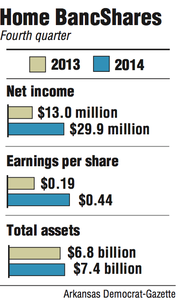

Home BancShares earned $29.9 million in the fourth quarter last year, more than double the net income of $13 million for the same period of 2013, the parent company of Centennial Bank said Thursday.

Conway-based Home BancShares reported earnings per share of 44 cents in the three months through Dec. 31, up from 19 cents in the fourth quarter of 2013.

For the year, Home BancShares recorded net income of $113.1 million, up 70 percent from $66.5 million in earnings in 2013.

The net income for the fourth quarter last year and for all of 2014 were records for the company.

Shares of Home BancShares closed at $28.66 Thursday, down 44 cents, in trading on the Nasdaq exchange.

Home BancShares had two acquisitions last year and closed them both in 2014, said Matt Olney, a Little Rock banking analyst for Stephens Inc.

Home BancShares bought Florida Traditions of Dade City, Fla., with $312 million in assets and eight offices, for $43 million, and paid $34 million for Broward Financial of Fort Lauderdale, Fla., with two offices and $170 million in assets.

"We're [expecting] either more deals [this year] or just larger deals," Olney said. "Both deals [last year] were on the smaller side."

John Allison, chairman of the bank, said he hopes this year is better for acquisitions than last year.

Home BancShares is doing some "bottom fishing," Allison said.

"To find a good trade right now, you've got to find something that is a little messy to make it work," Allison said. "We believe in finding banks that are not performing very well that give us so much upside."

Home BancShares had $7.4 billion in total assets on Dec. 31, up from $6.8 billion a year earlier.

Regulatory costs increase dramatically when a bank's assets exceed $10 billion. Home BancShares is making preparations to surpass that level.

"We're starting to spend money -- not lots of it -- on forming committees and having a lot of operations to get ready for it," Allison said. "We're not scared to death to go over $10 billion. If we find the right [acquisition], we'll go over it. We're going to do what's in the best interest of shareholders."

Olney didn't consider Thursday's drop in Home BancShares' stock price to be a reaction to the earnings report.

"As far as I can tell, it is just the overall bank environment," Olney said. "I think a lot of larger institutional money managers are expecting banks to be pressured for a while and they are exiting some of their positions."

Home BancShares' stockholders equity or net worth exceeded $1 billion in the fourth quarter for the first time, said Brian Davis, the company's chief accounting officer.

The firm's core efficiency ratio ended the year at 40.15 percent. That means that it costs Home BancShares $40.15 to earn $100. One goal of the bank is to get the ratio below 40 percent.

There are 82 Centennial Bank branches in Arkansas, 61 in Florida and seven in Alabama. Arkansas offices have 64 percent of Centennial Bank's total assets, Florida has 32 percent, and Alabama has 4 percent.

Business on 01/16/2015