Incoming J.C. Penney Co. Chief Executive Officer Marvin Ellison told store managers that he'll give them more leeway to select merchandise and make other crucial decisions as the struggling chain works to increase sales.

Ellison, who replaces Mike Ullman in August, talked about his plans last month at a conference in Dallas that doubled as a pep rally for store managers and a coming-out party for the new leader, according to three people familiar with the meeting. The event, the first of its kind in five years, was attended by the employees who run the chain's 1,000 locations, said the people, who asked not to be named because the conference wasn't public.

Increasing managers' autonomy would continue a shift away from J.C. Penney's failed strategies under former CEO Ron Johnson, who sought to transform the century-old retailer with revamped stores and offerings to lure younger, wealthier shoppers. Johnson, ousted two years ago, wanted all locations to look and operate the same. That left managers focused on following rules -- such as making sure the space between clothing racks met regulations -- instead of working to drive sales.

One conference attendee said the micromanaging under Johnson was so severe that store managers couldn't make daily merchandising decisions. For example, they couldn't move poorly selling products from prime locations and swap in faster-moving items. Ellison wants managers to make more of those kinds of calls, the person said.

To reinforce the managers' expanded role, the company announced at the meeting that their titles would be changed from store leader, a term coined during the Johnson era, to general manager.

J.C. Penney declined to comment or make Ellison available for an interview.

Ullman, who returned to the CEO role in 2013 about 18 months after stepping aside for Johnson, has shored up J.C. Penney's finances by raising cash and narrowing losses. While the moves have lifted the stock off its lows, investors want more. The shares gained less than 2 percent in the 12 months through Wednesday as the retailer's focus shifts to increasing sales growth enough to revive profitability.

That task will be left to Ellison. He started at J.C. Penney in November as president and CEO designee after 12 years at Home Depot Inc., where he was a finalist for the CEO job last year. As head of the home-improvement chain's nearly 2,000 U.S. stores, Ellison helped revamp logistics and processes so workers could spend more time helping customers.

The strategy helped sales at Home Depot's existing locations, which was crucial for the company as it stopped adding new stores in the U.S. The retailer, which generates about 90 percent of its revenue domestically, has instead relied on making current locations more productive and increasing online sales.

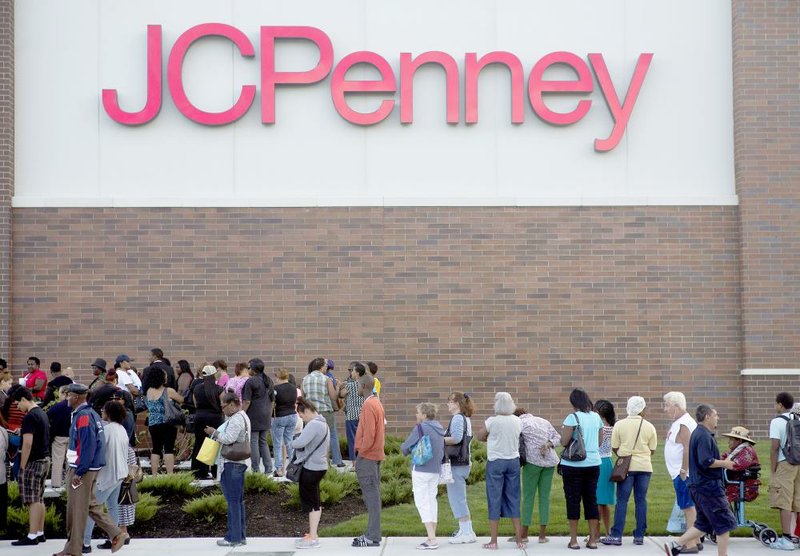

J.C. Penney isn't relying on new stores for growth, either. In fact, it has shuttered about 70 locations since the beginning of last year.

During the conference last month, Ellison, who was often accompanied on stage by Ullman, talked about the need to improve customer service. He also discussed his desire to strengthen the chain's blending of e-commerce and store operations, helping it provide services Web rivals can't, such as returning online purchases to a store.

Again, Home Depot may be a guide. The chain invested heavily in such services, and online revenue surged 36 percent last year. That almost tripled J.C. Penney's e-commerce growth.

With his performance so far, which has included a nationwide tour visiting stores, Ellison has won over J.C. Penney's rank and file, one of the people said. But in the beginning, Johnson did too.

Business on 04/10/2015