the quarter.

“We are thrilled with the progress made since our release of the Acxiom Audience Operating System,” said Scott Howe, Acxiom’s chief executive officer. “After just four months since launch, we now have more than 30 customers that are implementing or testing one or more aspects of [the system]”

The company said it has taken steps to “realize approximately $15 million in annualized cost reductions.” Acxiom said in November that it plans to reduce its annual expenses by $20 million to $30 million in six to 12 months.

The company did not say how it has cut costs.

Shares of Acxiom fell 2.3 percent Wednesday to close at $32.15. The company released its quarterly financial results after the markets closed and held a conference call Wednesday afternoon to discuss the report.

Acxiom spent $13.8 million during the quarter to buy back about 400,000 shares. The company also increased its share repurchasing program from $200 million to $250 million. Acxiom has spent $193 million since 2011 to repurchase 12.3 million shares.

Business, Pages 25 on 01/30/2014