Oil prices rebounded slightly Wednesday but remain below $50 a barrel in the U.S., adding to uncertainty about when the market will stabilize.

A government report showing a drop in U.S. crude stockpiles put a halt to the oil sell-off, but analysts said prices could easily continue to fall.

"I wouldn't read too much in [Wednesday's] rally at all," said Tariq Zahir, managing member of Tyche Capital Advisors LLC. "That still has not changed anything that has happened fundamentally."

The market has been volatile -- with oil prices down almost 50 percent since last summer -- as a result of an abundance of supply, mainly from U.S. shale producers who are pumping at record rates.

The price of oil fell further in November when the Organization of the Petroleum Exporting Countries decided to maintain its production output.

West Texas Intermediate crude rose 1.5 percent, or 72 cents, Wednesday with contracts for February settling at $48.65 on the New York Mercantile Exchange. Brent crude, which trades on the ICE Futures Europe exchange in London, rose to $51.15 a barrel.

"Considering how far we've fallen, not even being able to rally back a dollar is not much of a statement," said Phil Flynn, an energy analyst with Price Futures Group.

Prices could see more of a recovery as "we did see a surprise drawdown in crude supply," but, he said, the sell-off in the market isn't over.

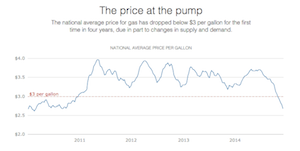

The drop in crude prices led directly to significantly lower gasoline prices. The average price of a gallon of regular grade gasoline in Arkansas on Wednesday was $2.06, down from $3.11 a year ago, according to auto club AAA. The national average price Wednesday was $2.19.

Wednesday's oil-price rebound came after a report from the U.S. Energy Information Administration that showed U.S. stocks fell about 3.1 million barrels to 382.4 million during the week that ended Friday.

During the same period a year ago, the U.S. had 357.9 million barrels of crude in stock, the agency said.

Michael Lynch, president of Strategic Energy and Economic Research Inc., said the oil market is unlikely to see a big recovery unless there is a demand increase or a supply disruption.

"I think we may have hit bottom," he said. "Although it's not the first time I thought that. I think people realize the drop has been so strong we may have even overshot a bit."

Crude prices fell below $50 a barrel earlier this week for the first time since 2009. That spurred a stock market sell-off as traders worried the drop was a sign of global economic weakness.

The lower crude prices have been hard on the share prices of energy companies that are now facing cutbacks in workforce and capital spending.

"I wouldn't even be surprised if some of these companies are pumping out oil at a loss right now," Zahir said.

With the quarterly earnings season approaching, analysts have been cutting their financial estimates for companies in the sector.

"People are in the process of cutting their estimates," said James Sullivan, an analyst with Alembic Global Advisors. "Obviously for the companies the main thing that is going to affect their earnings results is the price of oil."

Sullivan said he has lowered his earnings estimates for Murphy Oil Corp.'s fourth quarter but declined to say how much as projections are only given to the firm's clients.

The average fourth-quarter earnings estimate for Murphy Oil Corp., which is currently at 51 cents per share, has fallen 16.5 percent in the past four weeks. Six analysts have lowered their projections and one raised his, according Bloomberg data.

The El Dorado-based company will release its fourth-quarter financial results Jan. 28.

"As long as the price continues to be going down or not materially recovering from where it is, it will hurt Murphy," Sullivan said. "No more then anybody else. ... All of these guys are going to be negatively impacted by the fall in prices."

Business on 01/08/2015