The Arkansas Senate on Thursday handily approved legislation trimming income-tax rates for people with taxable incomes between $21,000 and $75,000 and repealing capital-gains tax cuts enacted in 2013.

In a 30-3 vote, the Senate sent the income-tax-cut measure to the state House of Representatives, a day after the Senate Revenue and Taxation Committee endorsed it.

Known as Senate Bill 6 and sponsored by Senate President Pro Tempore Jonathan Dismang, R-Searcy, it was backed by 22 of the Senate's 23 Republicans; Sen. Bryan King, R-Green Forest, was absent.

Eight of the Senate's 11 Democrats voted for it. Three Democratic senators from Little Rock, Linda Chesterfield, Joyce Elliott and David Johnson, dissented.

Republican Gov. Asa Hutchinson said he's "pleased with the swift action taken [Thursday] by the Senate to pass our income-tax reduction for middle-class Arkansans."

"I'm looking forward to the House passing the reduction as we continue the work of making Arkansas more competitive with surrounding states," Hutchinson said in a written statement.

House Revenue and Taxation Committee Chairman Joe Jett, D-Success, said he expects the committee will consider SB6 next Thursday, two days after Hutchinson releases his proposed fiscal 2016 budget to the Joint Budget Committee.

Earlier Thursday, Dismang told senators that the governor has proposed "broad-based tax reform in this state and this begins that process."

"It's something that we should be proud of. It provides relief for our working families," he said.

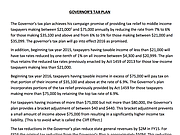

If SB6 becomes law, Arkansans with taxable incomes between $21,000 and $75,000 would see the tax rate drop from 6 percent to 5 percent on income between $21,000 and $35,099, starting next year.

The tax rate on income between $35,100 and $75,000 would fall from 7 percent to 6 percent.

About 597,000 Arkansans earning $21,000 to $75,000 will benefit from the reduced income-tax rates; the average net taxable income reported in Arkansas in 2013 was $35,200, so the tax savings under SB6 for someone with that level of taxable income would be $120, said John Theis, assistant revenue commissioner for the state.

Tim Leathers, deputy director for the state Department of Finance and Administration, said married taxpayers who both have income can file separately, even on one return, under state law. That would enable some families to benefit from the tax cut, even though their household income is higher than $75,000.

"Any law that lowers tax rates will allow both husband and wife to use the lower rates. A husband and wife can both have income under $75,000 and both receive the benefits of the tax cuts of SB6," Leathers wrote.

Among other things, SB6 repeals Act 1488 of 2013 that increased the capital-gains exclusion from the state income tax from 30 percent to 50 percent, starting this tax year, and provided an income-tax exemption for that part of a capital gain received by a taxpayer in excess of $10 million starting last tax year

Chesterfield questioned why the Senate wouldn't wait until after Hutchinson releases his budget plan.

SB6 would reduce state general tax revenue by $12.8 million in fiscal 2016, starting July 1, and $80.6 million in fiscal 2017, the Finance and Administration Department estimated.

Dismang said he appreciates Chesterfield's concerns.

"Our goal is to move quickly on this," he said, adding that Hutchinson had already provided information on his proposed budget to members of the House and Senate Revenue and Taxation committees.

Hutchinson said Tuesday that he delayed the release of his budget until next week because he wanted to focus on the health care speech that he delivered Thursday.

Elliott told senators that she was voting against SB6 because she doesn't have enough information about its effect on Hutchinson's proposed fiscal 2016 budget.

"I appreciate that Gov. Hutchinson ran on this [proposed tax cut] and he deserves to have a responsible bill, " Elliott said.

Senate Democratic leader Keith Ingram of West Memphis said an amendment to the bill proposed by Sen. Bill Sample, R-Hot Springs, repealing capital-gains tax cuts approved in 2013 made SB6 "a lot more palatable" to him. Repealing the capital-gains tax cuts frees up $21 million a year to help fund Hutchinson's tax cuts, Sample said.

Although he voted for SB6, Ingram said it would have been helpful to know ahead of time how much money Hutchinson's budget would leave for other programs, including prisons, school buildings and the governor's Quick Action Closing Fund, which spends money to attract industry to Arkansas.

"I think we as a Legislature need to know before we vote on something like a $80 million tax cut," said Ingram.

"In voting for this, we are trusting the governor's recommendations to us, with unknown reserves, if we hit a bump in the road and ... there are always bumps in the road," Ingram said. "I trust that the governor has his numbers that he has not shared with us that supports his position. But since he is comfortable accepting this responsibility, I'll accede to his wishes."

Dismang said the Senate will have another vote on the bill after the House passes it with minor amendments.

He said SB6 will reduce the state's general revenue forecast for fiscal 2016 "and we will be prudent with our budget.

"We'll make sure that we properly spend those dollars and prioritize those dollars the best for the people of Arkansas," he said.

Hutchinson said Tuesday that he'll be able to pay for his proposed $100 million income-tax cut because other state tax revenue will increase, budgets for certain state agencies will be cut and one-time surplus funds will be tapped. He said state funding for public schools would be increased and funding for the state's higher-education institutions would be maintained under his budget blueprint.

Democratic Sens. Larry Teague of Nashville and Bruce Maloch of Magnolia, who serve on the Senate Revenue and Taxation Committee, said Wednesday that after meeting with Hutchinson to discuss the budget, they were comfortable voting for SB6.

The Senate vote came in an otherwise slow day for legislative action at the state Capitol, after Hutchinson delivered a health care speech at the University of Arkansas for Medical Sciences.

The House and Senate will take off today and reconvene Monday.

Metro on 01/23/2015