Tyson Foods beat analysts' expectations for its fourth quarter and projected greater earnings in 2015 as the company continues to integrate Hillshire Brands.

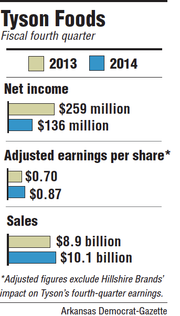

On Monday, Tyson reported earnings of $136 million or 35 cents per share -- far lower than last year's fourth-quarter results -- but analysts paid attention to Tyson's adjusted earnings of 87 cents per share, which excluded the Hillshire purchase.

That number beat analysts' expectations by 11 cents, and Tyson's stock increased by more than 5.8 percent Monday, coming within $1.25 of its all-time high.

Decreased supplies of beef and pork drove up prices in fiscal 2014, significantly increasing average prices in those segments relative to fiscal 2013. Chicken volume increased, although prices were down slightly.

Overall sales increased to $10.1 billion in the fourth quarter, a record for the company and a 16.1 percent increase from last year.

"Clearly, the market reacted positively today," said Bob Williams, senior vice president and managing director at Delta Trust Investments.

Although the adjusted earnings per share excluded Hillshire's single month as a part of Tyson, the emphasis on Hillshire's brands and leadership in prepared foods was evident throughout Monday's investor call.

Williams said the company's earnings show how it has evolved over time.

"Tyson started out as a plain-old chicken company. The way they guided their growth over time was entering into further processed foods," he said. "If you look at the way this company has grown and expanded, to me, the Hillshire acquisition made perfect sense."

Tyson completed its acquisition of Hillshire on Aug. 28. It cost the company $8.55 billion, including the assumption of debt, an amount that some analysts questioned.

But Donnie Smith, Tyson's chief executive officer, was optimistic for fiscal 2015 -- the first year of the new Tyson Foods. For the next year, Tyson is projecting earnings of $3.30 to $3.40 per share.

Analysts expected a profit of $3.33 per share. For fiscal 2014, earnings per share was $2.94, excluding the Hillshire acquisition.

Tyson expects yearly sales to increase to about $42 billion in 2015 from $37.6 billion.

"It's Tyson 2.0, and we're a different company," Smith said. "We have leading brands and market share that will allow us to grow faster than our peers, and we're not finished growing -- there's more to come. So, yeah, we feel really good about 2015 and 2016."

Smith said he expects beef and pork prices -- up 12.8 percent and 15.7 percent this year, respectively -- to remain elevated. At the same time, he expects the chicken segment to achieve a 7 percent to 9 percent profit and exceed 10 percent in early fiscal 2015. The segment achieved a 7.9 percent pre-tax profit in 2014.

Smith said the improved profitability would be achieved as increased capacity comes online and the cost of grain decreases. Operational issues that depressed last quarter's earnings are now resolved, he said.

And millennials, people born in the 1980s and 1990s, will account for some of the segment's growth.

"As the millennials enter the workforce, they index very heavy towards chicken," Smith said. "So we feel like that's a meaningful consumer shift that will allow us to continue to grow our business well into the future."

Tyson expects its international segment to continue operating at a loss. The company has the capacity to add a second shift to its plants in China but remains "in a holding pattern."

In July, the Chinese government suspended Illinois-based OSI Group LLC's operations in China after it sold meat beyond its expiration date.

"The issue is with these back-to-back food scares, demand for poultry is down," Smith said. "We were seeing a little bit of increase -- call it maybe a ray of hope -- a couple months ago, but then this latest scare caused demand to fall back."

Smith said the Hillshire integration process was on track. He projected $225 million in cost savings in fiscal 2014 and more than $500 million by the third year of ownership.

Most of the savings will be in the prepared foods segment or in areas such as freight management, he said. Sales, which reflect one month of Hillshire's integration, were already up 43 percent in the fourth quarter compared to last year.

As far as which brands will stay and go, little is certain. Smith did say that Tyson is no longer investing in its Day Starts protein breakfast brand, which is being replaced with Jimmy Dean products on retailers' shelves.

"Tyson has the right brands and the right products in the right places for today's consumers," Smith said. "I can assure you we're not slowing down the Hillshire innovation pipeline; they're speeding us up."

A Section on 11/18/2014