Windstream Holdings Inc. shares plunged 7.8 percent Thursday after the telecommunication company reported a 74.2% percent drop in profit and missed analysts' estimates when it released its third-quarter financial results.

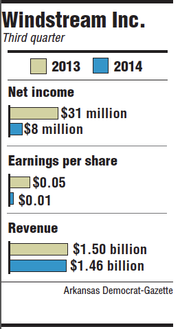

Windstream reported a net income of $8 million for the period that ended Sept. 30, compared with $31 million during the same quarter a year ago.

The Little Rock company had earnings per share of 1 cent for the quarter, down from 5 cents and missing analysts' estimates of 4 cents per share for the period.

Excluding a 2 cent after-tax merger, integration and restructuring charge, Windstream would have earnings per share of 3 cents for the quarter.

The telecommunication company's shares fell 82 cents to close Thursday at $9.67 on the Nasdaq stock exchange in more than triple the average trading volume.

Windstream also missed analysts' revenue estimates of $1.47 billion for the third quarter, reporting $1.46 billion for the period.

"We are taking proactive steps to increase profitability, improve our cost structure and drive operating efficiency in the business," Jeff Gardner, Windstream's chief executive officer, said during a conference call with analysts Thursday morning.

"In addition, we continue to target higher-margin business sales opportunities through the combination of networks services, data center and managed services," he said.

Windstream's data and integrated services revenue increased 4 percent during the quarter to $423 million. Data center and managed services revenue increased 21 percent to $32 million, the company said.

Windstream said it is making progress in completing the spinoff of some of its assets, including filing a preliminary form to register the new company's shares with the Securities and Exchange Commission.

The company announced earlier this year that it plans to convert its copper and fiber-optic networks, along with other assets, into an independent, publicly traded real-estate investment trust.

The tax-free spinoff is expected to be completed in 2015, pending regulatory approval. Once the new company is formed, it will lease the assets to Windstream for $650 million per year on a long-term contract.

When asked by analysts during the company's conference call about the progress of the spinoff, particularly in terms of of using the new company to make mergers and acquisitions, Tony Thomas said he's been in talks with other companies.

"As you can imagine, I've been on the road talking to other telecommunication companies and I would describe there's been a high level of interest from those companies in the transaction," said Thomas, who will become chief executive officer of the real estate trust.

"This transaction is fairly unique in its ability to inject cash into a business to help restructure the balance sheet, invest more capital to improve the underlying network performance or simply return cash to shareholders," he said.

Industry analysts have said the new company being formed by Windstream would be in the position to acquire other assets from similar telecommunication companies looking to divest some of their infrastructure.

Thomas said, "So those conversations are progressing well, and I expect those to continue, and frankly, [it] reaffirms my view that there's going to be significant opportunities for this [real estate investment trust] vehicle to be an acquisition or potential partner in acquisitions on a prospective basis, be that with Windstream or other companies."

Business on 11/07/2014