NEW YORK -- For stock investors, there was no shortage of drama in October.

Stocks started the month modestly below a record high, only to cascade to their worst slump in two years. But after flirting with a correction, or a 10 percent drop, the U.S. market rebounded and closed at all-time highs on the last day of the month.

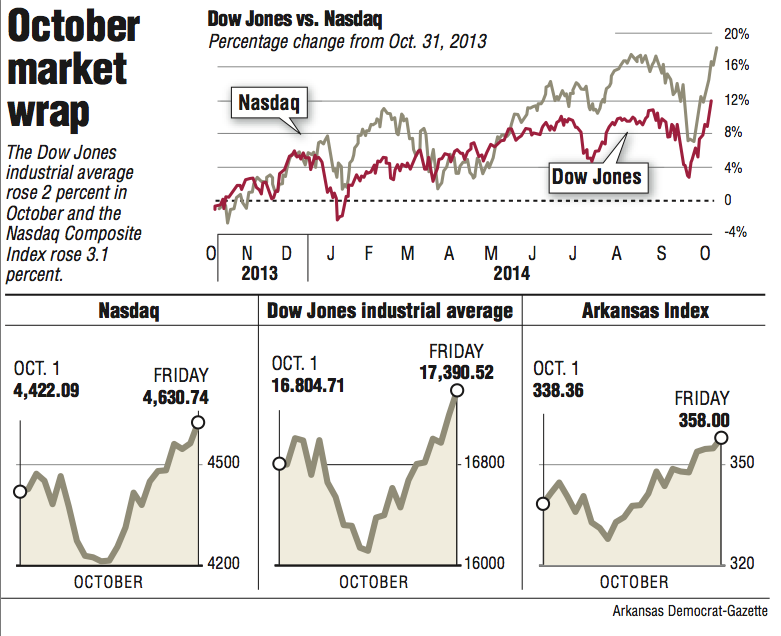

All told, U.S. stocks ended October solidly higher, up 2.3 percent.

The Dow Jones industrial average capped the rally by rising 195.1 points, or 1.1 percent, to end at 17,390.52 Friday. The Standard & Poor's 500 rose 23.4 points, or 1.2 percent, to 2,018.05, and the Nasdaq composite added 64.6 points, or 1.4 percent, to 4,630.74.

Both the Dow and S&P 500 closed at record highs.

It's a remarkable turn given the month's volatility, which at times approached levels from the 2008 financial crisis. Then again, the month has an unfortunate history for unsettling moves, with the stock market crashes of 1929 and 1987 both happening in October.

This October, the market's seesaw path was driven by fears that Europe's economy was slipping back into a recession, worries about plunging oil prices, concerns of possible weakness in the U.S. economy and Ebola. Those anxieties sent the market, for the most part, straight down for two weeks.

The nadir came Oct. 15, when the S&P 500 came within a hair's breadth of going into a correction. Investors had suspected such a drop. The last one occurred in late 2011, and historically corrections happen every 18 months or so.

But just after the market came close to going into a correction, it bounced right back. Strong U.S. corporate earnings were the primary driver of the rebound as well as signs that central banks in Japan and Europe were going to do all they could to stop their economies from dragging everyone else down with them.

"I don't think it's a surprise that we came close to a correction. We've been expecting one for a while. I think the bigger surprise has been how we rip-roared all the way back up," said Bob Doll, chief equity strategist at Nuveen Asset Management. "When you hit someone over their head with a hammer, you don't expect them to get up immediately."

U.S. companies have been, for the most part, reporting strong quarterly results the past two weeks. Corporate profits are up 7.3 percent from a year ago, according to FactSet, compared with the 4.5 percent investors had expected at the beginning of the month. And any worries about the U.S. economy earlier in the month evaporated as the data rolled in, most recently Thursday's data showing the U.S. economy grew at a 3.5 percent pace last quarter.

Friday's gains were driven by the Bank of Japan, which surprised investors by announcing it would increase its bond and asset purchases in a bid to pull the world's third-largest economy out of the doldrums, with household spending dropping and unemployment ticking up.

In other markets, the price of U.S. benchmark crude oil fell 58 cents to $80.54 a barrel in New York as increasing production from OPEC members added to already high global supplies of oil.

Bond prices fell. The yield on the U.S. 10-year Treasury note rose to 2.34 percent from 2.31 percent Thursday.

SundayMonday Business on 11/01/2014