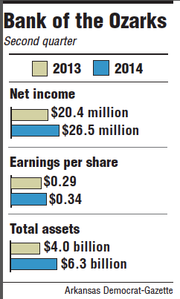

Bank of the Ozarks earned $26.5 million in the second quarter, a 30 percent improvement over the $20.4 million it made in the second quarter last year, the Little Rock bank said Monday.

Bank of the Ozarks made 34 cents a share, up from 29 cents in the second quarter last year and better than the 33 cents a share projected by nine analysts surveyed by Thomson Reuters.

Total assets at the end of the quarter were $6.3 billion, up more than 50 percent from $4 billion in the second quarter last year.

Shares of Bank of the Ozarks closed at $32.94 Monday, up 14 cents, in trading on the Nasdaq exchange. Monday's earnings were released after the markets closed.

George Gleason, chairman and chief executive officer of the bank, partly attributed the bank's growth to several purchases. In the past year, Bank of the Ozarks has closed on the purchase of First National Bank of Shelby, N.C.; OmniBank of Houston; and Summit Bancorp of Arkadelphia.

Even more important to Bank of the Ozarks' growth is its improvement in quality, "good yielding loans," Gleason said in a statement.

Excluding loans the bank has acquired in purchases of failed institutions, Bank of the Ozarks increased its loans by a record $393 million in the second quarter, Gleason said.

"Very few banks are seeing the loan growth and the [acquisition] growth that Bank of the Ozarks has over the last year," said Matt Olney, a banking analyst with Little Rock-based Stephens Inc. "I think that trend is going to continue."

Olney, who owns no stock in Bank of the Ozarks, expects that the bank will announce another acquisition by the end of the year.

The biggest purchase Bank of the Ozarks made in the past year was the acquisition of Summit Bancorp, which it bought for $216 million.

"I think the chances are pretty good that they find another acquisition by the end of the year," Olney said. "They have quite a few geographies to pick from."

Bank of the Ozarks has mentioned that it would consider acquisitions in Arkansas, Alabama, Florida, North Carolina, South Carolina, Tennessee and Texas, among other states in the Southeast, Olney said.

The bank completed a 2-for-1 stock split on June 24.

Its share price has risen by 17 percent so far this year and is one of the best-performing stocks among Arkansas-based companies in recent years. A $100 investment in Bank of the Ozarks at the close of 2008 now would be worth more than $490.

Business on 07/15/2014