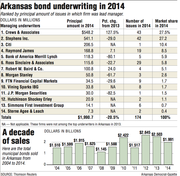

Municipal bond issues totaled almost $2 billion in Arkansas last year, about 20 percent below the $2.5 billion in 2013, according to statistics from Thomson-Reuters.

There were 174 bonds issued in the state last year, down from 192 in 2013.

Nationally, municipal bond sales were flat last year at $334 billion compared with about $330 billion in 2013, Thomson-Reuters said.

Crews & Associates of Little Rock, which is owned by First Security Bancorp of Searcy, was the top underwriter with $548 million in bonds, followed by Stephens Inc. with $541 million.

It was the first year that Crews led the annual list of bond underwriters in the state, said Edmond Hurst, senior managing director at Crews.

Crews more than doubled the business it did in 2013, when it underwrote $241 million in bonds.

“I think our partnership with First Security helped,” Hurst said. “They have a name recognition that helps us. We are more well-known in all corners of the state with their affiliation.”

First Security is the fourthlargest Arkansas-based bank with almost $4.6 billion in assets and more than 75 offices in the state, as of Sept. 30.

The largest bond issue last year was a general highway bond of $206 million, on which Citigroup was the lead underwriter.

Among other main municipal bonds issued last year were a $138 million issue for Baptist Health System, a $125 million state issue for the Big River Steel mill that is being built in Mississippi County, and a $66 million issue for the renovation of Robinson Auditorium in Little Rock.

Stephens and Crews shared evenly in the Big River Steel and the Robinson Auditorium issues, Hurst said.

Stephens was the top financial adviser in the state with 54 issues totaling $577 million last year. Crews was second with 40 bond issues totaling $310 million.

Nationally, steadily declining interest rates on the bonds last year were a surprise, Hurst said.

The lower the interest rate on bonds, the lower the debt service that the issuer has to pay, Hurst said.

Interest rates on bonds rose as high as about 5 percent in September 2013, Hurst said.

“At the end of 2013, rates were high and everybody was thinking rates were going to keep going up,” Hurst said.

But rates fell throughout last year and were at 3.36 percent late last month, Hurst said.

The supply of bonds issued nationally and in Arkansas this year will depend on the direction of interest rates, said Mark McBryde, former manager of public finance at Little Rock-based Stephens Inc. He stepped down from the position recently but will still remain with Stephens, McBryde said.

“If rates do stay low throughout 2015, I think we would be looking at levels that would be about the same amount as 2014,” McBryde said. “We really don’t see a large supply of bonds coming during 2015.”