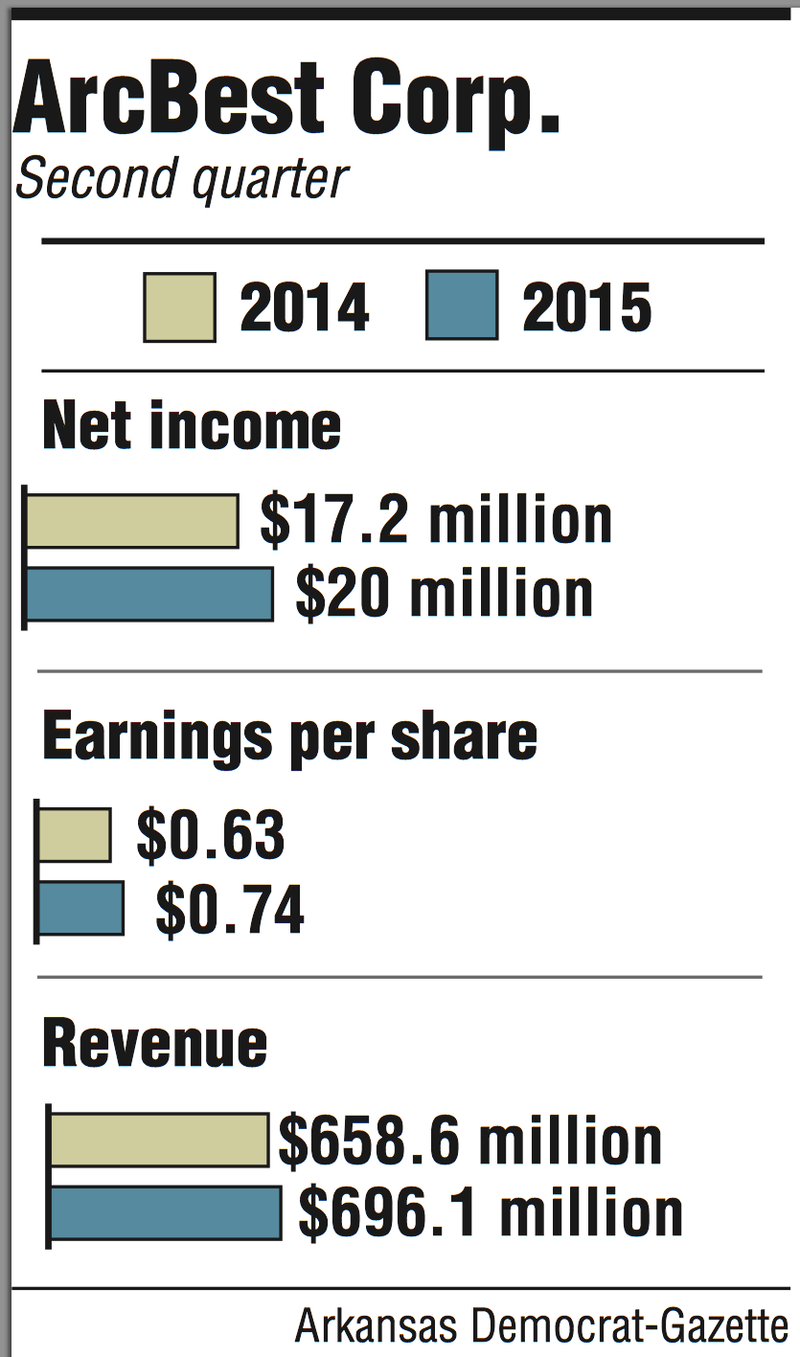

ArcBest Corp. reported $20 million in net income, or 74 cents per share, for the second quarter of 2015, turning in what Chief Executive Officer Judy McReynolds described as a "strong" quarter with profit growth across all of the company's businesses.

Earnings at the Fort Smith-based trucking and logistics company increased 16 percent over the same period last year, when ArcBest reported $17.2 million in net income, or 63 cents per share. Revenue climbed 5.7 percent to $696.1 million, which McReynolds said was a second-quarter record.

ArcBest attributed the gains to better pricing, an increase in tonnage shipped by its trucking division and continued growth among its emerging businesses. The company also benefited from a 13 percent decrease in fuel and supplies expenses.

The second-quarter results beat analyst estimates of 73 cents per share and $692 million in revenue.

"Our customers feel that our expanded service offerings are very attractive options coming from such a trusted partner," McReynolds said on a conference call. "We are continuing to invest in our enterprise platform to make sure we have the right people, systems and processes in place that lead to the answers customers want."

ABF Freight, the company's less-than-truckload division and largest subsidiary, produced $504.4 million in revenue in the quarter, a 2.3 percent increase from $492.9 million in the same period in 2014.

ArcBest reported a 1.9 percent increase in tonnage in the segment and said "positive trends in account pricing" impacted revenue growth. Efficiency improvements with purchased transportation and equipment resources also played a role in its second-quarter operating margins, according to ArcBest.

McReynolds noted during the conference call the company intentionally reduced the amount of volume business it handled. Brad Delco, a transportation analyst for Stephens Inc., in Little Rock, said it was a sign the company was trying to be more selective in the type of freight it moves.

"It probably goes back to one of those notions that not all business is good business," Delco said. "So there's probably, within some lanes, some customers where the freight is not profitable or it's not meeting the thresholds of what they need internally to justify doing the business."

ArcBest's emerging businesses accounted for 29 percent of the company's revenue in the quarter.

Panther Premium Logistics, FleetNet, ABF Logistics and ABF Moving combined to produce $205 million in revenue. The company continues to emphasize diversification in revenue and the second quarter total represents a 15 percent increase from the $178.1 million from the same period in 2014.

Combined operating income for the emerging businesses was $9.7 million, which was a 48 percent improved from $6.5 million over the same period last year.

"I was encouraged by the growth they're continuing to see," Delco said. "That business is less capital intensive so it drives a higher return on invested capital, which I think would help support a higher evaluation in terms of what the street is willing to pay for future earnings."

ABF Moving produced $32.2 million in revenue during the quarter, which was a 41 percent gain from a year ago. McReynolds said one of the biggest positive factors was a "significant increase" in moving shipments for military and governmental personnel.

ABF Logistics reported a similar gain with a 42 percent increase in revenue to $50.4 million, which was driven by truckload brokerage services. The segment produced $35.5 million a year ago.

"ABF Logistics had success in adding new customers, both those who have used other ArcBest services and those who are new to our company," McReynolds said.

ArcBest's growth as a logistics provider led the company to announce the addition of two members to its board of directors during Monday's conference call with analysts. Kathy D. McElligott and Stephen E. Gorman joined the group last week, expanding ArcBest's board to 11 members.

McElligott, 58, is the chief information and technology officer of McKesson Corp., a health care services and information technology company based in San Francisco. She started in his position at McKesson on July 20 after previously serving as chief information officer and vice president of information technology at Emerson Electric Co.

Gorman, 60, is the chief executive officer of Dallas-based Borden Dairy Co. He was previously the chief operating officer of Delta Air Lines Inc. from 2008 to 2014. Gorman also was the CEO of Greyhound Lines Inc./Laidlaw Industries from 2003 to 2007.

"As we enhance our ability to serve customers with a wide range of logistics services, Kathy, with her IT and supply-chain expertise, along with Steve, and his strong background in operations and transportation management, are excellent additions to our board of directors," McReynolds said.

Shares of ArcBest stock closed Monday trading at $34.21, up $1.16 per share.

Business on 08/04/2015